Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

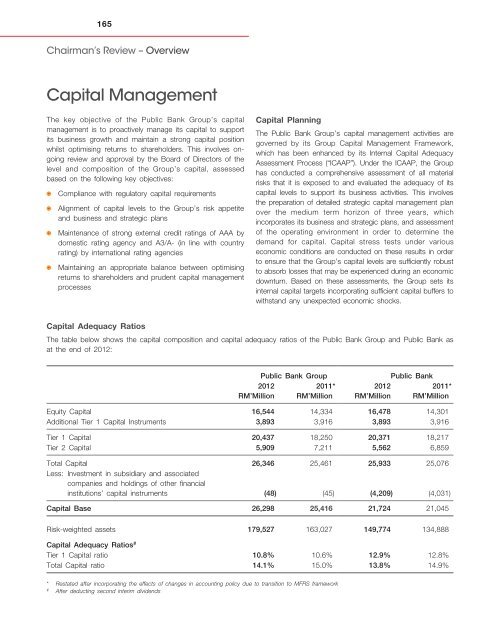

165Chairman’s Review – OverviewCapital ManagementThe key objective of the <strong>Public</strong> <strong>Bank</strong> Group’s capitalmanagement is to proactively manage its capital to supportits business growth and maintain a strong capital positionwhilst optimising returns to shareholders. This involves ongoingreview and approval by the Board of Directors of thelevel and <strong>com</strong>position of the Group’s capital, assessedbased on the following key objectives:Compliance with regulatory capital requirementsAlignment of capital levels to the Group’s risk appetiteand business and strategic plansMaintenance of strong external credit ratings of AAA bydomestic rating agency and A3/A- (in line with countryrating) by international rating agenciesMaintaining an appropriate balance between optimisingreturns to shareholders and prudent capital managementprocessesCapital PlanningThe <strong>Public</strong> <strong>Bank</strong> Group’s capital management activities aregoverned by its Group Capital Management Framework,which has been enhanced by its Internal Capital AdequacyAssessment Process (“ICAAP”). Under the ICAAP, the Grouphas conducted a <strong>com</strong>prehensive assessment of all materialrisks that it is exposed to and evaluated the adequacy of itscapital levels to support its business activities. This involvesthe preparation of detailed strategic capital management planover the medium term horizon of three years, whichincorporates its business and strategic plans, and assessmentof the operating environment in order to determine thedemand for capital. Capital stress tests under variouseconomic conditions are conducted on these results in orderto ensure that the Group’s capital levels are sufficiently robustto absorb losses that may be experienced during an economicdownturn. Based on these assessments, the Group sets itsinternal capital targets incorporating sufficient capital buffers towithstand any unexpected economic shocks.Capital Adequacy RatiosThe table below shows the capital <strong>com</strong>position and capital adequacy ratios of the <strong>Public</strong> <strong>Bank</strong> Group and <strong>Public</strong> <strong>Bank</strong> asat the end of 2012:2012RM’Million<strong>Public</strong> <strong>Bank</strong> Group <strong>Public</strong> <strong>Bank</strong>2011*2012RM’Million RM’Million2011*RM’MillionEquity Capital 16,544 14,334 16,478 14,301Additional Tier 1 Capital Instruments 3,893 3,916 3,893 3,916Tier 1 Capital 20,437 18,250 20,371 18,217Tier 2 Capital 5,909 7,211 5,562 6,859Total Capital 26,346 25,461 25,933 25,076Less: Investment in subsidiary and associated<strong>com</strong>panies and holdings of other financialinstitutions’ capital instruments (48) (45) (4,209) (4,031)Capital Base 26,298 25,416 21,724 21,045Risk-weighted assets 179,527 163,027 149,774 134,888Capital Adequacy Ratios #Tier 1 Capital ratio 10.8% 10.6% 12.9% 12.8%Total Capital ratio 14.1% 15.0% 13.8% 14.9%* Restated after incorporating the effects of changes in accounting policy due to transition to MFRS framework#After deducting second interim dividends