Managing Risks of Supply-Chain Disruptions: Dual ... - CiteSeerX

Managing Risks of Supply-Chain Disruptions: Dual ... - CiteSeerX

Managing Risks of Supply-Chain Disruptions: Dual ... - CiteSeerX

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

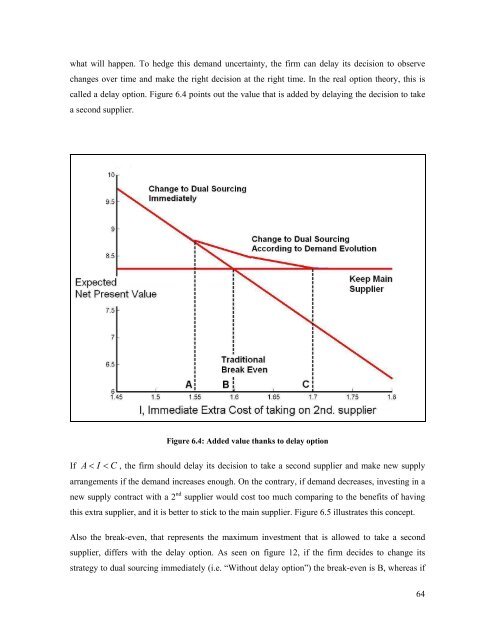

what will happen. To hedge this demand uncertainty, the firm can delay its decision to observechanges over time and make the right decision at the right time. In the real option theory, this iscalled a delay option. Figure 6.4 points out the value that is added by delaying the decision to takea second supplier.Figure 6.4: Added value thanks to delay optionIf A < I < C , the firm should delay its decision to take a second supplier and make new supplyarrangements if the demand increases enough. On the contrary, if demand decreases, investing in anew supply contract with a 2 nd supplier would cost too much comparing to the benefits <strong>of</strong> havingthis extra supplier, and it is better to stick to the main supplier. Figure 6.5 illustrates this concept.Also the break-even, that represents the maximum investment that is allowed to take a secondsupplier, differs with the delay option. As seen on figure 12, if the firm decides to change itsstrategy to dual sourcing immediately (i.e. “Without delay option”) the break-even is B, whereas if64