July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

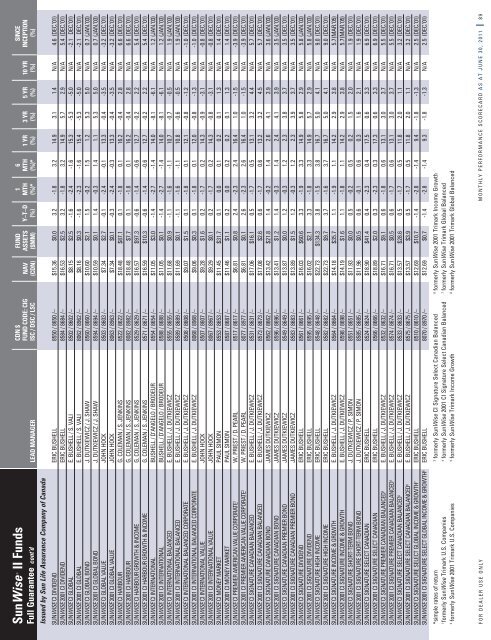

SunWise<br />

®<br />

II<br />

Funds<br />

Full Guarantee cont’d<br />

Issued by Sun Life Assurance Company of Canada<br />

LEAD MANAGER<br />

CDN $<br />

FUND CODE: <strong>CI</strong>G<br />

ISC / DSC / LSC<br />

SUNWISE <strong>CI</strong> DIVIDEND ERIC BUSHELL 8550 / 8650 /– $15.36 $0.0 3.2 -1.8 3.2 14.9 3.1 1.4 N/A 4.6 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> DIVIDEND ERIC BUSHELL 8584 / 8684 /– $16.53 $2.5 3.2 -1.8 3.2 14.9 5.7 2.9 N/A 5.4 (DEC.’01)<br />

SUNWISE <strong>CI</strong> GLOBAL E. BUSHELL / S. VALI 8502 / 8602 /– $8.15 $2.5 -1.6 -2.4 -1.6 15.3 -5.3 -5.0 N/A -2.1 DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> GLOBAL E. BUSHELL / S. VALI 8062 / 8962 /– $8.16 $0.3 -1.6 -2.3 -1.6 15.4 -5.3 -5.0 N/A -2.1 DEC.’01)<br />

SUNWISE <strong>CI</strong> GLOBAL BOND J. DUTKIEWICZ / J. SHAW 8560 / 8660 /– $10.60 $2.1 1.5 -0.2 1.5 1.2 5.3 5.0 N/A 0.7 (JAN.’03)<br />

SUNWISE 2001 <strong>CI</strong> GLOBAL BOND J. DUTKIEWICZ / J. SHAW 8594 / 8694 /– $10.59 $0.1 1.4 -0.3 1.4 1.1 5.3 5.0 N/A 0.7 (JAN.’03)<br />

SUNWISE <strong>CI</strong> GLOBAL VALUE JOHN HOCK 8503 / 8603 /– $7.34 $2.7 -0.1 -2.4 -0.1 13.3 -0.4 -3.5 N/A -3.2 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> GLOBAL VALUE JOHN HOCK 8063 / 8963 /– $7.34 $0.1 -0.3 -2.4 -0.3 13.3 -0.4 -3.5 N/A -3.2 (DEC.’01)<br />

SUNWISE <strong>CI</strong> HARBOUR G. COLEMAN / S. JENKINS 8522 / 8622 /– $18.48 $87.1 0.1 -1.8 0.1 16.2 -0.4 2.8 N/A 6.6 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> HARBOUR G. COLEMAN / S. JENKINS 8082 / 8982 /– $18.48 $7.7 0.1 -1.8 0.1 16.2 -0.4 2.8 N/A 6.6 (DEC.’01)<br />

SUNWISE <strong>CI</strong> HARBOUR GROWTH & INCOME G. COLEMAN / S. JENKINS 8529 / 8629 /– $16.57 $97.3 -0.6 -1.4 -0.6 12.7 -0.2 2.2 N/A 5.4 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> HARBOUR GROWTH & INCOME G. COLEMAN / S. JENKINS 8571 / 8671 /– $16.59 $10.3 -0.6 -1.4 -0.6 12.7 -0.2 2.2 N/A 5.4 (DEC.’01)<br />

SUNWISE <strong>CI</strong> INTERNATIONAL BUSHELL / D’ANGELO / BRODEUR 8554 / 8654 /– $11.05 $3.0 -1.4 -2.7 -1.4 14.0 -8.1 -6.1 N/A 1.2 (JAN.’03)<br />

SUNWISE 2001 <strong>CI</strong> INTERNATIONAL BUSHELL / D’ANGELO / BRODEUR 8588 / 8688 /– $11.05 $0.1 -1.4 -2.7 -1.4 14.0 -8.1 -6.1 N/A 1.2 (JAN.’03)<br />

