Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

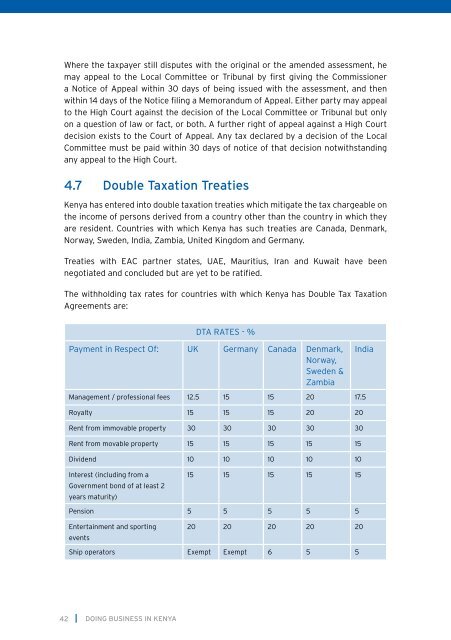

Where the taxpayer still disputes with the orig<strong>in</strong>al or the amended assessment, hemay appeal to the Local Committee or Tribunal by first giv<strong>in</strong>g the Commissionera Notice of Appeal with<strong>in</strong> 30 days of be<strong>in</strong>g issued with the assessment, and thenwith<strong>in</strong> 14 days of the Notice fil<strong>in</strong>g a Memorandum of Appeal. Either party may appealto the High Court aga<strong>in</strong>st the decision of the Local Committee or Tribunal but onlyon a question of law or fact, or both. A further right of appeal aga<strong>in</strong>st a High Courtdecision exists to the Court of Appeal. Any tax declared by a decision of the LocalCommittee must be paid with<strong>in</strong> 30 days of notice of that decision notwithstand<strong>in</strong>gany appeal to the High Court.4.7 Double Taxation Treaties<strong>Kenya</strong> has entered <strong>in</strong>to double taxation treaties which mitigate the tax chargeable onthe <strong>in</strong>come of persons derived from a country other than the country <strong>in</strong> which theyare resident. Countries with which <strong>Kenya</strong> has such treaties are Canada, Denmark,Norway, Sweden, India, Zambia, United K<strong>in</strong>gdom and Germany.Treaties with EAC partner states, UAE, Mauritius, Iran and Kuwait have beennegotiated and concluded but are yet to be ratified.The withhold<strong>in</strong>g tax rates for countries with which <strong>Kenya</strong> has Double Tax TaxationAgreements are:DTA RATES - %Payment <strong>in</strong> Respect Of: UK Germany Canada Denmark,Norway,Sweden &ZambiaIndiaManagement / professional fees 12.5 15 15 20 17.5Royalty 15 15 15 20 20Rent from immovable property 30 30 30 30 30Rent from movable property 15 15 15 15 15Dividend 10 10 10 10 10Interest (<strong>in</strong>clud<strong>in</strong>g from a15 15 15 15 15Government bond of at least 2years maturity)Pension 5 5 5 5 5Enterta<strong>in</strong>ment and sport<strong>in</strong>g 20 20 20 20 20eventsShip operators Exempt Exempt 6 5 542DOING BUSINESS IN KENYA