July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

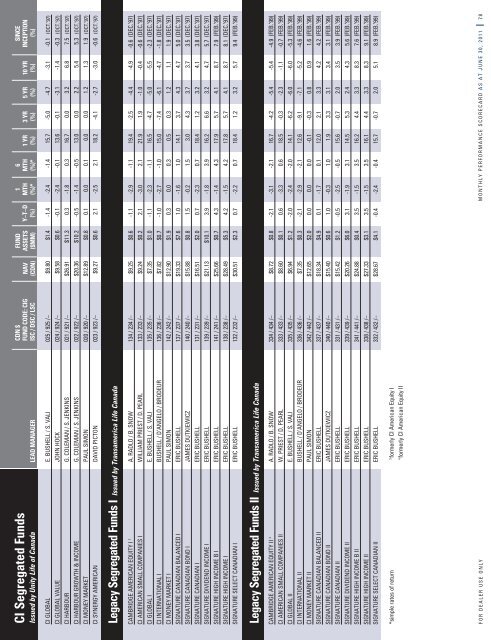

<strong>CI</strong> Segregated Funds<br />

Issued by Unity Life of Canada<br />

LEAD MANAGER<br />

CDN $<br />

FUND CODE: <strong>CI</strong>G<br />

ISC / DSC / LSC<br />

NAV<br />

(CDN)<br />

FUND<br />

ASSETS<br />

($MM)<br />

Y–T–D<br />

(%)<br />

1<br />

MTH<br />

(%)*<br />

6<br />

MTH<br />

(%)*<br />

1 YR<br />

(%)<br />

3 YR<br />

(%)<br />

5 YR<br />

(%)<br />

10 YR<br />

(%)<br />

SINCE<br />

INCEPTION<br />

(%)<br />

<strong>CI</strong> GLOBAL E. BUSHELL / S. VALI 025 / 925 /– $9.80 $1.4 -1.4 -2.4 -1.4 15.7 -5.0 -4.7 -3.1 -0.1 (OCT.’97)<br />

<strong>CI</strong> GLOBAL VALUE JOHN HOCK 024 / 924 /– $9.58 $0.6 -0.1 -2.4 -0.1 13.6 -0.1 -3.1 -1.4 -0.3 (OCT.’97)<br />

<strong>CI</strong> HARBOUR G. COLEMAN / S. JENKINS 021 / 921 /– $26.91 $11.3 0.3 -1.8 0.3 16.7 0.0 3.2 6.8 7.5 (OCT.’97)<br />

<strong>CI</strong> HARBOUR GROWTH & INCOME G. COLEMAN / S. JENKINS 022 / 922 /– $20.36 $10.2 -0.5 -1.4 -0.5 13.0 0.0 2.2 5.4 5.3 (OCT.’97)<br />

<strong>CI</strong> MONEY MARKET PAUL SIMON 020 / 920 /– $12.89 $0.8 0.1 0.0 0.1 0.0 0.0 1.2 1.3 1.9 (OCT.’97)<br />

<strong>CI</strong> SYNERGY AMERICAN DAVID PICTON 023 / 923 /– $9.27 $0.6 2.1 -2.5 2.1 18.2 -4.1 -2.7 -3.0 -0.6 (OCT.’97)<br />

Legacy Segregated Funds I Issued by Transamerica Life Canada<br />

CAMBRIDGE AMERICAN EQUITY I 3 A. RADLO / B. SNOW 134 / 234 /– $9.25 $0.6 -1.1 -2.9 -1.1 19.4 -2.5 -4.4 -4.9 -0.6 (DEC.’97)<br />

<strong>CI</strong> AMERICAN SMALL COMPANIES I WILLIAM PRIEST / D. PEARL 133 / 233 /– $9.24 $0.2 2.1 -3.0 2.1 21.9 1.9 -1.0 -0.4 -0.6 (DEC.’97)<br />

<strong>CI</strong> GLOBAL I E. BUSHELL / S. VALI 135 / 235 /– $7.35 $1.0 -1.1 -2.3 -1.1 16.5 -4.7 -5.0 -5.5 -2.3 (DEC.’97)<br />

<strong>CI</strong> INTERNATIONAL I BUSHELL / D’ANGELO / BRODEUR 136 / 236 /– $7.82 $0.7 -1.0 -2.7 -1.0 15.0 -7.4 -6.1 -4.7 -1.8 (DEC.’97)<br />

<strong>CI</strong> MONEY MARKET I PAUL SIMON 142 / 242 /– $12.90 $1.9 0.3 0.0 0.3 0.5 0.3 1.2 1.1 1.9 (DEC.’97)<br />

