Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

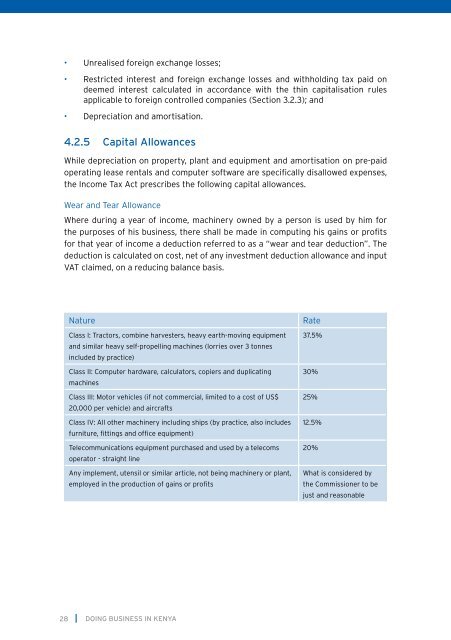

• Unrealised foreign exchange losses;• Restricted <strong>in</strong>terest and foreign exchange losses and withhold<strong>in</strong>g tax paid ondeemed <strong>in</strong>terest calculated <strong>in</strong> accordance with the th<strong>in</strong> capitalisation rulesapplicable to foreign controlled companies (Section 3.2.3); and• Depreciation and amortisation.4.2.5 Capital AllowancesWhile depreciation on property, plant and equipment and amortisation on pre-paidoperat<strong>in</strong>g lease rentals and computer software are specifically disallowed expenses,the Income Tax Act prescribes the follow<strong>in</strong>g capital allowances.Wear and Tear AllowanceWhere dur<strong>in</strong>g a year of <strong>in</strong>come, mach<strong>in</strong>ery owned by a person is used by him forthe purposes of his bus<strong>in</strong>ess, there shall be made <strong>in</strong> comput<strong>in</strong>g his ga<strong>in</strong>s or profitsfor that year of <strong>in</strong>come a deduction referred to as a “wear and tear deduction”. Thededuction is calculated on cost, net of any <strong>in</strong>vestment deduction allowance and <strong>in</strong>putVAT claimed, on a reduc<strong>in</strong>g balance basis.NatureClass I: Tractors, comb<strong>in</strong>e harvesters, heavy earth-mov<strong>in</strong>g equipmentand similar heavy self-propell<strong>in</strong>g mach<strong>in</strong>es (lorries over 3 tonnes<strong>in</strong>cluded by practice)Class II: Computer hardware, calculators, copiers and duplicat<strong>in</strong>gmach<strong>in</strong>esClass III: Motor vehicles (if not commercial, limited to a cost of US$20,000 per vehicle) and aircraftsClass IV: All other mach<strong>in</strong>ery <strong>in</strong>clud<strong>in</strong>g ships (by practice, also <strong>in</strong>cludesfurniture, fitt<strong>in</strong>gs and office equipment)Telecommunications equipment purchased and used by a telecomsoperator - straight l<strong>in</strong>eAny implement, utensil or similar article, not be<strong>in</strong>g mach<strong>in</strong>ery or plant,employed <strong>in</strong> the production of ga<strong>in</strong>s or profitsRate37.5%30%25%12.5%20%What is considered bythe Commissioner to bejust and reasonable28DOING BUSINESS IN KENYA