Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

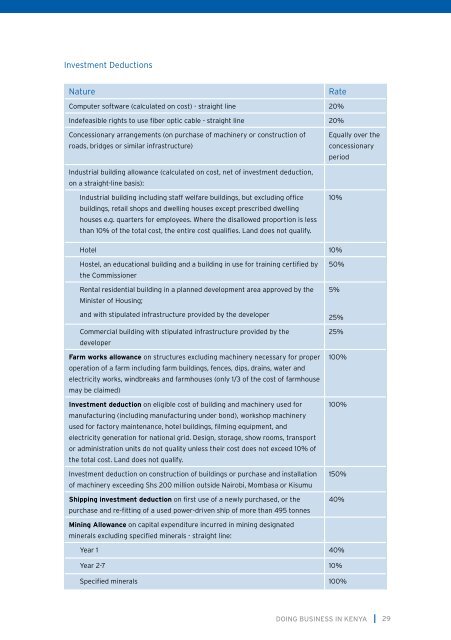

Investment DeductionsNatureRateComputer software (calculated on cost) - straight l<strong>in</strong>e 20%Indefeasible rights to use fiber optic cable - straight l<strong>in</strong>e 20%Concessionary arrangements (on purchase of mach<strong>in</strong>ery or construction ofroads, bridges or similar <strong>in</strong>frastructure)Equally over theconcessionaryperiodIndustrial build<strong>in</strong>g allowance (calculated on cost, net of <strong>in</strong>vestment deduction,on a straight-l<strong>in</strong>e basis):Industrial build<strong>in</strong>g <strong>in</strong>clud<strong>in</strong>g staff welfare build<strong>in</strong>gs, but exclud<strong>in</strong>g officebuild<strong>in</strong>gs, retail shops and dwell<strong>in</strong>g houses except prescribed dwell<strong>in</strong>ghouses e.g. quarters for employees. Where the disallowed proportion is lessthan 10% of the total cost, the entire cost qualifies. Land does not qualify.10%Hotel 10%Hostel, an educational build<strong>in</strong>g and a build<strong>in</strong>g <strong>in</strong> use for tra<strong>in</strong><strong>in</strong>g certified by 50%the CommissionerRental residential build<strong>in</strong>g <strong>in</strong> a planned development area approved by the 5%M<strong>in</strong>ister of Hous<strong>in</strong>g;and with stipulated <strong>in</strong>frastructure provided by the developer25%Commercial build<strong>in</strong>g with stipulated <strong>in</strong>frastructure provided by the25%developerFarm works allowance on structures exclud<strong>in</strong>g mach<strong>in</strong>ery necessary for proper 100%operation of a farm <strong>in</strong>clud<strong>in</strong>g farm build<strong>in</strong>gs, fences, dips, dra<strong>in</strong>s, water andelectricity works, w<strong>in</strong>dbreaks and farmhouses (only 1/3 of the cost of farmhousemay be claimed)Investment deduction on eligible cost of build<strong>in</strong>g and mach<strong>in</strong>ery used for 100%manufactur<strong>in</strong>g (<strong>in</strong>clud<strong>in</strong>g manufactur<strong>in</strong>g under bond), workshop mach<strong>in</strong>eryused for factory ma<strong>in</strong>tenance, hotel build<strong>in</strong>gs, film<strong>in</strong>g equipment, andelectricity generation for national grid. Design, storage, show rooms, transportor adm<strong>in</strong>istration units do not quality unless their cost does not exceed 10% ofthe total cost. Land does not qualify.Investment deduction on construction of build<strong>in</strong>gs or purchase and <strong>in</strong>stallation 150%of mach<strong>in</strong>ery exceed<strong>in</strong>g Shs 200 million outside Nairobi, Mombasa or KisumuShipp<strong>in</strong>g <strong>in</strong>vestment deduction on first use of a newly purchased, or the 40%purchase and re-fitt<strong>in</strong>g of a used power-driven ship of more than 495 tonnesM<strong>in</strong><strong>in</strong>g Allowance on capital expenditure <strong>in</strong>curred <strong>in</strong> m<strong>in</strong><strong>in</strong>g designatedm<strong>in</strong>erals exclud<strong>in</strong>g specified m<strong>in</strong>erals - straight l<strong>in</strong>e:Year 1 40%Year 2-7 10%Specified m<strong>in</strong>erals 100%DOING BUSINESS IN KENYA29