SUNWISE <strong>CI</strong> INTERNATIONAL BALANCED E. BUSHELL / J. DUTKIEWICZ 8555 / 8655 /– $11.68 $0.9 -1.1 -1.6 -1.1 10.7 -0.7 -0.5 N/A 1.9 (JAN.’03)<br />

SUNWISE 2001 <strong>CI</strong> INTERNATIONAL BALANCED E. BUSHELL / J. DUTKIEWICZ 8589 / 8689 /– $11.69 $0.1 -1.1 -1.6 -1.1 10.8 -0.6 -0.5 N/A 1.9 (JAN.’03)<br />

SUNWISE <strong>CI</strong> INTERNATIONAL BALANCED CORPORATE E. BUSHELL / J. DUTKIEWICZ 8508 / 8608 /– $9.07 $1.5 0.1 -1.8 0.1 12.1 -0.8 -1.2 N/A -1.0 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> INTERNATIONAL BALANCED CORPORATE E. BUSHELL / J. DUTKIEWICZ 8068 / 8968 /– $9.06 $0.3 0.1 -1.8 0.1 12.0 -0.8 -1.3 N/A -1.0 (DEC.’01)<br />

SUNWISE <strong>CI</strong> INTERNATIONAL VALUE JOHN HOCK 8507 / 8607 /– $9.28 $1.6 0.2 -1.7 0.2 14.3 -0.9 -3.1 N/A -0.8 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> INTERNATIONAL VALUE JOHN HOCK 8067 / 8967 /– $9.29 $0.1 0.2 -1.7 0.2 14.3 -0.8 -3.1 N/A -0.8 (DEC.’01)<br />

SUNWISE <strong>CI</strong> MONEY MARKET PAUL SIMON 8553 / 8653 /– $11.45 $31.7 0.1 0.0 0.1 0.2 0.1 1.3 N/A 1.4 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> MONEY MARKET PAUL SIMON 8587 / 8687 /– $11.46 $1.1 0.2 0.0 0.2 0.2 0.1 1.3 N/A 1.4 (DEC.’01)<br />

SUNWISE <strong>CI</strong> PREMIER AMERICAN VALUE CORPORATE 1 W. PRIEST / D. PEARL 8517 / 8617 /– $6.81 $0.8 2.4 -2.3 2.4 16.4 1.0 -1.5 N/A -3.9 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> PREMIER AMERICAN VALUE CORPORATE 2 W. PRIEST / D. PEARL 8077 / 8977 /– $6.81 $0.1 2.6 -2.3 2.6 16.4 1.0 -1.5 N/A -3.9 (DEC.’01)<br />

SUNWISE <strong>CI</strong> SIGNATURE CANADIAN BALANCED E. BUSHELL / J. DUTKIEWICZ 8531 / 8631 /– $17.06 $16.1 0.5 -1.7 0.5 13.1 3.2 4.4 N/A 5.7 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE CANADIAN BALANCED E. BUSHELL / J. DUTKIEWICZ 8573 / 8673 /– $17.08 $2.6 0.6 -1.7 0.6 13.2 3.2 4.5 N/A 5.7 (DEC.’01)<br />

SUNWISE <strong>CI</strong> SIGNATURE CANADIAN BOND JAMES DUTKIEWICZ 8562 / 8662 /– $13.42 $21.8 1.4 -0.2 1.4 2.6 4.1 3.9 N/A 3.6 (JAN.’03)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE CANADIAN BOND JAMES DUTKIEWICZ 8596 / 8696 /– $13.41 $1.2 1.4 -0.3 1.4 2.4 4.1 3.9 N/A 3.5 (JAN.’03)<br />

SUNWISE <strong>CI</strong> SIGNATURE CANADIAN PREMIER BOND JAMES DUTKIEWICZ 8549 / 8649 /– $13.87 $0.0 1.2 -0.3 1.2 2.3 3.8 3.7 N/A 3.5 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE CANADIAN PREMIER BOND JAMES DUTKIEWICZ 8583 / 8683 /– $13.89 $1.5 1.2 -0.3 1.2 2.3 3.9 3.7 N/A 3.5 (DEC.’01)<br />

SUNWISE <strong>CI</strong> SIGNATURE DIVIDEND ERIC BUSHELL 8561 / 8661 /– $16.03 $60.6 3.3 -1.9 3.3 14.9 5.8 2.9 N/A 5.8 (JAN.’03)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE DIVIDEND ERIC BUSHELL 8595 / 8695 /– $16.02 $2.1 3.3 -1.8 3.3 14.9 5.7 2.9 N/A 5.8 (JAN.’03)<br />