SIGNATURE CANADIAN BALANCED I ERIC BUSHELL 137 / 237 /– $19.33 $7.6 1.0 -1.6 1.0 14.1 3.7 4.3 4.7 5.0 (DEC.’97)<br />

SIGNATURE CANADIAN BOND I JAMES DUTKIEWICZ 140 / 240 /– $15.88 $0.8 1.5 -0.2 1.5 3.0 4.3 3.7 3.7 3.5 (DEC.’97)<br />

SIGNATURE CANADIAN I ERIC BUSHELL 131 / 231 /– $16.51 $2.0 0.7 -2.3 0.7 18.4 1.2 3.2 4.1 3.8 (DEC.’97)<br />

SIGNATURE DIVIDEND INCOME I ERIC BUSHELL 139 / 239 /– $21.13 $10.1 3.9 -1.8 3.9 16.2 6.6 3.2 4.7 5.7 (DEC.’97)<br />

SIGNATURE HIGH INCOME B I ERIC BUSHELL 141 / 241 /– $25.66 $0.7 4.3 -1.4 4.3 17.9 5.7 4.1 8.7 7.9 (FEB.’99)<br />

SIGNATURE HIGH INCOME I ERIC BUSHELL 138 / 238 /– $28.49 $5.3 4.2 -1.5 4.2 17.8 5.7 4.1 8.7 8.1 (DEC.’97)<br />

SIGNATURE SELECT CANADIAN I ERIC BUSHELL 132 / 232 /– $30.51 $2.3 0.7 -2.2 0.7 18.4 1.2 3.2 5.7 9.4 (FEB.’99)<br />

Legacy Segregated Funds II Issued by Transamerica Life Canada<br />

CAMBRIDGE AMERICAN EQUITY II 4 A. RADLO / B. SNOW 334 / 434 /– $8.72 $0.8 -2.1 -3.1 -2.1 16.7 -4.2 -5.4 -5.4 -4.9 (FEB.’99)<br />

<strong>CI</strong> AMERICAN SMALL COMPANIES II W. PRIEST / D. PEARL 333 / 433 /– $8.60 $0.1 0.6 -3.3 0.6 18.5 -0.3 -2.3 -1.1 -0.7 (FEB.’99)<br />

<strong>CI</strong> GLOBAL II E. BUSHELL / S. VALI 335 / 435 /– $6.94 $1.2 -2.0 -2.4 -2.0 14.1 -6.2 -6.0 -6.0 -5.3 (FEB.’99)<br />

<strong>CI</strong> INTERNATIONAL II BUSHELL / D’ANGELO / BRODEUR 336 / 436 /– $7.35 $0.3 -2.1 -2.9 -2.1 12.6 -9.1 -7.1 -5.2 -4.6 (FEB.’99)<br />

<strong>CI</strong> MONEY MARKET II PAUL SIMON 342 / 442 /– $12.65 $2.0 0.0 0.0 0.0 -0.1 -0.3 0.8 0.9 1.6 (FEB.’99)<br />

SIGNATURE CANADIAN BALANCED II ERIC BUSHELL 337 / 437 /– $18.34 $4.9 0.1 -1.7 0.1 12.0 2.1 3.3 4.2 4.2 (FEB.’99)<br />

SIGNATURE CANADIAN BOND II JAMES DUTKIEWICZ 340 / 440 /– $15.40 $0.6 1.0 -0.3 1.0 1.9 3.3 3.1 3.4 3.1 (FEB.’99)<br />

SIGNATURE CANADIAN II ERIC BUSHELL 331 / 431 /– $15.42 $1.2 -0.5 -2.5 -0.5 15.6 -0.7 2.0 3.5 3.9 (FEB.’99)<br />

SIGNATURE DIVIDEND INCOME II ERIC BUSHELL 339 / 439 /– $20.26 $6.0 3.1 -1.9 3.1 14.5 5.3 2.4 4.3 5.6 (FEB.’99)<br />

SIGNATURE HIGH INCOME B II ERIC BUSHELL 341 / 441 /– $24.88 $0.4 3.5 -1.5 3.5 16.2 4.4 3.3 8.3 7.6 (FEB.’99)<br />

SIGNATURE HIGH INCOME II ERIC BUSHELL 338 / 438 /– $27.33 $3.1 3.5 -1.5 3.5 16.1 4.4 3.3 8.3 9.1 (FEB.’99)<br />

SIGNATURE SELECT CANADIAN II ERIC BUSHELL 332 / 432 /– $28.67 $4.1 -0.4 -2.4 -0.4 15.7 -0.7 2.0 5.1 8.9 (FEB.’99)<br />

*simple rates of return<br />

3<br />

formerly <strong>CI</strong> American Equity I<br />

4<br />

formerly <strong>CI</strong> American Equity II<br />

FOR DEALER USE ONLY<br />

MONTHLY PERFORMANCE SCORECARD AS AT JUNE 30, 2011 7 8