2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

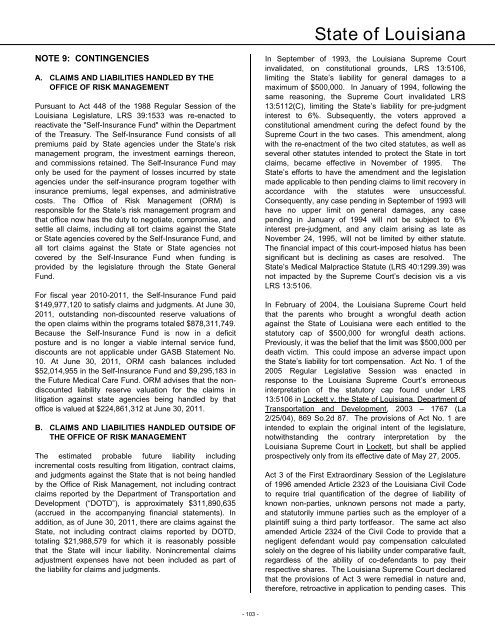

State <strong>of</strong> <strong>Louisiana</strong>NOTE 9: CONTINGENCIESA. CLAIMS AND LIABILITIES HANDLED BY THEOFFICE OF RISK MANAGEMENTPursuant to Act 448 <strong>of</strong> the 1988 Regular Session <strong>of</strong> the<strong>Louisiana</strong> Legislature, LRS 39:1533 was re-enacted toreactivate the "Self-Insurance Fund" within the Department<strong>of</strong> the Treasury. The Self-Insurance Fund consists <strong>of</strong> allpremiums paid by State agencies under the State’s riskmanagement program, the investment earnings thereon,and commissions retained. The Self-Insurance Fund mayonly be used for the payment <strong>of</strong> losses incurred by stateagencies under the self-insurance program together withinsurance premiums, legal expenses, and administrativecosts. The Office <strong>of</strong> Risk Management (ORM) isresponsible for the State’s risk management program andthat <strong>of</strong>fice now has the duty to negotiate, compromise, andsettle all claims, including all tort claims against the Stateor State agencies covered by the Self-Insurance Fund, andall tort claims against the State or State agencies notcovered by the Self-Insurance Fund when funding isprovided by the legislature through the State GeneralFund.For fiscal year 2010-<strong>2011</strong>, the Self-Insurance Fund paid$149,977,120 to satisfy claims and judgments. At June 30,<strong>2011</strong>, outstanding non-discounted reserve valuations <strong>of</strong>the open claims within the programs totaled $878,311,749.Because the Self-Insurance Fund is now in a deficitposture and is no longer a viable internal service fund,discounts are not applicable under GASB Statement No.10. At June 30, <strong>2011</strong>, ORM cash balances included$52,014,955 in the Self-Insurance Fund and $9,295,183 inthe Future Medical Care Fund. ORM advises that the nondiscountedliability reserve valuation for the claims inlitigation against state agencies being handled by that<strong>of</strong>fice is valued at $224,861,312 at June 30, <strong>2011</strong>.B. CLAIMS AND LIABILITIES HANDLED OUTSIDE OFTHE OFFICE OF RISK MANAGEMENTThe estimated probable future liability includingincremental costs resulting from litigation, contract claims,and judgments against the State that is not being handledby the Office <strong>of</strong> Risk Management, not including contractclaims reported by the Department <strong>of</strong> Transportation andDevelopment (“DOTD”), is approximately $311,890,635(accrued in the accompanying financial statements). Inaddition, as <strong>of</strong> June 30, <strong>2011</strong>, there are claims against theState, not including contract claims reported by DOTD,totaling $21,988,579 for which it is reasonably possiblethat the State will incur liability. Nonincremental claimsadjustment expenses have not been included as part <strong>of</strong>the liability for claims and judgments.In September <strong>of</strong> 1993, the <strong>Louisiana</strong> Supreme Courtinvalidated, on constitutional grounds, LRS 13:5106,limiting the State’s liability for general damages to amaximum <strong>of</strong> $500,000. In January <strong>of</strong> 1994, following thesame reasoning, the Supreme Court invalidated LRS13:5112(C), limiting the State’s liability for pre-judgmentinterest to 6%. Subsequently, the voters approved aconstitutional amendment curing the defect found by theSupreme Court in the two cases. This amendment, alongwith the re-enactment <strong>of</strong> the two cited statutes, as well asseveral other statutes intended to protect the State in tortclaims, became effective in November <strong>of</strong> 1995. TheState’s efforts to have the amendment and the legislationmade applicable to then pending claims to limit recovery inaccordance with the statutes were unsuccessful.Consequently, any case pending in September <strong>of</strong> 1993 willhave no upper limit on general damages, any casepending in January <strong>of</strong> 1994 will not be subject to 6%interest pre-judgment, and any claim arising as late asNovember 24, 1995, will not be limited by either statute.The financial impact <strong>of</strong> this court-imposed hiatus has beensignificant but is declining as cases are resolved. TheState’s Medical Malpractice Statute (LRS 40:1299.39) wasnot impacted by the Supreme Court’s decision vis a visLRS 13:5106.In February <strong>of</strong> 2004, the <strong>Louisiana</strong> Supreme Court heldthat the parents who brought a wrongful death actionagainst the State <strong>of</strong> <strong>Louisiana</strong> were each entitled to thestatutory cap <strong>of</strong> $500,000 for wrongful death actions.Previously, it was the belief that the limit was $500,000 perdeath victim. This could impose an adverse impact uponthe State’s liability for tort compensation. Act No. 1 <strong>of</strong> the2005 Regular Legislative Session was enacted inresponse to the <strong>Louisiana</strong> Supreme Court’s erroneousinterpretation <strong>of</strong> the statutory cap found under LRS13:5106 in Lockett v. the State <strong>of</strong> <strong>Louisiana</strong>, Department <strong>of</strong>Transportation and Development, 2003 – 1767 (La2/25/04), 869 So.2d 87. The provisions <strong>of</strong> Act No. 1 areintended to explain the original intent <strong>of</strong> the legislature,notwithstanding the contrary interpretation by the<strong>Louisiana</strong> Supreme Court in Lockett, but shall be appliedprospectively only from its effective date <strong>of</strong> May 27, 2005.Act 3 <strong>of</strong> the First Extraordinary Session <strong>of</strong> the Legislature<strong>of</strong> 1996 amended Article 2323 <strong>of</strong> the <strong>Louisiana</strong> Civil Codeto require trial quantification <strong>of</strong> the degree <strong>of</strong> liability <strong>of</strong>known non-parties, unknown persons not made a party,and statutorily immune parties such as the employer <strong>of</strong> aplaintiff suing a third party tortfeasor. The same act alsoamended Article 2324 <strong>of</strong> the Civil Code to provide that anegligent defendant would pay compensation calculatedsolely on the degree <strong>of</strong> his liability under comparative fault,regardless <strong>of</strong> the ability <strong>of</strong> co-defendants to pay theirrespective shares. The <strong>Louisiana</strong> Supreme Court declaredthat the provisions <strong>of</strong> Act 3 were remedial in nature and,therefore, retroactive in application to pending cases. This- 103 -