Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

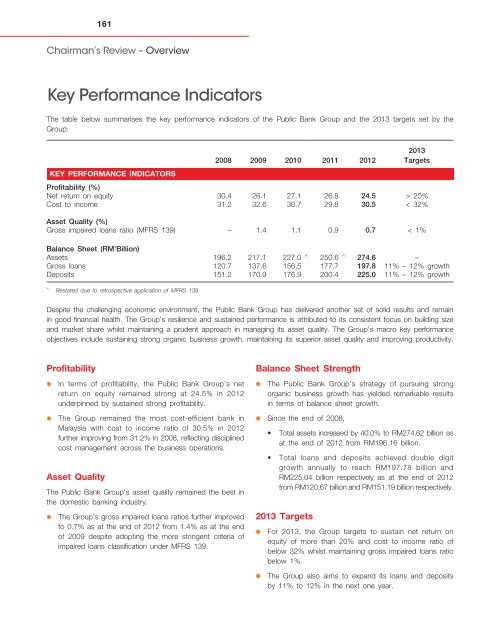

161Chairman’s Review – OverviewKey Performance IndicatorsThe table below summarises the key performance indicators of the <strong>Public</strong> <strong>Bank</strong> Group and the 2013 targets set by theGroup:2008 2009 2010 2011 20122013TargetsKEY PERFORMANCE INDICATORSProfitability (%)Net return on equity 30.4 26.1 27.1 26.8 24.5 > 20%Cost to in<strong>com</strong>e 31.2 32.6 30.7 29.8 30.5 < 32%Asset Quality (%)Gross impaired loans ratio (MFRS 139) – 1.4 1.1 0.9 0.7 < 1%Balance Sheet (RM’Billion)Assets 196.2 217.1 227.0 ^ 250.6 ^ 274.6 –Gross loans 120.7 137.6 156.5 177.7 197.8 11% – 12% growthDeposits 151.2 170.9 176.9 200.4 225.0 11% – 12% growth^Restated due to retrospective application of MFRS 139Despite the challenging economic environment, the <strong>Public</strong> <strong>Bank</strong> Group has delivered another set of solid results and remainin good financial health. The Group’s resilience and sustained performance is attributed to its consistent focus on building sizeand market share whilst maintaining a prudent approach in managing its asset quality. The Group’s macro key performanceobjectives include sustaining strong organic business growth, maintaining its superior asset quality and improving productivity.ProfitabilityIn terms of profitability, the <strong>Public</strong> <strong>Bank</strong> Group’s netreturn on equity remained strong at 24.5% in 2012underpinned by sustained strong profitability.The Group remained the most cost-efficient bank inMalaysia with cost to in<strong>com</strong>e ratio of 30.5% in 2012further improving from 31.2% in 2008, reflecting disciplinedcost management across the business operations.Asset QualityThe <strong>Public</strong> <strong>Bank</strong> Group’s asset quality remained the best inthe domestic banking industry.The Group’s gross impaired loans ratios further improvedto 0.7% as at the end of 2012 from 1.4% as at the endof 2009 despite adopting the more stringent criteria ofimpaired loans classification under MFRS 139.Balance Sheet StrengthThe <strong>Public</strong> <strong>Bank</strong> Group’s strategy of pursuing strongorganic business growth has yielded remarkable resultsin terms of balance sheet growth.Since the end of 2008,• Total assets increased by 40.0% to RM274.62 billion asat the end of 2012 from RM196.16 billion.• Total loans and deposits achieved double digitgrowth annually to reach RM197.78 billion andRM225.04 billion respectively as at the end of 2012from RM120.67 billion and RM151.19 billion respectively.2013 TargetsFor 2013, the Group targets to sustain net return onequity of more than 20% and cost to in<strong>com</strong>e ratio ofbelow 32% whilst maintaining gross impaired loans ratiobelow 1%.The Group also aims to expand its loans and depositsby 11% to 12% in the next one year.