2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

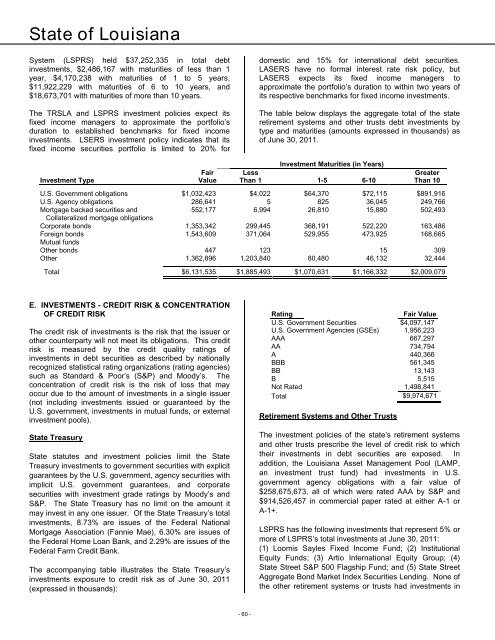

State <strong>of</strong> <strong>Louisiana</strong>System (LSPRS) held $37,252,335 in total debtinvestments, $2,486,167 with maturities <strong>of</strong> less than 1year, $4,170,238 with maturities <strong>of</strong> 1 to 5 years,$11,922,229 with maturities <strong>of</strong> 6 to 10 years, and$18,673,701 with maturities <strong>of</strong> more than 10 years.The TRSLA and LSPRS investment policies expect itsfixed income managers to approximate the portfolio’sduration to established benchmarks for fixed incomeinvestments. LSERS investment policy indicates that itsfixed income securities portfolio is limited to 20% fordomestic and 15% for international debt securities.LASERS have no formal interest rate risk policy, butLASERS expects its fixed income managers toapproximate the portfolio’s duration to within two years <strong>of</strong>its respective benchmarks for fixed income investments.The table below displays the aggregate total <strong>of</strong> the stateretirement systems and other trusts debt investments bytype and maturities (amounts expressed in thousands) as<strong>of</strong> June 30, <strong>2011</strong>.Investment Maturities (in Years)Fair Less GreaterInvestment Type Value Than 1 1-5 6-10 Than 10U.S. Government obligations $1,032,423 $4,022 $64,370 $72,115 $891,916U.S. Agency obligations 915,901 286,6411,3435 825 36,045 249,766Mortgage backed securities and 428,740 552,1776,99426,810 15,880 502,493Collateralized mortgage obligationsCorporate bonds878,0021,353,342292,636299,445 368,191 522,220 163,486Foreign bonds 1,919,515 1,543,609 561,898 371,064 584,836 529,955 473,925 168,665Mutual fundsOther bonds 447123 15 309Other 1,362,896 298,220 1,203,84080,480 46,132 32,444Total187,036$6,131,535177,417$1,885,493 $1,070,631 $1,166,332 $2,009,079E. INVESTMENTS - CREDIT RISK & CONCENTRATIONOF CREDIT RISKThe credit risk <strong>of</strong> investments is the risk that the issuer orother counterparty will not meet its obligations. This creditrisk is measured by the credit quality ratings <strong>of</strong>investments in debt securities as described by nationallyrecognized statistical rating organizations (rating agencies)such as Standard & Poor’s (S&P) and Moody’s. Theconcentration <strong>of</strong> credit risk is the risk <strong>of</strong> loss that mayoccur due to the amount <strong>of</strong> investments in a single issuer(not including investments issued or guaranteed by theU.S. government, investments in mutual funds, or externalinvestment pools).State TreasuryState statutes and investment policies limit the StateTreasury investments to government securities with explicitguarantees by the U.S. government, agency securities withimplicit U.S. government guarantees, and corporatesecurities with investment grade ratings by Moody’s andS&P. The State Treasury has no limit on the amount itmay invest in any one issuer. Of the State Treasury’s totalinvestments, 8.73% are issues <strong>of</strong> the Federal NationalMortgage Association (Fannie Mae), 6.30% are issues <strong>of</strong>the Federal Home Loan Bank, and 2.29% are issues <strong>of</strong> theFederal Farm Credit Bank.The accompanying table illustrates the State Treasury’sinvestments exposure to credit risk as <strong>of</strong> June 30, <strong>2011</strong>(expressed in thousands):RatingFair ValueU.S. Government Securities $4,097,147U.S. Government Agencies (GSEs) 1,956,223AAA 667,297AA 734,794A 440,366BBB 561,345BB 13,143B 5,515Not Rated 1,498,841Total $9,974,671Retirement Systems and Other TrustsThe investment policies <strong>of</strong> the state’s retirement systemsand other trusts prescribe the level <strong>of</strong> credit risk to whichtheir investments in debt securities are exposed. Inaddition, the <strong>Louisiana</strong> Asset Management Pool (LAMP,an investment trust fund) had investments in U.S.government agency obligations with a fair value <strong>of</strong>$258,675,673, all <strong>of</strong> which were rated AAA by S&P and$914,526,457 in commercial paper rated at either A-1 orA-1+.LSPRS has the following investments that represent 5% ormore <strong>of</strong> LSPRS’s total investments at June 30, <strong>2011</strong>:(1) Loomis Sayles Fixed Income Fund; (2) InstitutionalEquity Funds; (3) Artio International Equity Group; (4)State Street S&P 500 Flagship Fund; and (5) State StreetAggregate Bond Market Index Securities Lending. None <strong>of</strong>the other retirement systems or trusts had investments in- 60 -