2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

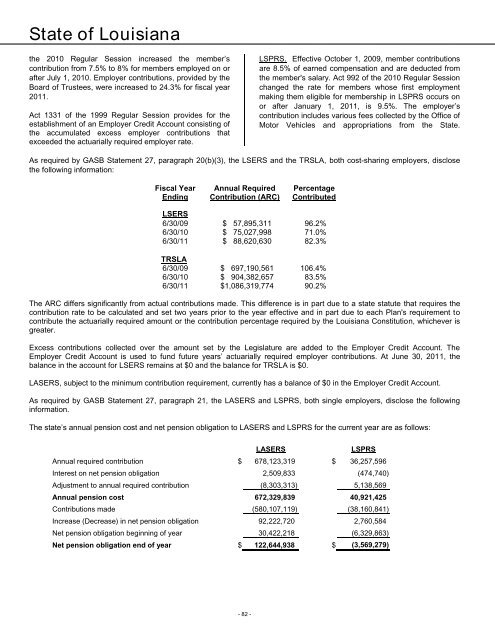

State <strong>of</strong> <strong>Louisiana</strong>the 2010 Regular Session increased the member’scontribution from 7.5% to 8% for members employed on orafter July 1, 2010. Employer contributions, provided by theBoard <strong>of</strong> Trustees, were increased to 24.3% for fiscal year<strong>2011</strong>.Act 1331 <strong>of</strong> the 1999 Regular Session provides for theestablishment <strong>of</strong> an Employer Credit Account consisting <strong>of</strong>the accumulated excess employer contributions thatexceeded the actuarially required employer rate.LSPRS. Effective October 1, 2009, member contributionsare 8.5% <strong>of</strong> earned compensation and are deducted fromthe member's salary. Act 992 <strong>of</strong> the 2010 Regular Sessionchanged the rate for members whose first employmentmaking them eligible for membership in LSPRS occurs onor after January 1, <strong>2011</strong>, is 9.5%. The employer’scontribution includes various fees collected by the Office <strong>of</strong>Motor Vehicles and appropriations from the State.As required by GASB Statement 27, paragraph 20(b)(3), the LSERS and the TRSLA, both cost-sharing employers, disclosethe following information:Fiscal YearEndingLSERS6/30/096/30/106/30/11TRSLA6/30/096/30/106/30/11Annual RequiredContribution (ARC)$ 57,895,311$ 75,027,998$ 88,620,630$ 697,190,561$ 904,382,657$1,086,319,774PercentageContributed96.2%71.0%82.3%106.4%83.5%90.2%The ARC differs significantly from actual contributions made. This difference is in part due to a state statute that requires thecontribution rate to be calculated and set two years prior to the year effective and in part due to each Plan's requirement tocontribute the actuarially required amount or the contribution percentage required by the <strong>Louisiana</strong> Constitution, whichever isgreater.Excess contributions collected over the amount set by the Legislature are added to the Employer Credit Account. TheEmployer Credit Account is used to fund future years’ actuarially required employer contributions. At June 30, <strong>2011</strong>, thebalance in the account for LSERS remains at $0 and the balance for TRSLA is $0.LASERS, subject to the minimum contribution requirement, currently has a balance <strong>of</strong> $0 in the Employer Credit Account.As required by GASB Statement 27, paragraph 21, the LASERS and LSPRS, both single employers, disclose the followinginformation.The state’s annual pension cost and net pension obligation to LASERS and LSPRS for the current year are as follows:LASERSLSPRSAnnual required contribution $ 678,123,319 $ 36,257,596Interest on net pension obligation 2,509,833 (474,740)Adjustment to annual required contribution (8,303,313) 5,138,569Annual pension cost 672,329,839 40,921,425Contributions made (580,107,119) (38,160,841)Increase (Decrease) in net pension obligation 92,222,720 2,760,584Net pension obligation beginning <strong>of</strong> year 30,422,218 (6,329,863)Net pension obligation end <strong>of</strong> year $ 122,644,938 $ (3,569,279)- 82 -