Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

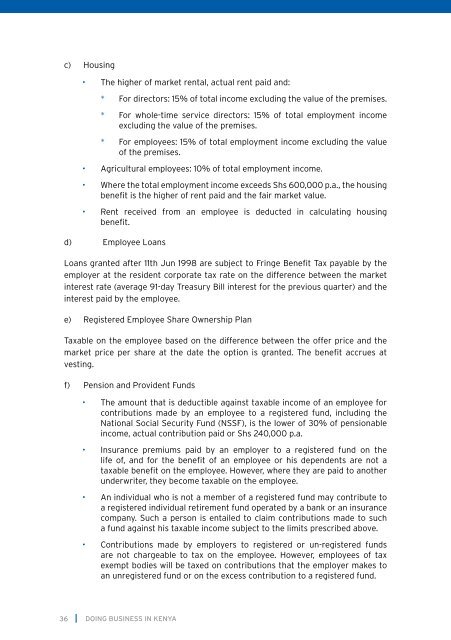

c) Hous<strong>in</strong>g• The higher of market rental, actual rent paid and:* For directors: 15% of total <strong>in</strong>come exclud<strong>in</strong>g the value of the premises.* For whole-time service directors: 15% of total employment <strong>in</strong>comeexclud<strong>in</strong>g the value of the premises.* For employees: 15% of total employment <strong>in</strong>come exclud<strong>in</strong>g the valueof the premises.• Agricultural employees: 10% of total employment <strong>in</strong>come.• Where the total employment <strong>in</strong>come exceeds Shs 600,000 p.a., the hous<strong>in</strong>gbenefit is the higher of rent paid and the fair market value.• Rent received from an employee is deducted <strong>in</strong> calculat<strong>in</strong>g hous<strong>in</strong>gbenefit.d) Employee LoansLoans granted after 11th Jun 1998 are subject to Fr<strong>in</strong>ge Benefit Tax payable by theemployer at the resident corporate tax rate on the difference between the market<strong>in</strong>terest rate (average 91-day Treasury Bill <strong>in</strong>terest for the previous quarter) and the<strong>in</strong>terest paid by the employee.e) Registered Employee Share Ownership PlanTaxable on the employee based on the difference between the offer price and themarket price per share at the date the option is granted. The benefit accrues atvest<strong>in</strong>g.f) Pension and Provident Funds• The amount that is deductible aga<strong>in</strong>st taxable <strong>in</strong>come of an employee forcontributions made by an employee to a registered fund, <strong>in</strong>clud<strong>in</strong>g theNational Social Security Fund (NSSF), is the lower of 30% of pensionable<strong>in</strong>come, actual contribution paid or Shs 240,000 p.a.• Insurance premiums paid by an employer to a registered fund on thelife of, and for the benefit of an employee or his dependents are not ataxable benefit on the employee. However, where they are paid to anotherunderwriter, they become taxable on the employee.• An <strong>in</strong>dividual who is not a member of a registered fund may contribute toa registered <strong>in</strong>dividual retirement fund operated by a bank or an <strong>in</strong>surancecompany. Such a person is entailed to claim contributions made to sucha fund aga<strong>in</strong>st his taxable <strong>in</strong>come subject to the limits prescribed above.• Contributions made by employers to registered or un-registered fundsare not chargeable to tax on the employee. However, employees of taxexempt bodies will be taxed on contributions that the employer makes toan unregistered fund or on the excess contribution to a registered fund.36DOING BUSINESS IN KENYA