July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

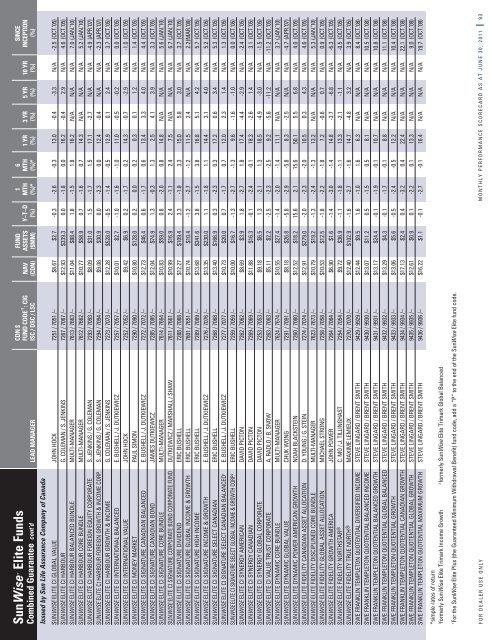

SunWise<br />

®<br />

Elite<br />

Funds<br />

Combined Guarantee cont’d<br />

Issued by Sun Life Assurance Company of Canada<br />

LEAD MANAGER<br />

CDN $<br />

FUND CODE † : <strong>CI</strong>G<br />

ISC / DSC / LSC<br />

SUNWISE ELITE <strong>CI</strong> GLOBAL VALUE JOHN HOCK 7251 / 7051 /– $8.67 $2.7 -0.3 -2.6 -0.3 13.0 -0.4 -3.3 N/A -2.5 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> HARBOUR G. COLEMAN / S. JENKINS 7267 / 7067 /– $12.93 $339.3 0.0 -1.8 0.0 16.2 -0.4 2.9 N/A 4.6 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> HARBOUR BALANCED BUNDLE MULTI-MANAGER 7613 / 7663 /– $11.04 $88.4 1.8 -1.5 1.8 16.2 N/A N/A N/A 7.0 (JAN.’10)<br />

SUNWISE ELITE <strong>CI</strong> HARBOUR CORE BUNDLE MULTI-MANAGER 7612 / 7662 /– $10.77 $58.9 0.7 -1.6 0.7 14.3 N/A N/A N/A 5.2 (JAN.’10)<br />

SUNWISE ELITE <strong>CI</strong> HARBOUR FOREIGN EQUITY CORPORATE S. JENKINS / G. COLEMAN 7293 / 7093 /– $8.09 $31.0 1.5 -1.7 1.5 17.1 -2.7 N/A N/A -4.9 (APR.’07)<br />

SUNWISE ELITE <strong>CI</strong> HARBOUR FOREIGN GROWTH & INCOME CORP. S. JENKINS / G. COLEMAN 7294 / 7094 /– $9.08 $30.9 0.0 -2.3 0.0 12.4 -0.4 N/A N/A -2.3 (APR.’07)<br />

