2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

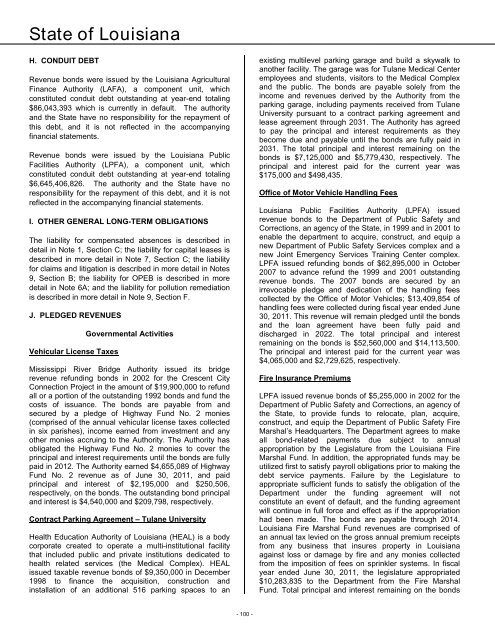

State <strong>of</strong> <strong>Louisiana</strong>H. CONDUIT DEBTRevenue bonds were issued by the <strong>Louisiana</strong> AgriculturalFinance Authority (LAFA), a component unit, whichconstituted conduit debt outstanding at year-end totaling$86,043,393 which is currently in default. The authorityand the State have no responsibility for the repayment <strong>of</strong>this debt, and it is not reflected in the accompanyingfinancial statements.Revenue bonds were issued by the <strong>Louisiana</strong> PublicFacilities Authority (LPFA), a component unit, whichconstituted conduit debt outstanding at year-end totaling$6,645,406,826. The authority and the State have noresponsibility for the repayment <strong>of</strong> this debt, and it is notreflected in the accompanying financial statements.I. OTHER GENERAL LONG-TERM OBLIGATIONSThe liability for compensated absences is described indetail in Note 1, Section C; the liability for capital leases isdescribed in more detail in Note 7, Section C; the liabilityfor claims and litigation is described in more detail in Notes9, Section B; the liability for OPEB is described in moredetail in Note 6A; and the liability for pollution remediationis described in more detail in Note 9, Section F.J. PLEDGED REVENUESVehicular License TaxesGovernmental ActivitiesMississippi River Bridge Authority issued its bridgerevenue refunding bonds in 2002 for the Crescent CityConnection Project in the amount <strong>of</strong> $19,900,000 to refundall or a portion <strong>of</strong> the outstanding 1992 bonds and fund thecosts <strong>of</strong> issuance. The bonds are payable from andsecured by a pledge <strong>of</strong> Highway Fund No. 2 monies(comprised <strong>of</strong> the annual vehicular license taxes collectedin six parishes), income earned from investment and anyother monies accruing to the Authority. The Authority hasobligated the Highway Fund No. 2 monies to cover theprincipal and interest requirements until the bonds are fullypaid in 2012. The Authority earned $4,655,089 <strong>of</strong> HighwayFund No. 2 revenue as <strong>of</strong> June 30, <strong>2011</strong>, and paidprincipal and interest <strong>of</strong> $2,195,000 and $250,506,respectively, on the bonds. The outstanding bond principaland interest is $4,540,000 and $209,798, respectively.Contract Parking Agreement – Tulane UniversityHealth Education Authority <strong>of</strong> <strong>Louisiana</strong> (HEAL) is a bodycorporate created to operate a multi-institutional facilitythat included public and private institutions dedicated tohealth related services (the Medical Complex). HEALissued taxable revenue bonds <strong>of</strong> $9,350,000 in December1998 to finance the acquisition, construction andinstallation <strong>of</strong> an additional 516 parking spaces to anexisting multilevel parking garage and build a skywalk toanother facility. The garage was for Tulane Medical Centeremployees and students, visitors to the Medical Complexand the public. The bonds are payable solely from theincome and revenues derived by the Authority from theparking garage, including payments received from TulaneUniversity pursuant to a contract parking agreement andlease agreement through 2031. The Authority has agreedto pay the principal and interest requirements as theybecome due and payable until the bonds are fully paid in2031. The total principal and interest remaining on thebonds is $7,125,000 and $5,779,430, respectively. Theprincipal and interest paid for the current year was$175,000 and $498,435.Office <strong>of</strong> Motor Vehicle Handling Fees<strong>Louisiana</strong> Public Facilities Authority (LPFA) issuedrevenue bonds to the Department <strong>of</strong> Public Safety andCorrections, an agency <strong>of</strong> the State, in 1999 and in 2001 toenable the department to acquire, construct, and equip anew Department <strong>of</strong> Public Safety Services complex and anew Joint Emergency Services Training Center complex.LPFA issued refunding bonds <strong>of</strong> $62,895,000 in October2007 to advance refund the 1999 and 2001 outstandingrevenue bonds. The 2007 bonds are secured by anirrevocable pledge and dedication <strong>of</strong> the handling feescollected by the Office <strong>of</strong> Motor Vehicles; $13,409,854 <strong>of</strong>handling fees were collected during fiscal year ended June30, <strong>2011</strong>. This revenue will remain pledged until the bondsand the loan agreement have been fully paid anddischarged in 2022. The total principal and interestremaining on the bonds is $52,560,000 and $14,113,500.The principal and interest paid for the current year was$4,065,000 and $2,729,625, respectively.Fire Insurance PremiumsLPFA issued revenue bonds <strong>of</strong> $5,255,000 in 2002 for theDepartment <strong>of</strong> Public Safety and Corrections, an agency <strong>of</strong>the State, to provide funds to relocate, plan, acquire,construct, and equip the Department <strong>of</strong> Public Safety FireMarshal’s Headquarters. The Department agrees to makeall bond-related payments due subject to annualappropriation by the Legislature from the <strong>Louisiana</strong> FireMarshal Fund. In addition, the appropriated funds may beutilized first to satisfy payroll obligations prior to making thedebt service payments. Failure by the Legislature toappropriate sufficient funds to satisfy the obligation <strong>of</strong> theDepartment under the funding agreement will notconstitute an event <strong>of</strong> default, and the funding agreementwill continue in full force and effect as if the appropriationhad been made. The bonds are payable through 2014.<strong>Louisiana</strong> Fire Marshal Fund revenues are comprised <strong>of</strong>an annual tax levied on the gross annual premium receiptsfrom any business that insures property in <strong>Louisiana</strong>against loss or damage by fire and any monies collectedfrom the imposition <strong>of</strong> fees on sprinkler systems. In fiscalyear ended June 30, <strong>2011</strong>, the legislature appropriated$10,283,835 to the Department from the Fire MarshalFund. Total principal and interest remaining on the bonds- 100 -