You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

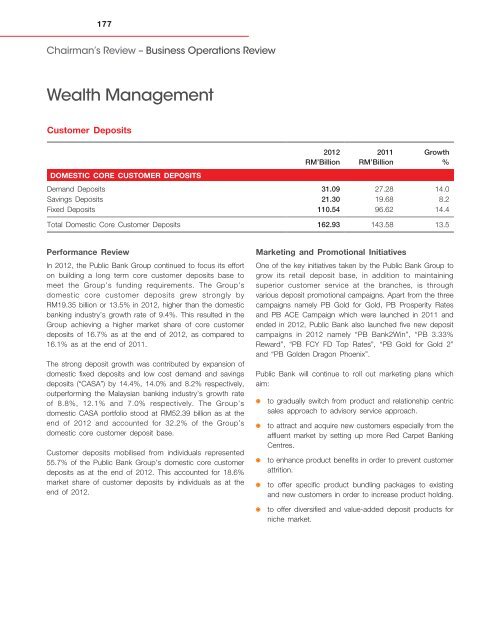

177Chairman’s Review – Business Operations ReviewWealth ManagementCustomer Deposits2012RM’Billion2011RM’BillionGrowth%DOMESTIC CORE CUSTOMER DEPOSITSDemand Deposits 31.09 27.28 14.0Savings Deposits 21.30 19.68 8.2Fixed Deposits 110.54 96.62 14.4Total Domestic Core Customer Deposits 162.93 143.58 13.5Performance ReviewIn 2012, the <strong>Public</strong> <strong>Bank</strong> Group continued to focus its efforton building a long term core customer deposits base tomeet the Group’s funding requirements. The Group’sdomestic core customer deposits grew strongly byRM19.35 billion or 13.5% in 2012, higher than the domesticbanking industry’s growth rate of 9.4%. This resulted in theGroup achieving a higher market share of core customerdeposits of 16.7% as at the end of 2012, as <strong>com</strong>pared to16.1% as at the end of 2011.The strong deposit growth was contributed by expansion ofdomestic fixed deposits and low cost demand and savingsdeposits (“CASA”) by 14.4%, 14.0% and 8.2% respectively,outperforming the Malaysian banking industry’s growth rateof 8.8%, 12.1% and 7.0% respectively. The Group’sdomestic CASA portfolio stood at RM52.39 billion as at theend of 2012 and accounted for 32.2% of the Group’sdomestic core customer deposit base.Customer deposits mobilised from individuals represented55.7% of the <strong>Public</strong> <strong>Bank</strong> Group’s domestic core customerdeposits as at the end of 2012. This accounted for 18.6%market share of customer deposits by individuals as at theend of 2012.Marketing and Promotional InitiativesOne of the key initiatives taken by the <strong>Public</strong> <strong>Bank</strong> Group togrow its retail deposit base, in addition to maintainingsuperior customer service at the branches, is throughvarious deposit promotional campaigns. Apart from the threecampaigns namely PB Gold for Gold, PB Prosperity Ratesand PB ACE Campaign which were launched in 2011 andended in 2012, <strong>Public</strong> <strong>Bank</strong> also launched five new depositcampaigns in 2012 namely “PB <strong>Bank</strong>2Win”, “PB 3.33%Reward”, “PB FCY FD Top Rates”, “PB Gold for Gold 2”and “PB Golden Dragon Phoenix”.<strong>Public</strong> <strong>Bank</strong> will continue to roll out marketing plans whichaim:to gradually switch from product and relationship centricsales approach to advisory service approach.to attract and acquire new customers especially from theaffluent market by setting up more Red Carpet <strong>Bank</strong>ingCentres.to enhance product benefits in order to prevent customerattrition.to offer specific product bundling packages to existingand new customers in order to increase product holding.to offer diversified and value-added deposit products forniche market.