SUNWISE ELITE <strong>CI</strong> HARBOUR GROWTH & INCOME G. COLEMAN / S. JENKINS 7273 / 7073 /– $12.28 $528.0 -0.5 -1.4 -0.5 12.9 0.1 2.4 N/A 3.7 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> INTERNATIONAL BALANCED E. BUSHELL / J. DUTKIEWICZ 7257 / 7057 /– $10.01 $2.7 -1.0 -1.6 -1.0 11.0 -0.5 -0.2 N/A 0.0 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> INTERNATIONAL VALUE JOHN HOCK 7252 / 7052 /– $9.42 $6.9 0.2 -1.7 0.2 14.3 -0.7 -2.9 N/A -1.0 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> MONEY MARKET PAUL SIMON 7290 / 7090 /– $10.80 $128.0 0.2 0.0 0.2 0.3 0.1 1.2 N/A 1.4 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE CANADIAN BALANCED E. BUSHELL / J. DUTKIEWICZ 7272 / 7072 /– $12.73 $46.4 0.6 -1.7 0.6 13.4 3.3 4.0 N/A 4.4 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE CANADIAN BOND JAMES DUTKIEWICZ 7285 / 7085 /– $12.04 $74.9 1.3 -0.3 1.3 2.5 4.1 3.9 N/A 3.3 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE CORE BUNDLE MULTI-MANAGER 7614 / 7664 /– $10.83 $59.0 0.8 -2.0 0.8 14.8 N/A N/A N/A 5.6 (JAN.’10)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE CORPORATE BOND CORPORATE FUND DUTKIEWICZ / MARSHALL / SHAW 7611 / 7661 /– $10.99 $16.9 2.4 -1.1 2.4 7.5 N/A N/A N/A 6.7 (JAN.’10)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE DIVIDEND ERIC BUSHELL 7288 / 7088 /– $12.27 $109.4 3.3 -1.8 3.3 15.0 5.8 3.0 N/A 3.7 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE GLOBAL INCOME & GROWTH ERIC BUSHELL 7601 / 7651 /– $10.74 $10.4 -1.2 -2.7 -1.2 11.5 2.4 N/A N/A 2.2 (MAR.’08)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE HIGH INCOME ERIC BUSHELL 7289 / 7089 /– $13.68 $341.6 3.8 -1.5 3.8 16.8 5.1 4.2 N/A 5.7 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE INCOME & GROWTH E. BUSHELL / J. DUTKIEWICZ 7276 / 7076 /– $13.35 $230.0 1.1 -1.8 1.1 14.4 3.1 4.0 N/A 5.2 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE SELECT CANADIAN ERIC BUSHELL 7268 / 7068 /– $13.40 $166.9 0.3 -2.3 0.3 17.2 0.6 3.4 N/A 5.3 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE SELECT CANADIAN BALANCED 1 E. BUSHELL / J. DUTKIEWICZ 7277 / 7077 /– $10.73 $20.0 0.7 -1.7 0.7 12.0 2.3 1.4 N/A 1.3 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SIGNATURE SELECT GLOBAL INCOME & GROWTH CORP. 2 ERIC BUSHELL 7259 / 7059 /– $10.00 $16.7 -1.3 -2.7 -1.3 9.6 -1.6 -1.0 N/A 0.0 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SYNERGY AMERICAN DAVID PICTON 7262 / 7062 /– $8.69 $3.9 1.8 -2.7 1.8 17.4 -4.4 -2.9 N/A -2.4 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SYNERGY CANADIAN DAVID PICTON 7269 / 7069 /– $11.88 $16.3 -0.1 -2.4 -0.1 18.3 -2.6 1.4 N/A 3.1 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> SYNERGY GLOBAL CORPORATE DAVID PICTON 7253 / 7053 /– $9.18 $6.5 1.3 -2.1 1.3 18.5 -4.9 -3.0 N/A -1.5 (OCT.’05)<br />

SUNWISE ELITE <strong>CI</strong> VALUE TRUST CORPORATE A. RADLO / B. SNOW 7263 / 7063 /– $5.11 $2.2 -2.5 -2.3 -2.5 9.2 -5.6 -11.2 N/A -11.2 (OCT.’05)<br />

SUNWISE ELITE DYNAMIC CORE BUNDLE MULTI-MANAGER 7624 / 7674 /– $10.55 $27.4 -1.4 -2.0 -1.4 11.1 N/A N/A N/A 3.7 (JAN.’10)<br />

SUNWISE ELITE DYNAMIC GLOBAL VALUE CHUK WONG 7291 / 7091 /– $8.18 $26.8 -5.8 -2.9 -5.8 8.3 -2.5 N/A N/A -4.7 (APR.’07)<br />

SUNWISE ELITE DYNAMIC POWER AMERICAN GROWTH NOAH BLACKSTEIN 7260 / 7060 /– $12.52 $18.2 15.6 2.1 15.6 50.1 5.5 6.8 N/A 4.0 (OCT.’05)<br />

SUNWISE ELITE FIDELITY CANADIAN ASSET ALLOCATION D. YOUNG / G. STEIN 7274 / 7074 /– $12.91 $279.0 -2.0 -2.3 -2.0 10.5 0.3 4.3 N/A 4.6 (OCT.’05)<br />

SUNWISE ELITE FIDELITY DIS<strong>CI</strong>PLINED CORE BUNDLE MULTI-MANAGER 7623 / 7673 /– $10.79 $19.2 -1.3 -2.4 -1.3 13.2 N/A N/A N/A 5.3 (JAN.’10)<br />

