Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

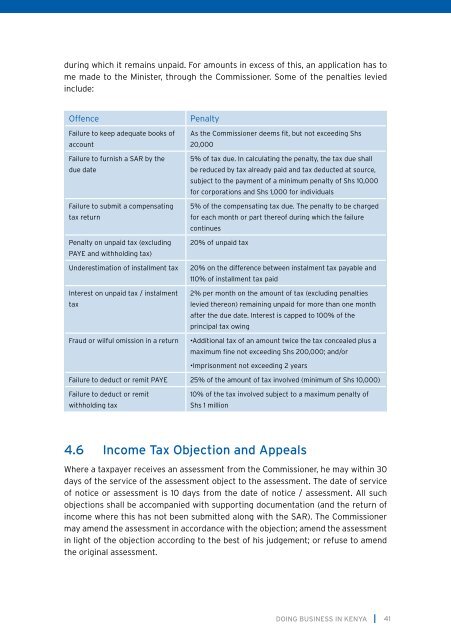

dur<strong>in</strong>g which it rema<strong>in</strong>s unpaid. For amounts <strong>in</strong> excess of this, an application has tome made to the M<strong>in</strong>ister, through the Commissioner. Some of the penalties levied<strong>in</strong>clude:OffencePenaltyFailure to keep adequate books of As the Commissioner deems fit, but not exceed<strong>in</strong>g Shsaccount20,000Failure to furnish a SAR by the 5% of tax due. In calculat<strong>in</strong>g the penalty, the tax due shalldue datebe reduced by tax already paid and tax deducted at source,subject to the payment of a m<strong>in</strong>imum penalty of Shs 10,000for corporations and Shs 1,000 for <strong>in</strong>dividualsFailure to submit a compensat<strong>in</strong>g 5% of the compensat<strong>in</strong>g tax due. The penalty to be chargedtax returnfor each month or part thereof dur<strong>in</strong>g which the failurecont<strong>in</strong>uesPenalty on unpaid tax (exclud<strong>in</strong>g 20% of unpaid taxPAYE and withhold<strong>in</strong>g tax)Underestimation of <strong>in</strong>stallment tax 20% on the difference between <strong>in</strong>stalment tax payable and110% of <strong>in</strong>stallment tax paidInterest on unpaid tax / <strong>in</strong>stalment 2% per month on the amount of tax (exclud<strong>in</strong>g penaltiestaxlevied thereon) rema<strong>in</strong><strong>in</strong>g unpaid for more than one monthafter the due date. Interest is capped to 100% of thepr<strong>in</strong>cipal tax ow<strong>in</strong>gFraud or wilful omission <strong>in</strong> a return •Additional tax of an amount twice the tax concealed plus amaximum f<strong>in</strong>e not exceed<strong>in</strong>g Shs 200,000; and/or•Imprisonment not exceed<strong>in</strong>g 2 yearsFailure to deduct or remit PAYE 25% of the amount of tax <strong>in</strong>volved (m<strong>in</strong>imum of Shs 10,000)Failure to deduct or remit10% of the tax <strong>in</strong>volved subject to a maximum penalty ofwithhold<strong>in</strong>g taxShs 1 million4.6 Income Tax Objection and AppealsWhere a taxpayer receives an assessment from the Commissioner, he may with<strong>in</strong> 30days of the service of the assessment object to the assessment. The date of serviceof notice or assessment is 10 days from the date of notice / assessment. All suchobjections shall be accompanied with support<strong>in</strong>g documentation (and the return of<strong>in</strong>come where this has not been submitted along with the SAR). The Commissionermay amend the assessment <strong>in</strong> accordance with the objection; amend the assessment<strong>in</strong> light of the objection accord<strong>in</strong>g to the best of his judgement; or refuse to amendthe orig<strong>in</strong>al assessment.DOING BUSINESS IN KENYA41