2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

2012 Annual Report & Financial Statements - UBA Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

34<br />

Directors’ <strong>Report</strong><br />

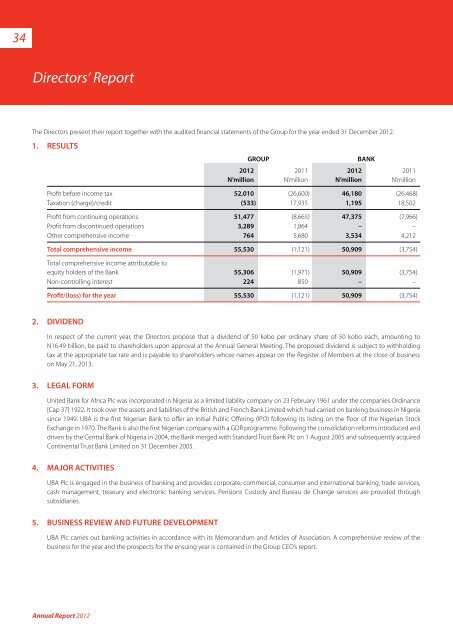

The Directors present their report together with the audited financial statements of the Group for the year ended 31 December <strong>2012</strong>.<br />

1. RESULTS<br />

<strong>2012</strong><br />

N’million<br />

GROUP<br />

2011<br />

N’million<br />

<strong>2012</strong><br />

N’million<br />

Bank<br />

2011<br />

N’million<br />

Profit before income tax 52,010 (26,600) 46,180 (26,468)<br />

Taxation (charge)/credit (533) 17,935 1,195 18,502<br />

Profit from continuing operations 51,477 (8,665) 47,375 (7,966)<br />

Profit from discontinued operations 3,289 1,864 – –<br />

Other comprehensive income 764 5,680 3,534 4,212<br />

Total comprehensive income 55,530 (1,121) 50,909 (3,754)<br />

Total comprehensive income attributable to<br />

equity holders of the Bank 55,306 (1,971) 50,909 (3,754)<br />

Non-controlling interest 224 850 – –<br />

Profit/(loss) for the year 55,530 (1,121) 50,909 (3,754)<br />

2. DIVIDEND<br />

In respect of the current year, the Directors propose that a dividend of 50 kobo per ordinary share of 50 kobo each, amounting to<br />

N16.49 billion, be paid to shareholders upon approval at the <strong>Annual</strong> General Meeting. The proposed dividend is subject to withholding<br />

tax at the appropriate tax rate and is payable to shareholders whose names appear on the Register of Members at the close of business<br />

on May 21, 2013.<br />

3. LEGAL FORM<br />

United Bank for Africa <strong>Plc</strong> was incorporated in Nigeria as a limited liability company on 23 February 1961 under the companies Ordinance<br />

[Cap 37] 1922. It took over the assets and liabilities of the British and French Bank Limited which had carried on banking business in Nigeria<br />

since 1949. <strong>UBA</strong> is the first Nigerian Bank to offer an Initial Public Offering (IPO) following its listing on the floor of the Nigerian Stock<br />

Exchange in 1970. The Bank is also the first Nigerian company with a GDR programme. Following the consolidation reforms introduced and<br />

driven by the Central Bank of Nigeria in 2004, the Bank merged with Standard Trust Bank <strong>Plc</strong> on 1 August 2005 and subsequently acquired<br />

Continental Trust Bank Limited on 31 December 2005.<br />

4. MAJOR ACTIVITIES<br />

<strong>UBA</strong> <strong>Plc</strong> is engaged in the business of banking and provides corporate, commercial, consumer and international banking, trade services,<br />

cash management, treasury and electronic banking services. Pensions Custody and Bureau de Change services are provided through<br />

subsidiaries.<br />

5. BUSINESS REVIEW AND FUTURE DEVELOPMENT<br />

<strong>UBA</strong> <strong>Plc</strong> carries out banking activities in accordance with its Memorandum and Articles of Association. A comprehensive review of the<br />

business for the year and the prospects for the ensuing year is contained in the Group CEO’s report.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>