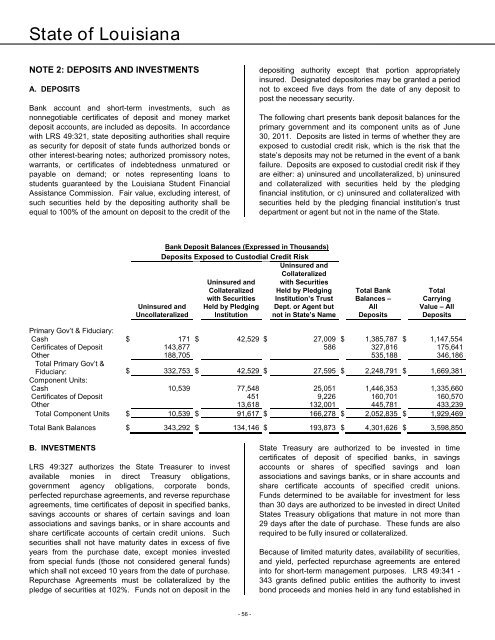

State <strong>of</strong> <strong>Louisiana</strong>NOTE 2: DEPOSITS AND INVESTMENTSA. DEPOSITSBank account and short-term investments, such asnonnegotiable certificates <strong>of</strong> deposit and money marketdeposit accounts, are included as deposits. In accordancewith LRS 49:321, state depositing authorities shall requireas security for deposit <strong>of</strong> state funds authorized bonds orother interest-bearing notes; authorized promissory notes,warrants, or certificates <strong>of</strong> indebtedness unmatured orpayable on demand; or notes representing loans tostudents guaranteed by the <strong>Louisiana</strong> Student FinancialAssistance Commission. Fair value, excluding interest, <strong>of</strong>such securities held by the depositing authority shall beequal to 100% <strong>of</strong> the amount on deposit to the credit <strong>of</strong> thedepositing authority except that portion appropriatelyinsured. Designated depositories may be granted a periodnot to exceed five days from the date <strong>of</strong> any deposit topost the necessary security.The following chart presents bank deposit balances for theprimary government and its component units as <strong>of</strong> June30, <strong>2011</strong>. Deposits are listed in terms <strong>of</strong> whether they areexposed to custodial credit risk, which is the risk that thestate’s deposits may not be returned in the event <strong>of</strong> a bankfailure. Deposits are exposed to custodial credit risk if theyare either: a) uninsured and uncollateralized, b) uninsuredand collateralized with securities held by the pledgingfinancial institution, or c) uninsured and collateralized withsecurities held by the pledging financial institution’s trustdepartment or agent but not in the name <strong>of</strong> the State.Bank Deposit Balances (Expressed in Thousands)Deposits Exposed to Custodial Credit RiskUninsured andCollateralizedUninsured and with SecuritiesCollateralized Held by Pledging Total Bank Totalwith Securities Institution’s Trust Balances – CarryingUninsured and Held by Pledging Dept. or Agent but All Value – AllUncollateralized Institution not in State’s Name Deposits DepositsCategoriesPrimary Gov’t & Fiduciary:Cash $ 171 $ 42,529 $ 27,009 $ 1,385,787 $ 1,147,554Certificates <strong>of</strong> Deposit 143,877 586 327,816 175,641Other 188,705 535,188 346,186Total Primary Gov’t &Fiduciary: $ 332,753 $ 42,529 $ 27,595 $ 2,248,791 $ 1,669,381Component Units:Cash 10,539 77,548 25,051 1,446,353 1,335,660Certificates <strong>of</strong> Deposit 451 9,226 160,701 160,570Other 13,618 132,001 445,781 433,239Total Component Units $ 10,539 $ 91,617 $ 166,278 $ 2,052,835 $ 1,929,469Total Bank Balances $ 343,292 $ 134,146 $ 193,873 $ 4,301,626 $ 3,598,850B. INVESTMENTSLRS 49:327 authorizes the State Treasurer to investavailable monies in direct Treasury obligations,government agency obligations, corporate bonds,perfected repurchase agreements, and reverse repurchaseagreements, time certificates <strong>of</strong> deposit in specified banks,savings accounts or shares <strong>of</strong> certain savings and loanassociations and savings banks, or in share accounts andshare certificate accounts <strong>of</strong> certain credit unions. Suchsecurities shall not have maturity dates in excess <strong>of</strong> fiveyears from the purchase date, except monies investedfrom special funds (those not considered general funds)which shall not exceed 10 years from the date <strong>of</strong> purchase.Repurchase Agreements must be collateralized by thepledge <strong>of</strong> securities at 102%. Funds not on deposit in theState Treasury are authorized to be invested in timecertificates <strong>of</strong> deposit <strong>of</strong> specified banks, in savingsaccounts or shares <strong>of</strong> specified savings and loanassociations and savings banks, or in share accounts andshare certificate accounts <strong>of</strong> specified credit unions.Funds determined to be available for investment for lessthan 30 days are authorized to be invested in direct UnitedStates Treasury obligations that mature in not more than29 days after the date <strong>of</strong> purchase. These funds are alsorequired to be fully insured or collateralized.Because <strong>of</strong> limited maturity dates, availability <strong>of</strong> securities,and yield, perfected repurchase agreements are enteredinto for short-term management purposes. LRS 49:341 -343 grants defined public entities the authority to investbond proceeds and monies held in any fund established in- 56 -

