Managing Risks of Supply-Chain Disruptions: Dual ... - CiteSeerX

Managing Risks of Supply-Chain Disruptions: Dual ... - CiteSeerX

Managing Risks of Supply-Chain Disruptions: Dual ... - CiteSeerX

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

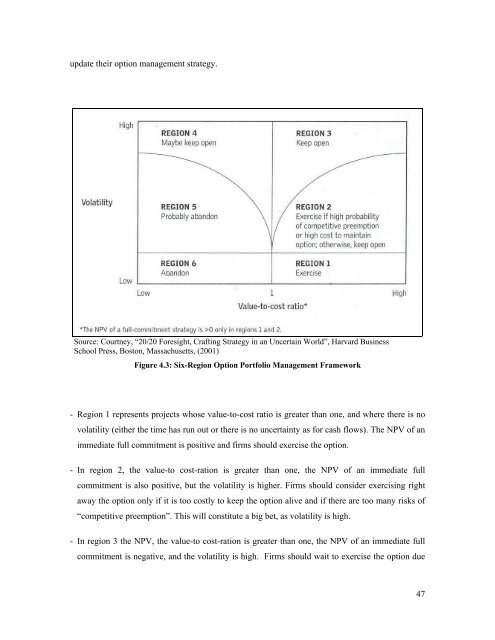

update their option management strategy.Source: Courtney, “20/20 Foresight, Crafting Strategy in an Uncertain World”, Harvard BusinessSchool Press, Boston, Massachusetts, (2001)Figure 4.3: Six-Region Option Portfolio Management Framework- Region 1 represents projects whose value-to-cost ratio is greater than one, and where there is novolatility (either the time has run out or there is no uncertainty as for cash flows). The NPV <strong>of</strong> animmediate full commitment is positive and firms should exercise the option.- In region 2, the value-to cost-ration is greater than one, the NPV <strong>of</strong> an immediate fullcommitment is also positive, but the volatility is higher. Firms should consider exercising rightaway the option only if it is too costly to keep the option alive and if there are too many risks <strong>of</strong>“competitive preemption”. This will constitute a big bet, as volatility is high.- In region 3 the NPV, the value-to cost-ration is greater than one, the NPV <strong>of</strong> an immediate fullcommitment is negative, and the volatility is high. Firms should wait to exercise the option due47