Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EUROPE<br />

Why challenged sector?<br />

EU’s access to the Chinese service<br />

market, although improved in recent<br />

years, remains difficult. Certain key<br />

sectors, such as banking, insurance, and<br />

telecommunications, remain particularly<br />

difficult for EU’s companies to access.<br />

The major complains from the EU<br />

on entering and expanding Chinese<br />

service market are as follows:<br />

(1) Excessive regulatory requirements<br />

that limit service providers. For<br />

example, of the 22,000 telecoms licenses<br />

granted since 2001, only 23 have gone<br />

to foreign companies. Foreign law firms<br />

in China are still not allowed to employ<br />

Chinese lawyers and their employees are<br />

not permitted to participate in bar exams<br />

to gain Chinese qualifications.<br />

(2) Lack of transparency, unfair<br />

implementation of public procurement<br />

awards, and unsatisfactory appeals procedures<br />

has made it very difficult for European<br />

companies to access the Chinese<br />

market in the area of public procurement,<br />

according to European Commission.<br />

For example, within the projects invested<br />

by China’s stimulus package of 4 trillion<br />

RMB, which played a significant role in<br />

infrastructure construction, foreign construction<br />

companies only won 2% of the<br />

contracts. In addition, foreign construction<br />

services are limited to designated<br />

areas, such as contracts wholly financed<br />

by foreign investment.<br />

(3) Unfavorable regulatory environment<br />

for foreign companies which<br />

create an unleveled playing field for<br />

EU companies. 43 % of EU companies<br />

expect the regulatory environment for<br />

foreign companies to worsen in the next<br />

2 years, surveyed by European Commission.<br />

For example, under China’s<br />

Insurance Law, all insurance companies<br />

operating in China must be registered<br />

and all staff or organizations requiring<br />

coverage in China must obtain insurance<br />

from an insurance company established<br />

and registered in China. While<br />

most licensed foreign insurers and all<br />

life insurers are fully incorporated in<br />

China, they are still considered “non-<br />

Chinese” and therefore subject to additional<br />

regulatory requirements and<br />

limitations, beyond those applicable to<br />

local insurance companies.<br />

Huge potential<br />

Although bilateral trade in services<br />

currently plays only a minor role in<br />

EU-China trade, as China continues<br />

to grow, there is huge potential.<br />

EU is more advanced and developed<br />

than China in service industry.<br />

China market is large, and more<br />

importantly, at the initial stage of<br />

service industry development, which<br />

means great opportunities to attract<br />

EU companies.<br />

The saying of “Grasp the China<br />

Opportunity” was stated in the recent<br />

EU parliament policy study. There are<br />

steps which EU is going to take: (a) EU<br />

states need to be better supported by a<br />

more unified EU that takes more account<br />

of the specificities of the China’s<br />

situation; (b) EU needs to increase the<br />

visibility political policies and measures<br />

toward China; and (c) With its technical<br />

expertise and diversity of approaches,<br />

the EU needs to play a leading role in<br />

thinking new economic policies forward.<br />

Change is coming to service trade.<br />

(Authors: Su Dan, undergraduate<br />

of Law School of Central University of<br />

Finance and Economics; Jiang Peng,<br />

PhD of School of Finance of Renmin<br />

University of China)<br />

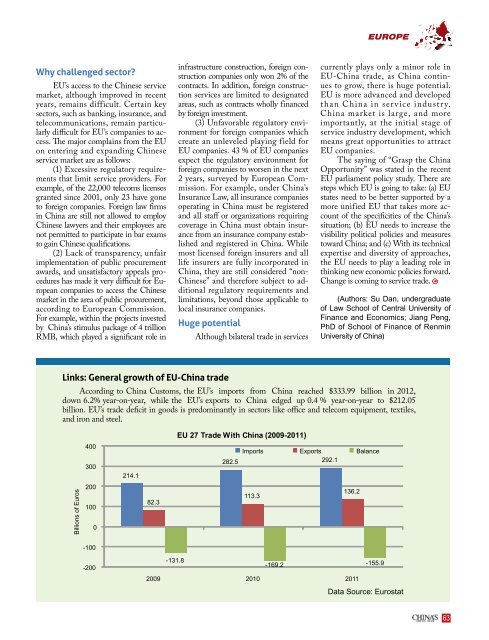

Links: General growth of EU-China trade<br />

According to China Customs, the EU’s imports from China reached $333.99 billion in 2012,<br />

down 6.2% year-on-year, while the EU’s exports to China edged up 0.4 % year-on-year to $212.05<br />

billion. EU’s trade deficit in goods is predominantly in sectors like office and telecom equipment, textiles,<br />

and iron and steel.<br />

Data Source: Eurostat<br />

63