State <strong>of</strong> <strong>Louisiana</strong>connection with bonds in any direct obligation <strong>of</strong>, orobligation guaranteed by, the United States and in taxexemptbonds until proceeds are required to be expendedfor the purpose <strong>of</strong> the issue.LRS 11:263 directs <strong>Louisiana</strong>'s pension systems to investin accordance with the prudent man rule. As used in thisstatute, the rule means that the systems ". . . act with thecare, skill, prudence, and diligence under thecircumstances prevailing that a prudent institutionalinvestor acting in a like capacity and familiar with suchmatters would use in the conduct <strong>of</strong> an enterprise <strong>of</strong> a likecharacter and with like aims." Notwithstanding the prudentman rule, no governing authority <strong>of</strong> any system shall investmore than 55% <strong>of</strong> the total portfolio in equities. Act 1004<strong>of</strong> the 2010 regular session amended LRS 11:263 torequire that pension systems give weight to certain factorsincluding, but not limited to the experience <strong>of</strong> thepr<strong>of</strong>essionals who will manage each investment, thejurisdiction <strong>of</strong> the laws that govern each investment, andthe risk <strong>of</strong> fluctuations in currency that may accompanyeach investment when making investment decisions. Itfurther requires pension systems to submit quarterlyreports, as specified in the statute, to the House andSenate committees beginning with the quarter endingJune 30, 2010. The amendment is effective beginningJuly 1, 2010.Generally, investment <strong>of</strong> funds by colleges and universitiesare subject to the same provisions <strong>of</strong> LRS 49:327 thatgovern the State Treasurer and State agencies. However,investment <strong>of</strong> funds <strong>of</strong> state colleges and universitiesderived from private sources such as gifts, grants, andendowments are governed by the "Uniform PrudentManagement <strong>of</strong> Institutional Funds Act," LRS 9:2337.1 -2337.8. If a donor has not provided specific instructions,state law permits the colleges and universities to authorizeexpenditure <strong>of</strong> the net appreciation (realized andunrealized) <strong>of</strong> the investments <strong>of</strong> endowment funds. Anynet appreciation that is spent is required to be spent for thepurposes for which the endowment was established. Forthe fiscal year ended June 30, <strong>2011</strong>, $22,547,737 netappreciation <strong>of</strong> investments <strong>of</strong> endowment funds wasavailable to be spent; all was restricted for specificpurposes. These amounts are reported in the financialstatements <strong>of</strong> the colleges and universities as restrictedexpendable net assets, except for that which isunrestricted.Authorized investments include "mortgages, stocks, bonds,debentures, and other securities <strong>of</strong> pr<strong>of</strong>it or nonpr<strong>of</strong>itcorporations, shares in or obligations <strong>of</strong> associations,partnerships, or individuals, and obligations <strong>of</strong> anygovernment or subdivision or instrumentality there<strong>of</strong>." Ininvesting funds, the governing board <strong>of</strong> the college oruniversity must exercise ordinary business care andprudence under the facts and circumstances prevailing atthe time <strong>of</strong> the investment action or decision.Management <strong>of</strong> the cash and investments held by theState Treasurer is independent <strong>of</strong> the automatedaccounting system <strong>of</strong> the state. The vast majority <strong>of</strong> thecash reported on the financial statements within all fundtypes is reported by the State Treasurer as investments forthis note disclosure. In order to accurately compare thecash and investments shown on the accompanyingfinancial statements with the carrying values <strong>of</strong> depositsand investments in the schedules presented as part <strong>of</strong> thisnote disclosure, the following reconciliation is provided(amounts expressed in thousands):Carrying Value <strong>of</strong> Deposits per Note $ 3,598,8502 Carrying Value <strong>of</strong> Investmentsper Note 41,481,697$ 45,080,547Cash per Financial Statements $ 8,708,042Investments per FinancialStatements 34,865,662Restricted Cash per FinancialStatements 662,989Restricted Investments perFinancial Statements 1,404,517Reconciling Items between NoteNote and Financial and Statements (560,663)$ 45,080,547C. INVESTMENTS - CUSTODIAL CREDIT RISKThe following chart presents the investment position <strong>of</strong> theState at June 30, <strong>2011</strong>, unless otherwise noted. Thevarious types <strong>of</strong> investments are listed and presented bywhether they are exposed to custodial credit risk by theState. Custodial credit risk for investments is the risk thatin the event <strong>of</strong> the failure <strong>of</strong> the counterparty to atransaction, the State will not be able to recover the value<strong>of</strong> investment or collateral securities that are in thepossession <strong>of</strong> an outside party. Investments are exposedto custodial credit risk if the securities are uninsured andunregistered and are either held by the counterparty, or bythe counterparty’s trust department or agent but not in thename <strong>of</strong> the State.- 57 -