Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

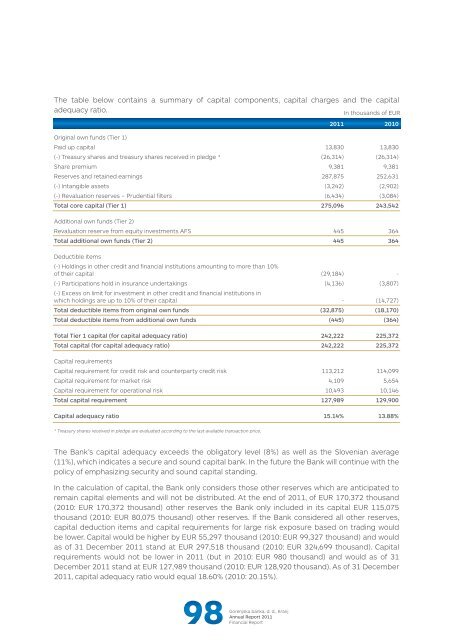

The table below contains a summary of capital components, capital charges and the capital<br />

adequacy ratio.<br />

In thousands of EUR<br />

* Treasury shares received in pledge are evaluated according to the last available transaction price.<br />

The Bank’s capital adequacy exceeds the obligatory level (8%) as well as the Slovenian average<br />

(11%), which indicates a secure and sound capital bank. In the future the Bank will continue with the<br />

policy of emphasizing security and sound capital standing.<br />

In the calculation of capital, the Bank only considers those other reserves which are anticipated to<br />

remain capital elements and will not be distributed. At the end of 2011, of EUR 170,372 thousand<br />

(2010: EUR 170,372 thousand) other reserves the Bank only included in its capital EUR 115,075<br />

thousand (2010: EUR 80,075 thousand) other reserves. If the Bank considered all other reserves,<br />

capital deduction items and capital requirements for large risk exposure based on trading would<br />

be lower. Capital would be higher by EUR 55,297 thousand (2010: EUR 99,327 thousand) and would<br />

as of 31 December 2011 stand at EUR 297,518 thousand (2010: EUR 324,699 thousand). Capital<br />

requirements would not be lower in 2011 (but in 2010: EUR 980 thousand) and would as of 31<br />

December 2011 stand at EUR 127,989 thousand (2010: EUR 128,920 thousand). As of 31 December<br />

2011, capital adequacy ratio would equal 18.60% (2010: 20.15%).<br />

98<br />

<strong>Gorenjska</strong> <strong>banka</strong>, d. d., Kranj<br />

<strong>Annual</strong> <strong>Report</strong> 2011<br />

Financial <strong>Report</strong><br />

2011 2010<br />

Original own funds (Tier 1)<br />

Paid up capital 13,830 13,830<br />

(-) Treasury shares and treasury shares received in pledge * (26,314) (26,314)<br />

Share premium 9,381 9,381<br />

Reserves and retained earnings 287,875 252,631<br />

(-) Intangible assets (3,242) (2,902)<br />

(-) Revaluation reserves – Prudential filters (6,434) (3,084)<br />

Total core capital (Tier 1) 275,096 243,542<br />

Additional own funds (Tier 2)<br />

Revaluation reserve from equity investments AFS 445 364<br />

Total additional own funds (Tier 2) 445 364<br />

Deductible items<br />

(-) Holdings in other credit and financial institutions amounting to more than 10%<br />

of their capital (29,184) -<br />

(-) Participations hold in insurance undertakings<br />

(-) Excess on limit for investment in other credit and financial institutions in<br />

(4,136) (3,807)<br />

which holdings are up to 10% of their capital - (14,727)<br />

Total deductible items from original own funds (32,875) (18,170)<br />

Total deductible items from additional own funds (445) (364)<br />

Total Tier 1 capital (for capital adequacy ratio) 242,222 225,372<br />

Total capital (for capital adequacy ratio) 242,222 225,372<br />

Capital requirements<br />

Capital requirement for credit risk and counterparty credit risk 113,212 114,099<br />

Capital requirement for market risk 4,109 5,654<br />

Capital requirement for operational risk 10,493 10,146<br />

Total capital requirement 127,989 129,900<br />

Capital adequacy ratio 15.14% 13.88%