Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

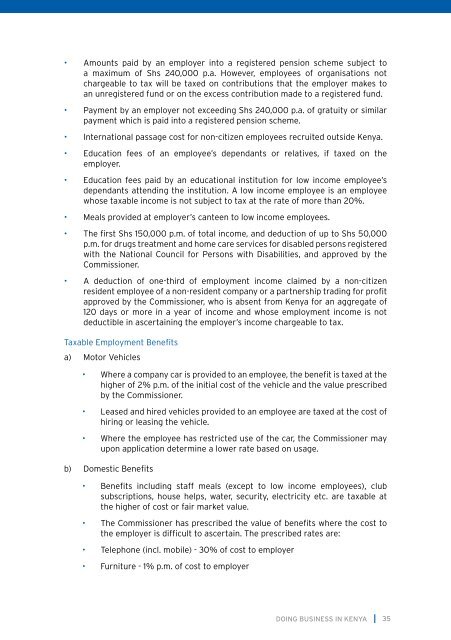

• Amounts paid by an employer <strong>in</strong>to a registered pension scheme subject toa maximum of Shs 240,000 p.a. However, employees of organisations notchargeable to tax will be taxed on contributions that the employer makes toan unregistered fund or on the excess contribution made to a registered fund.• Payment by an employer not exceed<strong>in</strong>g Shs 240,000 p.a. of gratuity or similarpayment which is paid <strong>in</strong>to a registered pension scheme.• <strong>International</strong> passage cost for non-citizen employees recruited outside <strong>Kenya</strong>.• Education fees of an employee’s dependants or relatives, if taxed on theemployer.• Education fees paid by an educational <strong>in</strong>stitution for low <strong>in</strong>come employee’sdependants attend<strong>in</strong>g the <strong>in</strong>stitution. A low <strong>in</strong>come employee is an employeewhose taxable <strong>in</strong>come is not subject to tax at the rate of more than 20%.• Meals provided at employer’s canteen to low <strong>in</strong>come employees.• The first Shs 150,000 p.m. of total <strong>in</strong>come, and deduction of up to Shs 50,000p.m. for drugs treatment and home care services for disabled persons registeredwith the National Council for Persons with Disabilities, and approved by theCommissioner.• A deduction of one-third of employment <strong>in</strong>come claimed by a non-citizenresident employee of a non-resident company or a partnership trad<strong>in</strong>g for profitapproved by the Commissioner, who is absent from <strong>Kenya</strong> for an aggregate of120 days or more <strong>in</strong> a year of <strong>in</strong>come and whose employment <strong>in</strong>come is notdeductible <strong>in</strong> ascerta<strong>in</strong><strong>in</strong>g the employer’s <strong>in</strong>come chargeable to tax.Taxable Employment Benefitsa) Motor Vehicles• Where a company car is provided to an employee, the benefit is taxed at thehigher of 2% p.m. of the <strong>in</strong>itial cost of the vehicle and the value prescribedby the Commissioner.• Leased and hired vehicles provided to an employee are taxed at the cost ofhir<strong>in</strong>g or leas<strong>in</strong>g the vehicle.• Where the employee has restricted use of the car, the Commissioner mayupon application determ<strong>in</strong>e a lower rate based on usage.b) Domestic Benefits• Benefits <strong>in</strong>clud<strong>in</strong>g staff meals (except to low <strong>in</strong>come employees), clubsubscriptions, house helps, water, security, electricity etc. are taxable atthe higher of cost or fair market value.• The Commissioner has prescribed the value of benefits where the cost tothe employer is difficult to ascerta<strong>in</strong>. The prescribed rates are:• Telephone (<strong>in</strong>cl. mobile) - 30% of cost to employer• Furniture - 1% p.m. of cost to employerDOING BUSINESS IN KENYA35