Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

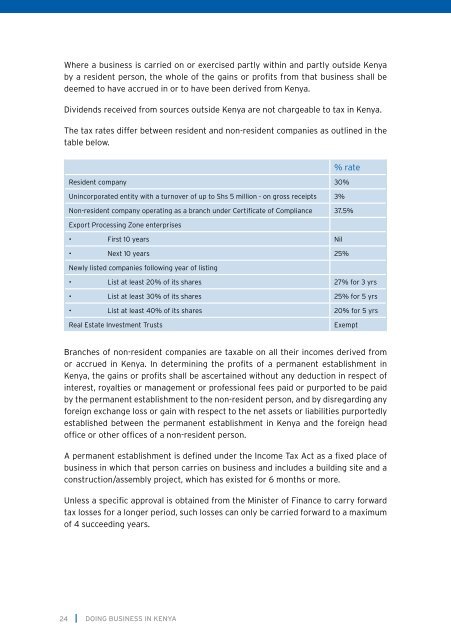

Where a bus<strong>in</strong>ess is carried on or exercised partly with<strong>in</strong> and partly outside <strong>Kenya</strong>by a resident person, the whole of the ga<strong>in</strong>s or profits from that bus<strong>in</strong>ess shall bedeemed to have accrued <strong>in</strong> or to have been derived from <strong>Kenya</strong>.Dividends received from sources outside <strong>Kenya</strong> are not chargeable to tax <strong>in</strong> <strong>Kenya</strong>.The tax rates differ between resident and non-resident companies as outl<strong>in</strong>ed <strong>in</strong> thetable below.% rateResident company 30%Un<strong>in</strong>corporated entity with a turnover of up to Shs 5 million - on gross receipts 3%Non-resident company operat<strong>in</strong>g as a branch under Certificate of Compliance 37.5%Export Process<strong>in</strong>g Zone enterprises• First 10 years Nil• Next 10 years 25%Newly listed companies follow<strong>in</strong>g year of list<strong>in</strong>g• List at least 20% of its shares 27% for 3 yrs• List at least 30% of its shares 25% for 5 yrs• List at least 40% of its shares 20% for 5 yrsReal Estate Investment TrustsExemptBranches of non-resident companies are taxable on all their <strong>in</strong>comes derived fromor accrued <strong>in</strong> <strong>Kenya</strong>. In determ<strong>in</strong><strong>in</strong>g the profits of a permanent establishment <strong>in</strong><strong>Kenya</strong>, the ga<strong>in</strong>s or profits shall be ascerta<strong>in</strong>ed without any deduction <strong>in</strong> respect of<strong>in</strong>terest, royalties or management or professional fees paid or purported to be paidby the permanent establishment to the non-resident person, and by disregard<strong>in</strong>g anyforeign exchange loss or ga<strong>in</strong> with respect to the net assets or liabilities purportedlyestablished between the permanent establishment <strong>in</strong> <strong>Kenya</strong> and the foreign headoffice or other offices of a non-resident person.A permanent establishment is def<strong>in</strong>ed under the Income Tax Act as a fixed place ofbus<strong>in</strong>ess <strong>in</strong> which that person carries on bus<strong>in</strong>ess and <strong>in</strong>cludes a build<strong>in</strong>g site and aconstruction/assembly project, which has existed for 6 months or more.Unless a specific approval is obta<strong>in</strong>ed from the M<strong>in</strong>ister of F<strong>in</strong>ance to carry forwardtax losses for a longer period, such losses can only be carried forward to a maximumof 4 succeed<strong>in</strong>g years.24DOING BUSINESS IN KENYA