2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

93<br />

General risk rating process<br />

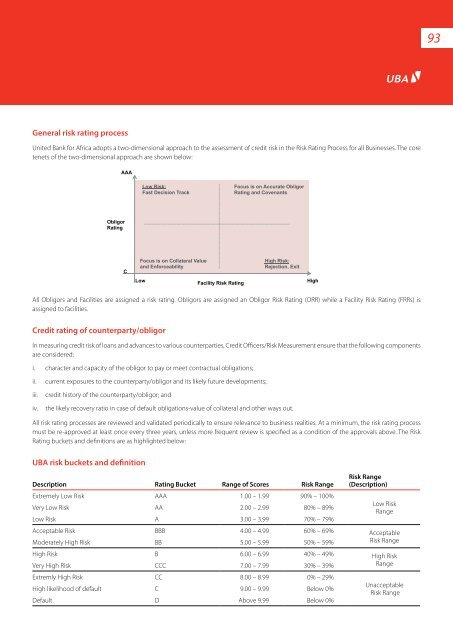

United Bank for Africa adopts a two-dimensional approach to the assessment of credit risk in the Risk Rating Process for all Businesses. The core<br />

tenets of the two-dimensional approach are shown below:<br />

AAA<br />

Low Risk:<br />

Fast Decision Track<br />

Focus is on Accurate Obligor<br />

Rating and Covenants<br />

Obligor<br />

Rating<br />

C<br />

Focus is on Collateral Value<br />

and Enforceability<br />

Low<br />

Facility Risk Rating<br />

High Risk:<br />

Rejection, Exit<br />

High<br />

All Obligors and Facilities are assigned a risk rating. Obligors are assigned an Obligor Risk Rating (ORR) while a Facility Risk Rating (FRRs) is<br />

assigned to facilities.<br />

Credit rating of counterparty/obligor<br />

In measuring credit risk of loans and advances to various counterparties, Credit Officers/Risk Measurement ensure that the following components<br />

are considered:<br />

i. character and capacity of the obligor to pay or meet contractual obligations;<br />

ii.<br />

iii.<br />

iv.<br />

current exposures to the counterparty/obligor and its likely future developments;<br />

credit history of the counterparty/obligor; and<br />

the likely recovery ratio in case of default obligations-value of collateral and other ways out.<br />

All risk rating processes are reviewed and validated periodically to ensure relevance to business realities. At a minimum, the risk rating process<br />

must be re-approved at least once every three years, unless more frequent review is specified as a condition of the approvals above. The Risk<br />

Rating buckets and definitions are as highlighted below:<br />

<strong>UBA</strong> risk buckets and definition<br />

Description Rating Bucket Range of Scores Risk Range<br />

Extremely Low Risk AAA 1.00 – 1.99 90% – 100%<br />

Very Low Risk AA 2.00 – 2.99 80% – 89%<br />

Low Risk A 3.00 – 3.99 70% – 79%<br />

Risk Range<br />

(Description)<br />

Low Risk<br />

Range<br />

Acceptable Risk BBB 4.00 – 4.99 60% – 69% Acceptable<br />

Moderately High Risk BB 5.00 – 5.99 50% – 59%<br />

Risk Range<br />

High Risk B 6.00 – 6.99 40% – 49% High Risk<br />

Very High Risk CCC 7.00 – 7.99 30% – 39%<br />

Range<br />

Extremly High Risk CC 8.00 – 8.99 0% – 29%<br />

High likelihood of default C 9.00 – 9.99 Below 0%<br />

Default D Above 9.99 Below 0%<br />

Unacceptable<br />

Risk Range