2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

143<br />

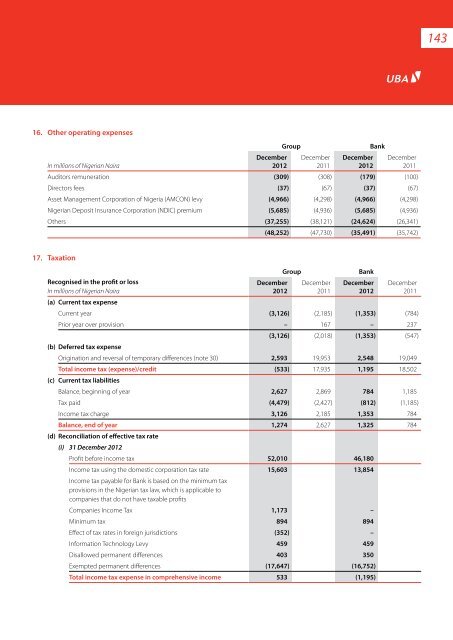

16. Other operating expenses<br />

In millions of Nigerian Naira<br />

December<br />

<strong>2012</strong><br />

Group<br />

December<br />

2011<br />

December<br />

<strong>2012</strong><br />

Bank<br />

December<br />

2011<br />

Auditors remuneration (309) (308) (179) (100)<br />

Directors fees (37) (67) (37) (67)<br />

Asset Management Corporation of Nigeria (AMCON) levy (4,966) (4,298) (4,966) (4,298)<br />

Nigerian Deposit Insurance Corporation (NDIC) premium (5,685) (4,936) (5,685) (4,936)<br />

Others (37,255) (38,121) (24,624) (26,341)<br />

(48,252) (47,730) (35,491) (35,742)<br />

17. Taxation<br />

Recognised in the profit or loss<br />

In millions of Nigerian Naira<br />

(a) Current tax expense<br />

December<br />

<strong>2012</strong><br />

Group<br />

December<br />

2011<br />

Bank<br />

December<br />

<strong>2012</strong><br />

December<br />

2011<br />

Current year (3,126) (2,185) (1,353) (784)<br />

Prior year over provision – 167 – 237<br />

(3,126) (2,018) (1,353) (547)<br />

(b) Deferred tax expense<br />

Origination and reversal of temporary differences (note 30) 2,593 19,953 2,548 19,049<br />

Total income tax (expense)/credit (533) 17,935 1,195 18,502<br />

(c) Current tax liabilities<br />

Balance, beginning of year 2,627 2,869 784 1,185<br />

Tax paid (4,479) (2,427) (812) (1,185)<br />

Income tax charge 3,126 2,185 1,353 784<br />

Balance, end of year 1,274 2,627 1,325 784<br />

(d) Reconciliation of effective tax rate<br />

(i) 31 December <strong>2012</strong><br />

Profit before income tax 52,010 46,180<br />

Income tax using the domestic corporation tax rate 15,603 13,854<br />

Income tax payable for Bank is based on the minimum tax<br />

provisions in the Nigerian tax law, which is applicable to<br />

companies that do not have taxable profits<br />

Companies Income Tax 1,173 –<br />

Minimum tax 894 894<br />

Effect of tax rates in foreign jurisdictions (352) –<br />

Information Technology Levy 459 459<br />

Disallowed permanent differences 403 350<br />

Exempted permanent differences (17,647) (16,752)<br />

Total income tax expense in comprehensive income 533 (1,195)