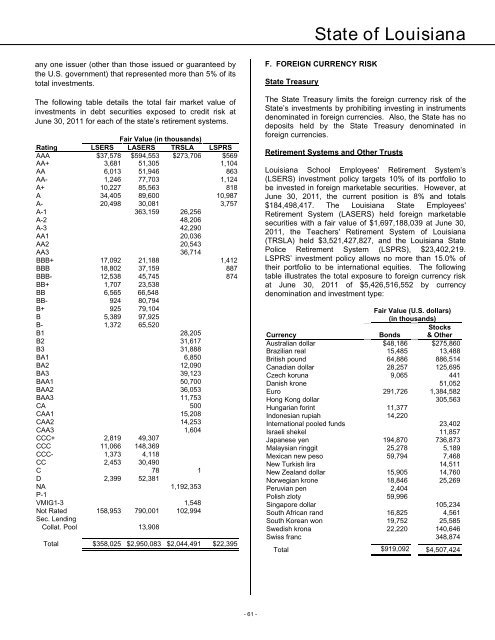

State <strong>of</strong> <strong>Louisiana</strong>System (LSPRS) held $37,252,335 in total debtinvestments, $2,486,167 with maturities <strong>of</strong> less than 1year, $4,170,238 with maturities <strong>of</strong> 1 to 5 years,$11,922,229 with maturities <strong>of</strong> 6 to 10 years, and$18,673,701 with maturities <strong>of</strong> more than 10 years.The TRSLA and LSPRS investment policies expect itsfixed income managers to approximate the portfolio’sduration to established benchmarks for fixed incomeinvestments. LSERS investment policy indicates that itsfixed income securities portfolio is limited to 20% fordomestic and 15% for international debt securities.LASERS have no formal interest rate risk policy, butLASERS expects its fixed income managers toapproximate the portfolio’s duration to within two years <strong>of</strong>its respective benchmarks for fixed income investments.The table below displays the aggregate total <strong>of</strong> the stateretirement systems and other trusts debt investments bytype and maturities (amounts expressed in thousands) as<strong>of</strong> June 30, <strong>2011</strong>.Investment Maturities (in Years)Fair Less GreaterInvestment Type Value Than 1 1-5 6-10 Than 10U.S. Government obligations $1,032,423 $4,022 $64,370 $72,115 $891,916U.S. Agency obligations 915,901 286,6411,3435 825 36,045 249,766Mortgage backed securities and 428,740 552,1776,99426,810 15,880 502,493Collateralized mortgage obligationsCorporate bonds878,0021,353,342292,636299,445 368,191 522,220 163,486Foreign bonds 1,919,515 1,543,609 561,898 371,064 584,836 529,955 473,925 168,665Mutual fundsOther bonds 447123 15 309Other 1,362,896 298,220 1,203,84080,480 46,132 32,444Total187,036$6,131,535177,417$1,885,493 $1,070,631 $1,166,332 $2,009,079E. INVESTMENTS - CREDIT RISK & CONCENTRATIONOF CREDIT RISKThe credit risk <strong>of</strong> investments is the risk that the issuer orother counterparty will not meet its obligations. This creditrisk is measured by the credit quality ratings <strong>of</strong>investments in debt securities as described by nationallyrecognized statistical rating organizations (rating agencies)such as Standard & Poor’s (S&P) and Moody’s. Theconcentration <strong>of</strong> credit risk is the risk <strong>of</strong> loss that mayoccur due to the amount <strong>of</strong> investments in a single issuer(not including investments issued or guaranteed by theU.S. government, investments in mutual funds, or externalinvestment pools).State TreasuryState statutes and investment policies limit the StateTreasury investments to government securities with explicitguarantees by the U.S. government, agency securities withimplicit U.S. government guarantees, and corporatesecurities with investment grade ratings by Moody’s andS&P. The State Treasury has no limit on the amount itmay invest in any one issuer. Of the State Treasury’s totalinvestments, 8.73% are issues <strong>of</strong> the Federal NationalMortgage Association (Fannie Mae), 6.30% are issues <strong>of</strong>the Federal Home Loan Bank, and 2.29% are issues <strong>of</strong> theFederal Farm Credit Bank.The accompanying table illustrates the State Treasury’sinvestments exposure to credit risk as <strong>of</strong> June 30, <strong>2011</strong>(expressed in thousands):RatingFair ValueU.S. Government Securities $4,097,147U.S. Government Agencies (GSEs) 1,956,223AAA 667,297AA 734,794A 440,366BBB 561,345BB 13,143B 5,515Not Rated 1,498,841Total $9,974,671Retirement Systems and Other TrustsThe investment policies <strong>of</strong> the state’s retirement systemsand other trusts prescribe the level <strong>of</strong> credit risk to whichtheir investments in debt securities are exposed. Inaddition, the <strong>Louisiana</strong> Asset Management Pool (LAMP,an investment trust fund) had investments in U.S.government agency obligations with a fair value <strong>of</strong>$258,675,673, all <strong>of</strong> which were rated AAA by S&P and$914,526,457 in commercial paper rated at either A-1 orA-1+.LSPRS has the following investments that represent 5% ormore <strong>of</strong> LSPRS’s total investments at June 30, <strong>2011</strong>:(1) Loomis Sayles Fixed Income Fund; (2) InstitutionalEquity Funds; (3) Artio International Equity Group; (4)State Street S&P 500 Flagship Fund; and (5) State StreetAggregate Bond Market Index Securities Lending. None <strong>of</strong>the other retirement systems or trusts had investments in- 60 -

