Tesco v Constain - Thomson Reuters

Tesco v Constain - Thomson Reuters

Tesco v Constain - Thomson Reuters

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

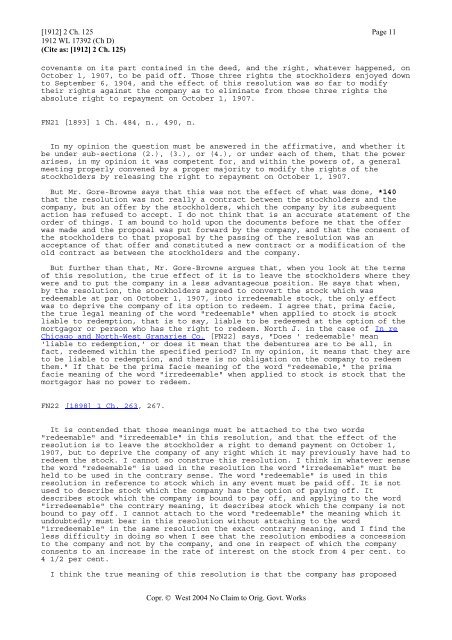

[1912] 2 Ch. 125 Page 111912 WL 17392 (Ch D)(Cite as: [1912] 2 Ch. 125)covenants on its part contained in the deed, and the right, whatever happened, onOctober 1, 1907, to be paid off. Those three rights the stockholders enjoyed downto September 6, 1904, and the effect of this resolution was so far to modifytheir rights against the company as to eliminate from those three rights theabsolute right to repayment on October 1, 1907.FN21 [1893] 1 Ch. 484, n., 490, n.In my opinion the question must be answered in the affirmative, and whether itbe under sub-sections (2.), (3.), or (4.), or under each of them, that the powerarises, in my opinion it was competent for, and within the powers of, a generalmeeting properly convened by a proper majority to modify the rights of thestockholders by releasing the right to repayment on October 1, 1907.But Mr. Gore-Browne says that this was not the effect of what was done, *140that the resolution was not really a contract between the stockholders and thecompany, but an offer by the stockholders, which the company by its subsequentaction has refused to accept. I do not think that is an accurate statement of theorder of things. I am bound to hold upon the documents before me that the offerwas made and the proposal was put forward by the company, and that the consent ofthe stockholders to that proposal by the passing of the resolution was anacceptance of that offer and constituted a new contract or a modification of theold contract as between the stockholders and the company.But further than that, Mr. Gore-Browne argues that, when you look at the termsof this resolution, the true effect of it is to leave the stockholders where theywere and to put the company in a less advantageous position. He says that when,by the resolution, the stockholders agreed to convert the stock which wasredeemable at par on October 1, 1907, into irredeemable stock, the only effectwas to deprive the company of its option to redeem. I agree that, prima facie,the true legal meaning of the word "redeemable" when applied to stock is stockliable to redemption, that is to say, liable to be redeemed at the option of themortgagor or person who has the right to redeem. North J. in the case of HIn reChicago and North-West Granaries Co. [FN22] says, "Does ' redeemable' mean'liable to redemption,' or does it mean that the debentures are to be all, infact, redeemed within the specified period? In my opinion, it means that they areto be liable to redemption, and there is no obligation on the company to redeemthem." If that be the prima facie meaning of the word "redeemable," the primafacie meaning of the word "irredeemable" when applied to stock is stock that themortgagor has no power to redeem.FN22 H[1898] 1 Ch. 263, 267.It is contended that those meanings must be attached to the two words"redeemable" and "irredeemable" in this resolution, and that the effect of theresolution is to leave the stockholder a right to demand payment on October 1,1907, but to deprive the company of any right which it may previously have had toredeem the stock. I cannot so construe this resolution. I think in whatever sensethe word "redeemable" is used in the resolution the word "irredeemable" must beheld to be used in the contrary sense. The word "redeemable" is used in thisresolution in reference to stock which in any event must be paid off. It is notused to describe stock which the company has the option of paying off. Itdescribes stock which the company is bound to pay off, and applying to the word"irredeemable" the contrary meaning, it describes stock which the company is notbound to pay off. I cannot attach to the word "redeemable" the meaning which itundoubtedly must bear in this resolution without attaching to the word"irredeemable" in the same resolution the exact contrary meaning, and I find theless difficulty in doing so when I see that the resolution embodies a concessionto the company and not by the company, and one in respect of which the companyconsents to an increase in the rate of interest on the stock from 4 per cent. to4 1/2 per cent.I think the true meaning of this resolution is that the company has proposedCopr. © West 2004 No Claim to Orig. Govt. Works