2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

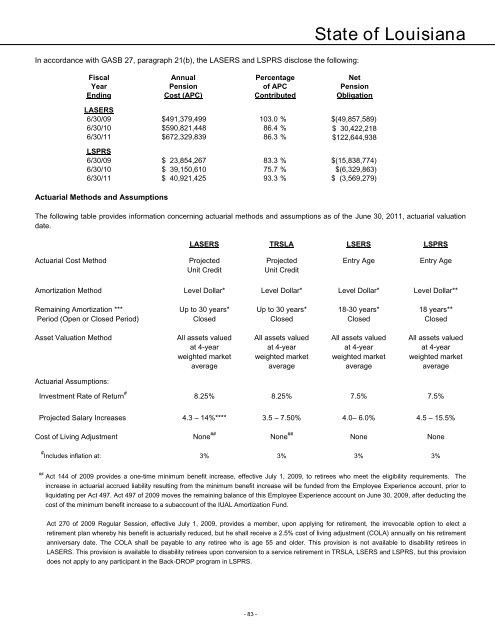

In accordance with GASB 27, paragraph 21(b), the LASERS and LSPRS disclose the following:Fiscal Annual Percentage NetYear Pension <strong>of</strong> APC PensionEnding Cost (APC) Contributed ObligationLASERS6/30/09 $491,379,499 103.0 % $(49,857,589)6/30/10 $590,821,448 86.4 % $ 51,096,083 30,422,2186/30/11 $672,329,839 86.3 % $122,644,938LSPRS6/30/09 $ 23,854,267 83.3 % $(15,838,774)6/30/10 $ 39,150,610 75.7 % $(6,329,863)6/30/11 $ 40,921,425 93.3 % $ (3,569,279)Actuarial Methods and AssumptionsState <strong>of</strong> <strong>Louisiana</strong>The following table provides information concerning actuarial methods and assumptions as <strong>of</strong> the June 30, <strong>2011</strong>, actuarial valuationdate.LASERS TRSLA LSERS LSPRSActuarial Cost MethodProjectedUnit CreditProjectedUnit CreditEntry AgeEntry AgeAmortization MethodLevel Dollar*Level Dollar*Level Dollar*Level Dollar**Remaining Amortization ***Period (Open or Closed Period)Up to 30 years*ClosedUp to 30 years*Closed18-30 years*Closed18 years**ClosedAsset Valuation MethodAll assets valuedat 4-yearweighted marketaverageAll assets valuedat 4-yearweighted marketaverageAll assets valuedat 4-yearweighted marketaverageAll assets valuedat 4-yearweighted marketaverageActuarial Assumptions:Investment Rate <strong>of</strong> Return # 8.25% 8.25% 7.5% 7.5%4.3 – 14%****Projected Salary Increases# Includes inflation at: 3%Cost <strong>of</strong> Living AdjustmentNone ##3.5 – 7.50%None ##3%4.0– 6.0%None3%4.5 – 15.5%None3%##Act 144 <strong>of</strong> 2009 provides a one-time minimum benefit increase, effective July 1, 2009, to retirees who meet the eligibility requirements. Theincrease in actuarial accrued liability resulting from the minimum benefit increase will be funded from the Employee Experience account, prior toliquidating per Act 497. Act 497 <strong>of</strong> 2009 moves the remaining balance <strong>of</strong> this Employee Experience account on June 30, 2009, after deducting thecost <strong>of</strong> the minimum benefit increase to a subaccount <strong>of</strong> the IUAL Amortization Fund.Act 270 <strong>of</strong> 2009 Regular Session, effective July 1, 2009, provides a member, upon applying for retirement, the irrevocable option to elect aretirement plan whereby his benefit is actuarially reduced, but he shall receive a 2.5% cost <strong>of</strong> living adjustment (COLA) annually on his retirementanniversary date. The COLA shall be payable to any retiree who is age 55 and older. This provision is not available to disability retirees inLASERS. This provision is available to disability retirees upon conversion to a service retirement in TRSLA, LSERS and LSPRS, but this provisiondoes not apply to any participant in the Back-DROP program in LSPRS.- 83 -