July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

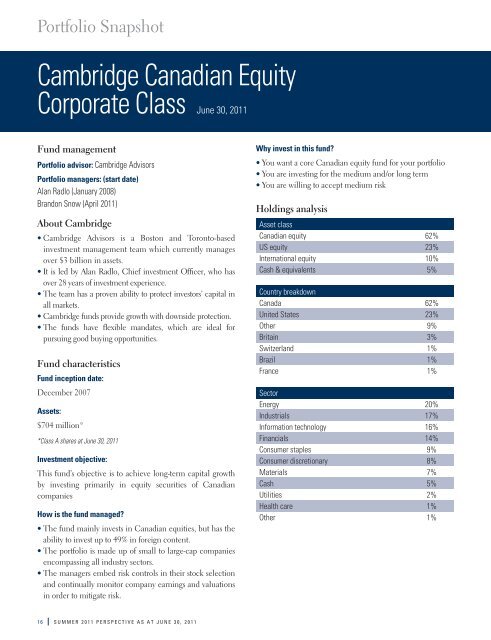

Portfolio Snapshot<br />

Cambridge Canadian Equity<br />

Corporate Class June 30, 2011<br />

Fund management<br />

Portfolio advisor: Cambridge Advisors<br />

Portfolio managers: (start date)<br />

Alan Radlo (January 2008)<br />

Brandon Snow (April 2011)<br />

About Cambridge<br />

• Cambridge Advisors is a Boston and Toronto-based<br />

investment management team which currently manages<br />

over $3 billion in assets.<br />

• It is led by Alan Radlo, Chief investment Officer, who has<br />

over 28 years of investment experience.<br />

• The team has a proven ability to protect investors’ capital in<br />

all markets.<br />

• Cambridge funds provide growth with downside protection.<br />

• The funds have flexible mandates, which are ideal for<br />

pursuing good buying opportunities.<br />

Fund characteristics<br />

Fund inception date:<br />

December 2007<br />

Assets:<br />

$704 million*<br />

*Class A shares at June 30, 2011<br />

Investment objective:<br />

This fund’s objective is to achieve long-term capital growth<br />

by investing primarily in equity securities of Canadian<br />

companies<br />

How is the fund managed?<br />

• The fund mainly invests in Canadian equities, but has the<br />

ability to invest up to 49% in foreign content.<br />

• The portfolio is made up of small to large-cap companies<br />

encompassing all industry sectors.<br />

• The managers embed risk controls in their stock selection<br />

and continually monitor company earnings and valuations<br />

in order to mitigate risk.<br />

Why invest in this fund?<br />

• You want a core Canadian equity fund for your portfolio<br />

• You are investing for the medium and/or long term<br />

• You are willing to accept medium risk<br />

Holdings analysis<br />

Asset class<br />

Canadian equity 62%<br />

US equity 23%<br />

International equity 10%<br />

Cash & equivalents 5%<br />

Country breakdown<br />

Canada 62%<br />

United States 23%<br />

Other 9%<br />

Britain 3%<br />

Switzerland 1%<br />

Brazil 1%<br />

France 1%<br />

Sector<br />

Energy 20%<br />

Industrials 17%<br />

Information technology 16%<br />

Financials 14%<br />

Consumer staples 9%<br />

Consumer discretionary 8%<br />

Materials 7%<br />

Cash 5%<br />

Utilities 2%<br />

Health care 1%<br />

Other 1%<br />

16 SUMMER 2011 PERSPECTIVE AS AT JUNE 30, 2011