SUNWISE ELITE FIDELITY GLOBAL ASSET ALLOCATION MICHAEL STRONG 7258 / 7058 /– $10.53 $12.5 -1.8 -2.2 -1.8 7.2 -0.6 0.7 N/A 0.9 (OCT.’05)<br />

SUNWISE ELITE FIDELITY GROWTH AMERICA JOHN POWER 7264 / 7064 /– $6.90 $1.6 -1.4 -3.0 -1.4 14.8 -3.7 -6.8 N/A -6.3 (OCT.’05)<br />

SUNWISE ELITE FIDELITY NORTHSTAR ® C. MO / J. TILLINGHAST 7254 / 7054 /– $9.72 $36.9 -1.1 -1.8 -1.1 13.3 -2.1 -1.1 N/A -0.5 (OCT.’05)<br />

SUNWISE ELITE FIDELITY TRUE NORTH ® MAXIME LEMIEUX 7270 / 7070 /– $12.40 $102.9 -1.6 -2.7 -1.6 14.7 -4.8 3.2 N/A 3.9 (OCT.’05)<br />

SWE FRANKLIN TEMPLETON QUOTENTIAL DIVERSIFIED INCOME STEVE LINGARD / BRENT SMITH 9429 / 9929 /– $12.44 $9.5 1.6 -1.0 1.6 6.3 N/A N/A N/A 8.4 (OCT.’08)<br />

SWE FRANKLIN TEMPLETON QUOTENTIAL BALANCED INCOME STEVE LINGARD / BRENT SMITH 9430 / 9930 /– $13.07 $11.2 0.5 -1.5 0.5 8.1 N/A N/A N/A 10.5 (OCT.’08)<br />

SWE FRANKLIN TEMPLETON QUOTENTIAL BALANCED GROWTH STEVE LINGARD / BRENT SMITH 9431 / 9931 /– $13.17 $24.4 -0.1 -1.9 -0.1 10.7 N/A N/A N/A 10.8 (OCT.’08)<br />

SWE FRANKLIN TEMPLETON QUOTENTIAL GLOBAL BALANCED STEVE LINGARD / BRENT SMITH 9432 / 9932 /– $13.29 $4.3 -0.1 -1.7 -0.1 8.8 N/A N/A N/A 11.1 (OCT.’08)<br />

SWE FRANKLIN TEMPLETON QUOTENTIAL GROWTH STEVE LINGARD / BRENT SMITH 9433 / 9933 /– $13.06 $5.6 -0.5 -2.4 -0.5 12.2 N/A N/A N/A 10.4 (OCT.’08)<br />

SWE FRANKLIN TEMPLETON QUOTENTIAL CANADIAN GROWTH STEVE LINGARD / BRENT SMITH 9434 / 9934 /– $17.13 $2.4 0.4 -3.2 0.4 22.4 N/A N/A N/A 22.1 (OCT.’08)<br />

SWE FRANKLIN TEMPLETON QUOTENTIAL GLOBAL GROWTH STEVE LINGARD / BRENT SMITH 9435 / 9935 /– $12.61 $0.9 0.1 -2.2 0.1 13.3 N/A N/A N/A 9.0 (OCT.’08)<br />

SWE FRANKLIN TEMPLETON QUOTENTIAL MAXIMUM GROWTH STEVE LINGARD / BRENT SMITH 9436 / 9936 /– $16.22 $1.1 -0.1 -2.7 -0.1 16.4 N/A N/A N/A 19.7 (OCT.’08)<br />

NAV<br />

(CDN)<br />

FUND<br />

ASSETS<br />

($MM)<br />

Y–T–D<br />

(%)<br />

1<br />

MTH<br />

(%)*<br />

6<br />

MTH<br />

(%)*<br />

1 YR<br />

(%)<br />

3 YR<br />

(%)<br />

5 YR<br />

(%)<br />

10 YR<br />

(%)<br />

SINCE<br />

INCEPTION<br />

(%)<br />

*simple rates of return<br />

2 1formerly SunWise Elite Trimark Income Growth formerly SunWise Elite Trimark Global Balanced<br />

†For the SunWise Elite Plus (the Guaranteed Minimum Withdrawal Benefit) fund code, add a “P” to the end of the SunWise Elite fund code.<br />

FOR DEALER USE ONLY<br />

MONTHLY PERFORMANCE SCORECARD AS AT JUNE 30, 2011 93