SUNWISE <strong>CI</strong> SIGNATURE HIGH INCOME ERIC BUSHELL 8548 / 8648 /– $22.73 $134.3 3.8 -1.5 3.8 16.7 5.0 4.1 N/A 9.0 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE HIGH INCOME ERIC BUSHELL 8582 / 8682 /– $22.73 $9.7 3.7 -1.6 3.7 16.7 5.0 4.1 N/A 9.0 (DEC.’01)<br />

SUNWISE <strong>CI</strong> SIGNATURE INCOME & GROWTH E. BUSHELL / J. DUTKIEWICZ 8564 / 8664 /– $14.18 $35.7 1.1 -1.9 1.1 14.2 2.9 3.8 N/A 5.7 (MAR.’05)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE INCOME & GROWTH E. BUSHELL / J. DUTKIEWICZ 8598 / 8698 /– $14.19 $1.6 1.1 -1.8 1.1 14.2 2.9 3.8 N/A 5.7 (MAR.’05)<br />

SUNWISE <strong>CI</strong> SIGNATURE SHORT-TERM BOND J. DUTKIEWICZ / P. SIMON 8551 / 8651 /– $11.93 $0.0 0.5 -0.2 0.5 0.2 1.5 2.0 N/A 1.9 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE SHORT-TERM BOND J. DUTKIEWICZ / P. SIMON 8585 / 8685 /– $11.96 $0.5 0.6 -0.1 0.6 0.3 1.6 2.1 N/A 1.9 (DEC.’01)<br />

SUNWISE <strong>CI</strong> SIGNATURE SELECT CANADIAN ERIC BUSHELL 8524 / 8624 /– $18.90 $41.4 0.4 -2.3 0.4 17.5 0.6 3.3 N/A 6.9 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE SELECT CANADIAN ERIC BUSHELL 8566 / 8666 /– $18.89 $2.0 0.3 -2.3 0.3 17.3 0.6 3.3 N/A 6.9 (DEC.’01)<br />

SUNWISE <strong>CI</strong> SIGNATURE PREMIER CANADIAN BALANCED 3 E. BUSHELL / J. DUTKIEWICZ 8532 / 8632 /– $16.71 $9.1 0.6 -1.8 0.6 13.1 3.0 3.7 N/A 5.5 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE PREMIER CANADIAN BALANCED 4 E. BUSHELL / J. DUTKIEWICZ 8574 / 8674 /– $16.71 $0.5 0.6 -1.7 0.6 13.1 3.0 3.7 N/A 5.5 (DEC.’01)<br />

SUNWISE <strong>CI</strong> SIGNATURE SELECT CANADIAN BALANCED 5 E. BUSHELL / J. DUTKIEWICZ 8533 / 8633 /– $13.57 $28.6 0.5 -1.7 0.5 11.8 2.0 1.1 N/A 3.2 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE SELECT CANADIAN BALANCED 6 E. BUSHELL / J. DUTKIEWICZ 8575 / 8675 /– $13.57 $3.9 0.5 -1.7 0.5 11.8 2.0 1.1 N/A 3.2 (DEC.’01)<br />

SUNWISE <strong>CI</strong> SIGNATURE SELECT GLOBAL INCOME & GROWTH 7 ERIC BUSHELL 8510 / 8610 /– $12.69 $10.7 -1.4 -2.8 -1.4 9.4 -1.8 -1.3 N/A 2.5 (DEC.’01)<br />

SUNWISE 2001 <strong>CI</strong> SIGNATURE SELECT GLOBAL INCOME & GROWTH 8 ERIC BUSHELL 8070 / 8970 /– $12.69 $0.7 -1.4 -2.8 -1.4 9.3 -1.8 -1.3 N/A 2.5 (DEC.’01)<br />

NAV<br />

(CDN)<br />

FUND<br />

ASSETS<br />

($MM)<br />

Y–T–D<br />

(%)<br />

1<br />

MTH<br />

(%)*<br />

6<br />

MTH<br />

(%)*<br />

1 YR<br />

(%)<br />

3 YR<br />

(%)<br />

5 YR<br />

(%)<br />

10 YR<br />

(%)<br />

SINCE<br />

INCEPTION<br />

(%)<br />

*simple rates of return 3 formerly SunWise <strong>CI</strong> Signature Select Canadian Balanced 6<br />

formerly SunWise 2001 Trimark Income Growth<br />

1 formerly SunWise Trimark U.S. Companies 4 formerly SunWise 2001 <strong>CI</strong> Signature Select Canadian Balanced 7<br />

formerly SunWise Trimark Global Balanced<br />

2<br />

formerly SunWise 2001 Trimark U.S. Companies<br />

5<br />

formerly SunWise Trimark Income Growth<br />

8<br />

formerly SunWise 2001 Trimark Global Balanced<br />

FOR DEALER USE ONLY<br />

MONTHLY PERFORMANCE SCORECARD AS AT JUNE 30, 2011 8 9