Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

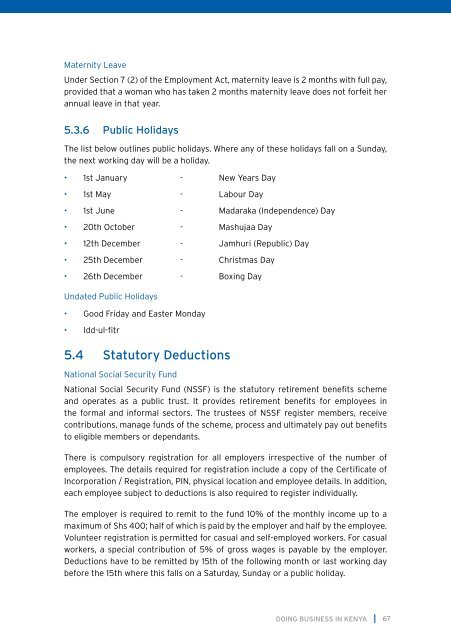

Maternity LeaveUnder Section 7 (2) of the Employment Act, maternity leave is 2 months with full pay,provided that a woman who has taken 2 months maternity leave does not forfeit herannual leave <strong>in</strong> that year.5.3.6 Public HolidaysThe list below outl<strong>in</strong>es public holidays. Where any of these holidays fall on a Sunday,the next work<strong>in</strong>g day will be a holiday.• 1st January - New Years Day• 1st May - Labour Day• 1st June - Madaraka (Independence) Day• 20th October - Mashujaa Day• 12th December - Jamhuri (Republic) Day• 25th December - Christmas Day• 26th December - Box<strong>in</strong>g DayUndated Public Holidays• Good Friday and Easter Monday• Idd-ul-fitr5.4 Statutory DeductionsNational Social Security FundNational Social Security Fund (NSSF) is the statutory retirement benefits schemeand operates as a public trust. It provides retirement benefits for employees <strong>in</strong>the formal and <strong>in</strong>formal sectors. The trustees of NSSF register members, receivecontributions, manage funds of the scheme, process and ultimately pay out benefitsto eligible members or dependants.There is compulsory registration for all employers irrespective of the number ofemployees. The details required for registration <strong>in</strong>clude a copy of the Certificate ofIncorporation / Registration, PIN, physical location and employee details. In addition,each employee subject to deductions is also required to register <strong>in</strong>dividually.The employer is required to remit to the fund 10% of the monthly <strong>in</strong>come up to amaximum of Shs 400; half of which is paid by the employer and half by the employee.Volunteer registration is permitted for casual and self-employed workers. For casualworkers, a special contribution of 5% of gross wages is payable by the employer.Deductions have to be remitted by 15th of the follow<strong>in</strong>g month or last work<strong>in</strong>g daybefore the 15th where this falls on a Saturday, Sunday or a public holiday.DOING BUSINESS IN KENYA67