2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

2011 - Division of Administration - Louisiana

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

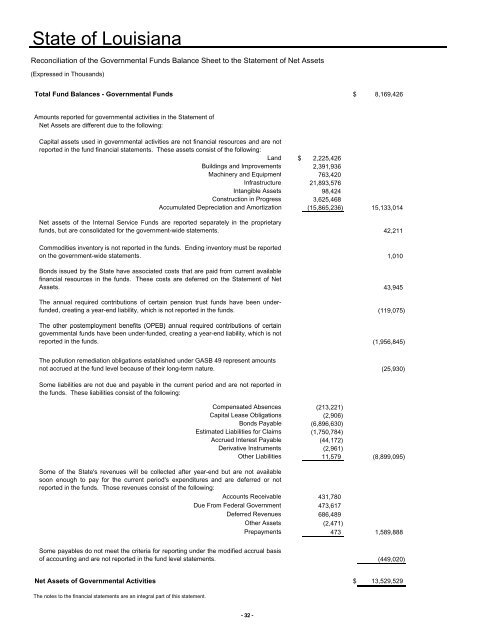

State <strong>of</strong> <strong>Louisiana</strong>Reconciliation <strong>of</strong> the Governmental Funds Balance Sheet to the Statement <strong>of</strong> Net Assets(Expressed in Thousands)Total Fund Balances - Governmental Funds $ 8,169,426Amounts reported for governmental activities in the Statement <strong>of</strong>Net Assets are different due to the following:Capital assets used in governmental activities are not financial resources and are notreported in the fund financial statements. These assets consist <strong>of</strong> the following:Land $ 2,225,426Buildings and Improvements 2,391,936Machinery and Equipment 763,420Infrastructure 21,893,576Intangible Assets 98,424Construction in Progress 3,625,468Accumulated Depreciation and Amortization (15,865,236) 15,133,014Net assets <strong>of</strong> the Internal Service Funds are reported separately in the proprietaryfunds, but are consolidated for the government-wide statements. 42,211Commodities inventory is not reported in the funds. Ending inventory must be reportedon the government-wide statements. 1,010Bonds issued by the State have associated costs that are paid from current availablefinancial resources in the funds. These costs are deferred on the Statement <strong>of</strong> NetAssets. 43,945The annual required contributions <strong>of</strong> certain pension trust funds have been underfunded,creating a year-end liability, which is not reported in the funds. (119,075)The other postemployment benefits (OPEB) annual required contributions <strong>of</strong> certaingovernmental funds have been under-funded, creating a year-end liability, which is notreported in the funds. (1,956,845)The pollution remediation obligations established under GASB 49 represent amountsnot accrued at the fund level because <strong>of</strong> their long-term nature. (25,930)Some liabilities are not due and payable in the current period and are not reported inthe funds. These liabilities consist <strong>of</strong> the following:Compensated Absences (213,221)Capital Lease Obligations (2,906)Bonds Payable (6,896,630)Estimated Liabilities for Claims (1,750,784)Accrued Interest Payable (44,172)Derivative Instruments (2,961)Other Liabilities 11,579 (8,899,095)Some <strong>of</strong> the State's revenues will be collected after year-end but are not availablesoon enough to pay for the current period's expenditures and are deferred or notreported in the funds. Those revenues consist <strong>of</strong> the following:Accounts Receivable 431,780Due From Federal Government 473,617Deferred Revenues 686,489Other Assets (2,471)Prepayments 473 1,589,888Some payables do not meet the criteria for reporting under the modified accrual basis<strong>of</strong> accounting and are not reported in the fund level statements. (449,020)Net Assets <strong>of</strong> Governmental Activities $ 13,529,529The notes to the financial statements are an integral part <strong>of</strong> this statement.- 32 -