July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

July - Summer Edition - CI Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Commentary<br />

However, if investors were truly concerned with financial<br />

collapse in Europe, the euro would not be holding up as<br />

well as it has. The euro could yet collapse or it may rally<br />

to new highs – making a prediction is not the objective of<br />

this analysis. The point is that, rightly or wrongly, the euro<br />

exchange has yet to flash a crisis signal.<br />

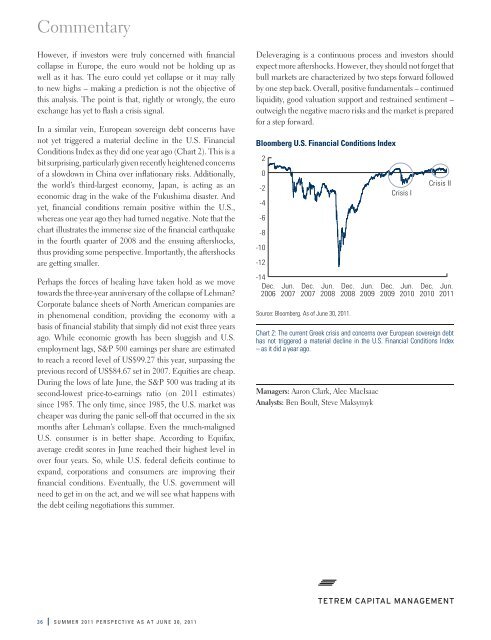

In a similar vein, European sovereign debt concerns have<br />

not yet triggered a material decline in the U.S. Financial<br />

Conditions Index as they did one year ago (Chart 2). This is a<br />

bit surprising, particularly given recently heightened concerns<br />

of a slowdown in China over inflationary risks. Additionally,<br />

the world’s third-largest economy, Japan, is acting as an<br />

economic drag in the wake of the Fukushima disaster. And<br />

yet, financial conditions remain positive within the U.S.,<br />

whereas one year ago they had turned negative. Note that the<br />

chart illustrates the immense size of the financial earthquake<br />

in the fourth quarter of 2008 and the ensuing aftershocks,<br />

thus providing some perspective. Importantly, the aftershocks<br />

are getting smaller.<br />

Perhaps the forces of healing have taken hold as we move<br />

towards the three-year anniversary of the collapse of Lehman?<br />

Corporate balance sheets of North American companies are<br />

in phenomenal condition, providing the economy with a<br />

basis of financial stability that simply did not exist three years<br />

ago. While economic growth has been sluggish and U.S.<br />

employment lags, S&P 500 earnings per share are estimated<br />

to reach a record level of US$99.27 this year, surpassing the<br />

previous record of US$84.67 set in 2007. Equities are cheap.<br />

During the lows of late June, the S&P 500 was trading at its<br />

second-lowest price-to-earnings ratio (on 2011 estimates)<br />

since 1985. The only time, since 1985, the U.S. market was<br />

cheaper was during the panic sell-off that occurred in the six<br />

months after Lehman’s collapse. Even the much-maligned<br />

U.S. consumer is in better shape. According to Equifax,<br />

average credit scores in June reached their highest level in<br />

over four years. So, while U.S. federal deficits continue to<br />

expand, corporations and consumers are improving their<br />

financial conditions. Eventually, the U.S. government will<br />

need to get in on the act, and we will see what happens with<br />

the debt ceiling negotiations this summer.<br />

Deleveraging is a continuous process and investors should<br />

expect more aftershocks. However, they should not forget that<br />

bull markets are characterized by two steps forward followed<br />

by one step back. Overall, positive fundamentals – continued<br />

liquidity, good valuation support and restrained sentiment –<br />

outweigh the negative macro risks and the market is prepared<br />

for a step forward.<br />

Bloomberg U.S. Financial Conditions Index<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

-10<br />

-12<br />

-14<br />

Dec.<br />

2006<br />

Jun.<br />

2007<br />

Dec.<br />

2007<br />

Jun.<br />

2008<br />

Dec.<br />

2008<br />

Source: Bloomberg. As of June 30, 2011.<br />

Jun.<br />

2009<br />

Chart 2: The current Greek crisis and concerns over European sovereign debt<br />

has not triggered a material decline in the U.S. Financial Conditions Index<br />

– as it did a year ago.<br />

Managers: Aaron Clark, Alec MacIsaac<br />

Analysts: Ben Boult, Steve Maksymyk<br />

Dec.<br />

2009<br />

Crisis I<br />

Jun.<br />

2010<br />

Dec.<br />

2010<br />

Crisis II<br />

Jun.<br />

2011<br />

36 SUMMER 2011 PERSPECTIVE AS AT JUNE 30, 2011