Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

Doing Business in Kenya - RSM International

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

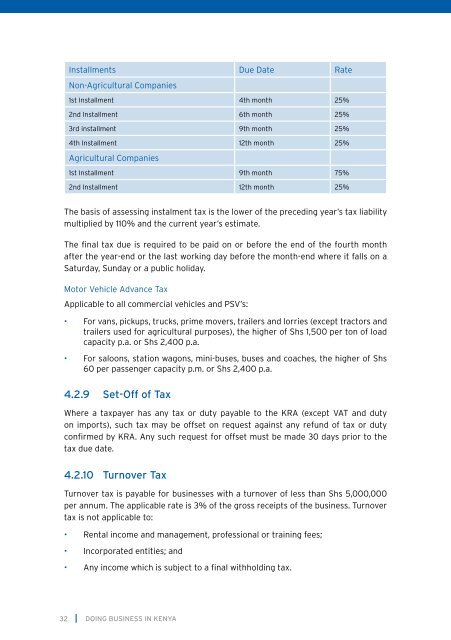

Installments Due Date RateNon-Agricultural Companies1st Installment 4th month 25%2nd Installment 6th month 25%3rd <strong>in</strong>stallment 9th month 25%4th Installment 12th month 25%Agricultural Companies1st Installment 9th month 75%2nd Installment 12th month 25%The basis of assess<strong>in</strong>g <strong>in</strong>stalment tax is the lower of the preced<strong>in</strong>g year’s tax liabilitymultiplied by 110% and the current year’s estimate.The f<strong>in</strong>al tax due is required to be paid on or before the end of the fourth monthafter the year-end or the last work<strong>in</strong>g day before the month-end where it falls on aSaturday, Sunday or a public holiday.Motor Vehicle Advance TaxApplicable to all commercial vehicles and PSV’s:• For vans, pickups, trucks, prime movers, trailers and lorries (except tractors andtrailers used for agricultural purposes), the higher of Shs 1,500 per ton of loadcapacity p.a. or Shs 2,400 p.a.• For saloons, station wagons, m<strong>in</strong>i-buses, buses and coaches, the higher of Shs60 per passenger capacity p.m. or Shs 2,400 p.a.4.2.9 Set-Off of TaxWhere a taxpayer has any tax or duty payable to the KRA (except VAT and dutyon imports), such tax may be offset on request aga<strong>in</strong>st any refund of tax or dutyconfirmed by KRA. Any such request for offset must be made 30 days prior to thetax due date.4.2.10 Turnover TaxTurnover tax is payable for bus<strong>in</strong>esses with a turnover of less than Shs 5,000,000per annum. The applicable rate is 3% of the gross receipts of the bus<strong>in</strong>ess. Turnovertax is not applicable to:• Rental <strong>in</strong>come and management, professional or tra<strong>in</strong><strong>in</strong>g fees;• Incorporated entities; and• Any <strong>in</strong>come which is subject to a f<strong>in</strong>al withhold<strong>in</strong>g tax.32DOING BUSINESS IN KENYA