Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

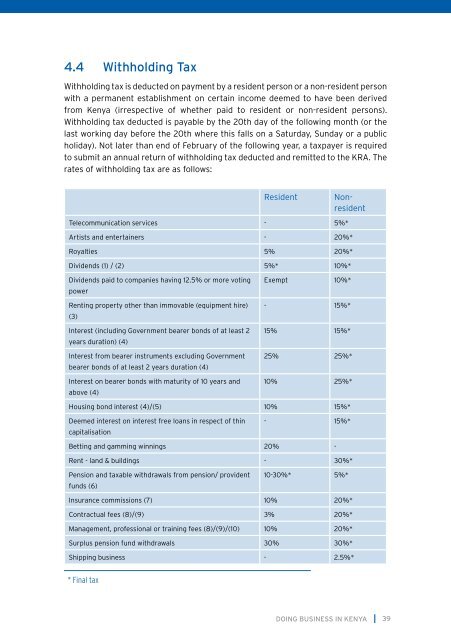

4.4 Withhold<strong>in</strong>g TaxWithhold<strong>in</strong>g tax is deducted on payment by a resident person or a non-resident personwith a permanent establishment on certa<strong>in</strong> <strong>in</strong>come deemed to have been derivedfrom <strong>Kenya</strong> (irrespective of whether paid to resident or non-resident persons).Withhold<strong>in</strong>g tax deducted is payable by the 20th day of the follow<strong>in</strong>g month (or thelast work<strong>in</strong>g day before the 20th where this falls on a Saturday, Sunday or a publicholiday). Not later than end of February of the follow<strong>in</strong>g year, a taxpayer is requiredto submit an annual return of withhold<strong>in</strong>g tax deducted and remitted to the KRA. Therates of withhold<strong>in</strong>g tax are as follows:ResidentTelecommunication services - 5%*NonresidentArtists and enterta<strong>in</strong>ers - 20%*Royalties 5% 20%*Dividends (1) / (2) 5%* 10%*Dividends paid to companies hav<strong>in</strong>g 12.5% or more vot<strong>in</strong>gpowerRent<strong>in</strong>g property other than immovable (equipment hire)(3)Interest (<strong>in</strong>clud<strong>in</strong>g Government bearer bonds of at least 2years duration) (4)Interest from bearer <strong>in</strong>struments exclud<strong>in</strong>g Governmentbearer bonds of at least 2 years duration (4)Interest on bearer bonds with maturity of 10 years andabove (4)Exempt 10%*- 15%*15% 15%*25% 25%*10% 25%*Hous<strong>in</strong>g bond <strong>in</strong>terest (4)/(5) 10% 15%*Deemed <strong>in</strong>terest on <strong>in</strong>terest free loans <strong>in</strong> respect of th<strong>in</strong>capitalisation- 15%*Bett<strong>in</strong>g and gamm<strong>in</strong>g w<strong>in</strong>n<strong>in</strong>gs 20% -Rent - land & build<strong>in</strong>gs - 30%*Pension and taxable withdrawals from pension/ providentfunds (6)10-30%* 5%*Insurance commissions (7) 10% 20%*Contractual fees (8)/(9) 3% 20%*Management, professional or tra<strong>in</strong><strong>in</strong>g fees (8)/(9)/(10) 10% 20%*Surplus pension fund withdrawals 30% 30%*Shipp<strong>in</strong>g bus<strong>in</strong>ess - 2.5%** F<strong>in</strong>al taxDOING BUSINESS IN KENYA39