State <strong>of</strong> <strong>Louisiana</strong>any one issuer (other than those issued or guaranteed bythe U.S. government) that represented more than 5% <strong>of</strong> itstotal investments.The following table details the total fair market value <strong>of</strong>investments in debt securities exposed to credit risk atJune 30, <strong>2011</strong> for each <strong>of</strong> the state’s retirement systems.Fair Value (in thousands)Rating LSERS LASERS TRSLA LSPRSAAA $37,578 $594,553 $273,706 $569AA+ 27,309 3,681 757,588 51,305 320,111 1,104AA 3,050 6,013 51,946 863AA- 1,246 77,703 1,124A+ 10,227 85,563 818A 34,405 89,600 10,987A- 20,498 30,081 3,757A-1 363,159 26,256A-2 48,206A-3 42,290AA1 20,036AA2 20,543AA3 36,714BBB+ 17,092 21,188 1,412BBB 18,802 37,159 887BBB- 12,538 45,745 874BB+ 1,707 23,538BB 6,565 66,548BB- 924 80,794B+ 925 79,104B 5,389 97,925B- 1,372 65,520B1 28,205B2 31,617B3 31,888BA1 6,850BA2 12,090BA3 39,123BAA1 50,700BAA2 36,053BAA3 11,753CA 500CAA1 15,208CAA2 14,253CAA3 1,604CCC+ 2,819 49,307CCC 11,066 148,369CCC- 1,373 4,118CC 2,453 30,490C 78 1D 2,399 52,381NA 1,192,353P-1VMIG1-3 1,548Not Rated 158,953 790,001 102,994Sec. LendingCollat. Pool 13,908Total $358,025 $2,950,083 $2,044,491 $22,395F. FOREIGN CURRENCY RISKState TreasuryThe State Treasury limits the foreign currency risk <strong>of</strong> theState’s investments by prohibiting investing in instrumentsdenominated in foreign currencies. Also, the State has nodeposits held by the State Treasury denominated inforeign currencies.Retirement Systems and Other Trusts<strong>Louisiana</strong> School Employees' Retirement System’s(LSERS) investment policy targets 10% <strong>of</strong> its portfolio tobe invested in foreign marketable securities. However, atJune 30, <strong>2011</strong>, the current position is 8% and totals$184,498,417. The <strong>Louisiana</strong> State Employees'Retirement System (LASERS) held foreign marketablesecurities with a fair value <strong>of</strong> $1,697,188,039 at June 30,<strong>2011</strong>, the Teachers' Retirement System <strong>of</strong> <strong>Louisiana</strong>(TRSLA) held $3,521,427,827, and the <strong>Louisiana</strong> StatePolice Retirement System (LSPRS), $23,402,219.LSPRS’ investment policy allows no more than 15.0% <strong>of</strong>their portfolio to be international equities. The followingtable illustrates the total exposure to foreign currency riskat June 30, <strong>2011</strong> <strong>of</strong> $5,426,516,552 by currencydenomination and investment type:Fair Value (U.S. dollars)(in thousands)) StocksCurrency Bonds & OtherAustralian dollar $48,186 $275,860Brazilian real 15,485 13,488British pound 14,736 64,886 886,514 17,704Canadian dollar 68,494 28,257 488,275 125,695Czech koruna 10,536 9,065 101,839 441Danish krone 51,052Euro 291,726 1,384,582 40,279Hong Kong dollar 339,697 932,543 305,563Hungarian forint 11,377 145,491Indonesian rupiah 14,220International pooled funds 9,051 23,402Israeli shekel 17,392 11,857Japanese yen 194,870 736,8736Malaysian ringgit 129,309 25,278 616,138 5,189Mexican new peso 19,271 59,7941,971 7,468New Turkish lira 30,541 14,511 4,621New Zealand dollar 15,905 14,760 6,192Norwegian krone 15,652 18,846 25,269 705Peruvian pen 2,404 15,922Polish zloty 59,996171Singapore dollar 54,340 105,234 663South African rand 16,825 53,782 4,561South Korean won 10,402 19,752 25,585 7,571Swedish krona 22,220 140,646 23,189Swiss franc 18,757 348,874 80,985Total $919,092 17,149783,820204,659$4,507,424- 61 -