You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

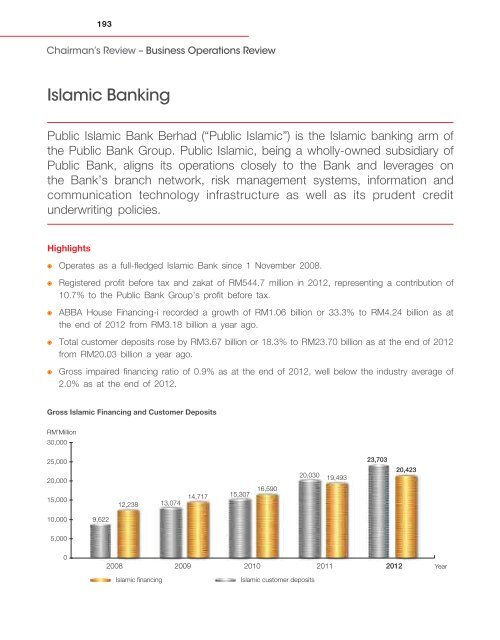

193Chairman’s Review – Business Operations ReviewIslamic <strong>Bank</strong>ing<strong>Public</strong> Islamic <strong>Bank</strong> Berhad (“<strong>Public</strong> Islamic”) is the Islamic banking arm ofthe <strong>Public</strong> <strong>Bank</strong> Group. <strong>Public</strong> Islamic, being a wholly-owned subsidiary of<strong>Public</strong> <strong>Bank</strong>, aligns its operations closely to the <strong>Bank</strong> and leverages onthe <strong>Bank</strong>’s branch network, risk management systems, information and<strong>com</strong>munication technology infrastructure as well as its prudent creditunderwriting policies.HighlightsOperates as a full-fledged Islamic <strong>Bank</strong> since 1 November 2008.Registered profit before tax and zakat of RM544.7 million in 2012, representing a contribution of10.7% to the <strong>Public</strong> <strong>Bank</strong> Group’s profit before tax.ABBA House Financing-i recorded a growth of RM1.06 billion or 33.3% to RM4.24 billion as atthe end of 2012 from RM3.18 billion a year ago.Total customer deposits rose by RM3.67 billion or 18.3% to RM23.70 billion as at the end of 2012from RM20.03 billion a year ago.Gross impaired financing ratio of 0.9% as at the end of 2012, well below the industry average of2.0% as at the end of 2012.Gross Islamic Financing and Customer DepositsRM’Million30,00025,00020,00015,00012,23813,074 14,717 15,307 16,59020,03019,49323,70320,42310,0009,6225,00002008 2009 201020112012YearIslamic financingIslamic customer deposits