Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

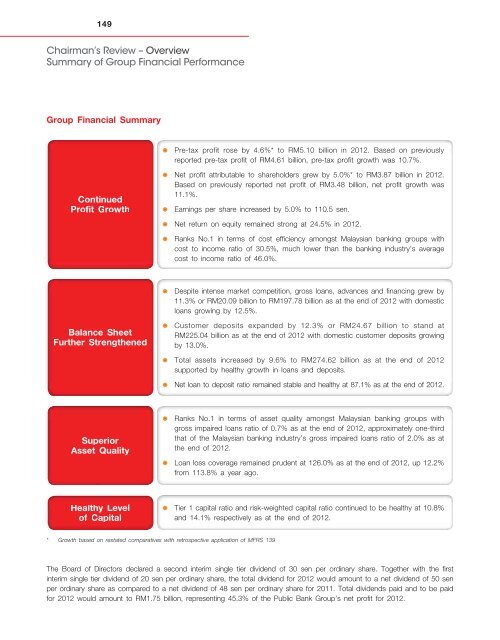

149Chairman’s Review – OverviewSummary of Group Financial PerformanceGroup Financial SummaryPre-tax profit rose by 4.6%* to RM5.10 billion in 2012. Based on previouslyreported pre-tax profit of RM4.61 billion, pre-tax profit growth was 10.7%.ContinuedProfit GrowthNet profit attributable to shareholders grew by 5.0%* to RM3.87 billion in 2012.Based on previously reported net profit of RM3.48 billion, net profit growth was11.1%.Earnings per share increased by 5.0% to 110.5 sen.Net return on equity remained strong at 24.5% in 2012.Ranks No.1 in terms of cost efficiency amongst Malaysian banking groups withcost to in<strong>com</strong>e ratio of 30.5%, much lower than the banking industry’s averagecost to in<strong>com</strong>e ratio of 46.0%.Despite intense market <strong>com</strong>petition, gross loans, advances and financing grew by11.3% or RM20.09 billion to RM197.78 billion as at the end of 2012 with domesticloans growing by 12.5%.Balance SheetFurther StrengthenedCustomer deposits expanded by 12.3% or RM24.67 billion to stand atRM225.04 billion as at the end of 2012 with domestic customer deposits growingby 13.0%.Total assets increased by 9.6% to RM274.62 billion as at the end of 2012supported by healthy growth in loans and deposits.Net loan to deposit ratio remained stable and healthy at 87.1% as at the end of 2012.SuperiorAsset QualityRanks No.1 in terms of asset quality amongst Malaysian banking groups withgross impaired loans ratio of 0.7% as at the end of 2012, approximately one-thirdthat of the Malaysian banking industry’s gross impaired loans ratio of 2.0% as atthe end of 2012.Loan loss coverage remained prudent at 126.0% as at the end of 2012, up 12.2%from 113.8% a year ago.Healthy Levelof CapitalTier 1 capital ratio and risk-weighted capital ratio continued to be healthy at 10.8%and 14.1% respectively as at the end of 2012.* Growth based on restated <strong>com</strong>paratives with retrospective application of MFRS 139The Board of Directors declared a second interim single tier dividend of 30 sen per ordinary share. Together with the firstinterim single tier dividend of 20 sen per ordinary share, the total dividend for 2012 would amount to a net dividend of 50 senper ordinary share as <strong>com</strong>pared to a net dividend of 48 sen per ordinary share for 2011. Total dividends paid and to be paidfor 2012 would amount to RM1.75 billion, representing 45.3% of the <strong>Public</strong> <strong>Bank</strong> Group’s net profit for 2012.