Managing Risks of Supply-Chain Disruptions: Dual ... - CiteSeerX

Managing Risks of Supply-Chain Disruptions: Dual ... - CiteSeerX

Managing Risks of Supply-Chain Disruptions: Dual ... - CiteSeerX

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

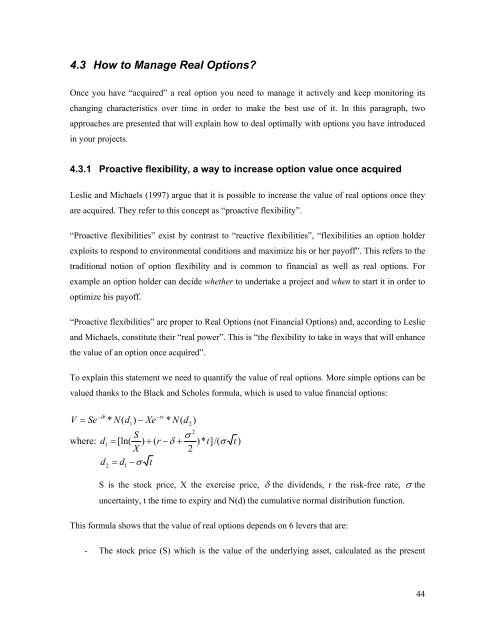

4.3 How to Manage Real Options?Once you have “acquired” a real option you need to manage it actively and keep monitoring itschanging characteristics over time in order to make the best use <strong>of</strong> it. In this paragraph, twoapproaches are presented that will explain how to deal optimally with options you have introducedin your projects.4.3.1 Proactive flexibility, a way to increase option value once acquiredLeslie and Michaels (1997) argue that it is possible to increase the value <strong>of</strong> real options once theyare acquired. They refer to this concept as “proactive flexibility”.“Proactive flexibilities” exist by contrast to “reactive flexibilities”, “flexibilities an option holderexploits to respond to environmental conditions and maximize his or her pay<strong>of</strong>f”. This refers to thetraditional notion <strong>of</strong> option flexibility and is common to financial as well as real options. Forexample an option holder can decide whether to undertake a project and when to start it in order tooptimize his pay<strong>of</strong>f.“Proactive flexibilities” are proper to Real Options (not Financial Options) and, according to Leslieand Michaels, constitute their “real power”. This is “the flexibility to take in ways that will enhancethe value <strong>of</strong> an option once acquired”.To explain this statement we need to quantify the value <strong>of</strong> real options. More simple options can bevalued thanks to the Black and Scholes formula, which is used to value financial options:−δt −rtV = Se * N(d1)− Xe * N(d2)2S σwhere: d1 = [ln( ) + ( r −δ + )* t]/(σ t )X2d d −σt2= 1S is the stock price, X the exercise price, δ the dividends, r the risk-free rate, σ theuncertainty, t the time to expiry and N(d) the cumulative normal distribution function.This formula shows that the value <strong>of</strong> real options depends on 6 levers that are:- The stock price (S) which is the value <strong>of</strong> the underlying asset, calculated as the present44