Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

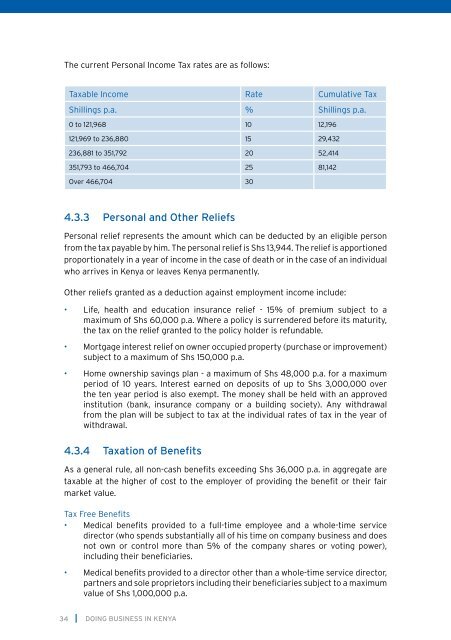

The current Personal Income Tax rates are as follows:Taxable Income Rate Cumulative TaxShill<strong>in</strong>gs p.a. % Shill<strong>in</strong>gs p.a.0 to 121,968 10 12,196121,969 to 236,880 15 29,432236,881 to 351,792 20 52,414351,793 to 466,704 25 81,142Over 466,704 304.3.3 Personal and Other ReliefsPersonal relief represents the amount which can be deducted by an eligible personfrom the tax payable by him. The personal relief is Shs 13,944. The relief is apportionedproportionately <strong>in</strong> a year of <strong>in</strong>come <strong>in</strong> the case of death or <strong>in</strong> the case of an <strong>in</strong>dividualwho arrives <strong>in</strong> <strong>Kenya</strong> or leaves <strong>Kenya</strong> permanently.Other reliefs granted as a deduction aga<strong>in</strong>st employment <strong>in</strong>come <strong>in</strong>clude:• Life, health and education <strong>in</strong>surance relief - 15% of premium subject to amaximum of Shs 60,000 p.a. Where a policy is surrendered before its maturity,the tax on the relief granted to the policy holder is refundable.• Mortgage <strong>in</strong>terest relief on owner occupied property (purchase or improvement)subject to a maximum of Shs 150,000 p.a.• Home ownership sav<strong>in</strong>gs plan - a maximum of Shs 48,000 p.a. for a maximumperiod of 10 years. Interest earned on deposits of up to Shs 3,000,000 overthe ten year period is also exempt. The money shall be held with an approved<strong>in</strong>stitution (bank, <strong>in</strong>surance company or a build<strong>in</strong>g society). Any withdrawalfrom the plan will be subject to tax at the <strong>in</strong>dividual rates of tax <strong>in</strong> the year ofwithdrawal.4.3.4 Taxation of BenefitsAs a general rule, all non-cash benefits exceed<strong>in</strong>g Shs 36,000 p.a. <strong>in</strong> aggregate aretaxable at the higher of cost to the employer of provid<strong>in</strong>g the benefit or their fairmarket value.Tax Free Benefits• Medical benefits provided to a full-time employee and a whole-time servicedirector (who spends substantially all of his time on company bus<strong>in</strong>ess and doesnot own or control more than 5% of the company shares or vot<strong>in</strong>g power),<strong>in</strong>clud<strong>in</strong>g their beneficiaries.• Medical benefits provided to a director other than a whole-time service director,partners and sole proprietors <strong>in</strong>clud<strong>in</strong>g their beneficiaries subject to a maximumvalue of Shs 1,000,000 p.a.34DOING BUSINESS IN KENYA