July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

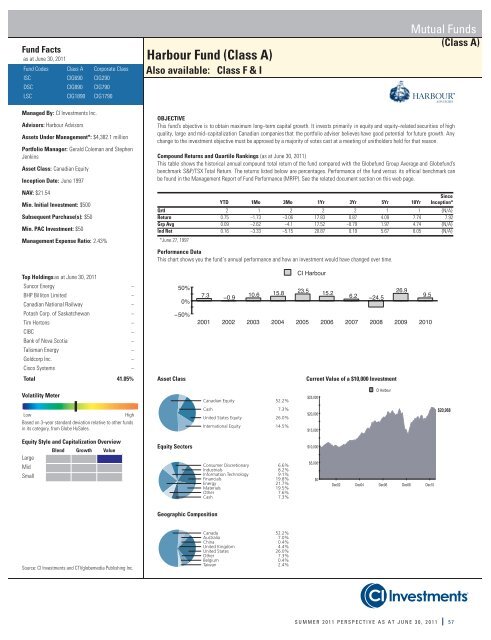

Fund Facts<br />

as at June 30, 2011<br />

Fund Codes Class A Corporate Class<br />

ISC <strong>CI</strong>G690 <strong>CI</strong>G290<br />

DSC <strong>CI</strong>G890 <strong>CI</strong>G790<br />

LSC <strong>CI</strong>G1890 <strong>CI</strong>G1790<br />

Harbour Fund (Class A)<br />

Also available: Class F & I<br />

Mutual Funds<br />

(Class A)<br />

Managed By: <strong>CI</strong> <strong>Investments</strong> Inc.<br />

Advisors: Harbour Advisors<br />

Assets Under Management*: $4,382.1 million<br />

Portfolio Manager: Gerald Coleman and Stephen<br />

Jenkins<br />

Asset Class: Canadian Equity<br />

Inception Date: June 1997<br />

NAV: $21.54<br />

Min. Initial Investment: $500<br />

Subsequent Purchase(s): $50<br />

Min. PAC Investment: $50<br />

Management Expense Ratio: 2.43%<br />

OBJECTIVE<br />

This fund’s objective is to obtain maximum long−term capital growth. It invests primarily in equity and equity−related securities of high<br />

quality, large and mid−capitalization Canadian companies that the portfolio adviser believes have good potential for future growth. Any<br />

change to the investment objective must be approved by a majority of votes cast at a meeting of unitholders held for that reason.<br />

Compound Returns and Quartile Rankings (as at June 30, 2011)<br />

This table shows the historical annual compound total return of the fund compared with the Globefund Group Average and Globefund’s<br />

benchmark S&P/TSX Total Return. The returns listed below are percentages. Performance of the fund versus its official benchmark can<br />

be found in the Management Report of Fund Performance (MRFP). See the related document section on this web page.<br />

Since<br />

YTD 1Mo 3Mo 1Yr 3Yr 5Yr 10Yr Inception*<br />

Qrtl 2 1 2 2 2 1 1 {N/A}<br />

Return 0.75 −1.73 −3.06 17.83 0.87 4.09 7.74 7.92<br />

Grp Avg 0.09 −2.62 −4.1 17.52 −0.79 1.97 4.74 {N/A}<br />

Ind Ret 0.16 −3.33 −5.15 20.87 0.19 5.67 8.05 {N/A}<br />

*June 27, 1997<br />

Performance Data<br />

This chart shows you the fund´s annual performance and how an investment would have changed over time.<br />

Top Holdings as at June 30, 2011<br />

Suncor Energy<br />

−<br />

BHP Billiton Limited<br />

−<br />

Canadian National Railway<br />

−<br />

Potash Corp. of Saskatchewan<br />

−<br />

Tim Hortons<br />

−<br />

<strong>CI</strong>BC<br />

−<br />

Bank of Nova Scotia<br />

−<br />

Talisman Energy<br />

−<br />

Goldcorp Inc.<br />

−<br />

Cisco Systems<br />

−<br />

Total 41.05%<br />

50%<br />

0%<br />

−50%<br />

Asset Class<br />

7.3<br />

<strong>CI</strong> Harbour<br />

15.8 23.5 15.2<br />

26.9<br />

−0.9<br />

10.6<br />

6.2 −24.5<br />

9.5<br />

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Current Value of a $10,000 Investment<br />

Volatility Meter<br />

Canadian Equity 52.2%<br />

$25,000<br />

<strong>CI</strong> Harbour<br />

Low<br />

High<br />

Based on 3−year standard deviation relative to other funds<br />

in its category, from Globe HySales.<br />

Cash 7.3%<br />

United States Equity 26.0%<br />

International Equity 14.5%<br />

$20,000<br />

$15,000<br />

$20,968<br />

Equity Style and Capitalization Overview<br />

Blend Growth Value<br />

Large<br />

Mid<br />

Small<br />

Equity Sectors<br />

Consumer Discretionary 6.6%<br />

Industrials 8.2%<br />

Information Technology 9.1%<br />

Financials 19.8%<br />

Energy 21.7%<br />

Materials 19.5%<br />

Other 7.6%<br />

Cash 7.3%<br />

$10,000<br />

$5,000<br />

$0<br />

Dec02 Dec04 Dec06 Dec08 Dec10<br />

Geographic Composition<br />

Source: <strong>CI</strong> <strong>Investments</strong> and CTVglobemedia Publishing Inc.<br />

Canada 52.2%<br />

Australia 7.0%<br />

China 0.4%<br />

United Kingdom 4.4%<br />

United States 26.0%<br />

Other 7.3%<br />

Belgium 0.4%<br />

Taiwan 2.4%<br />

SUMMER 2011 PERSPECTIVE AS AT JUNE 30, 2011 57