Our endeavour is to enhance Stakeholders' Value - Uflex Ltd.

Our endeavour is to enhance Stakeholders' Value - Uflex Ltd.

Our endeavour is to enhance Stakeholders' Value - Uflex Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DIRECTOR’S UPET HOLDINGS REPORT LIMITED<br />

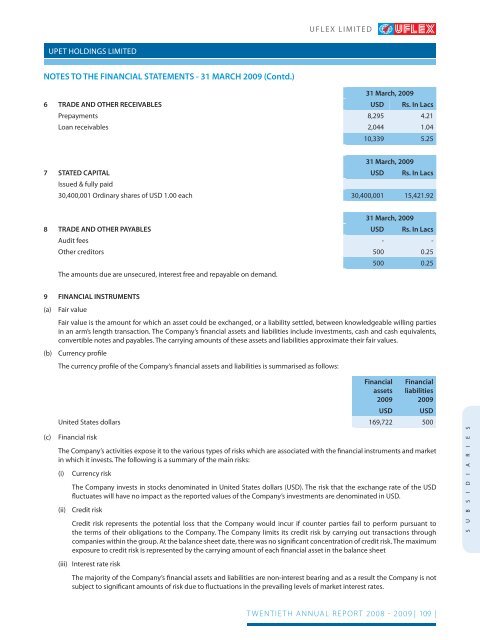

NOTES TO THE FINANCIAL STATEMENTS - 31 MARCH 2009 (Contd.)<br />

UFLEX LIMITED<br />

31 March, 2009<br />

6 TRADE AND OTHER RECEIVABLES USD Rs. In Lacs<br />

Prepayments 8,295 4.21<br />

Loan receivables 2,044 1.04<br />

10,339 5.25<br />

31 March, 2009<br />

7 STATED CAPITAL<br />

Issued & fully paid<br />

USD Rs. In Lacs<br />

30,400,001 Ordinary shares of USD 1.00 each 30,400,001 15,421.92<br />

31 March, 2009<br />

8 TRADE AND OTHER PAYABLES USD Rs. In Lacs<br />

Audit fees - -<br />

Other credi<strong>to</strong>rs 500 0.25<br />

The amounts due are unsecured, interest free and repayable on demand.<br />

500 0.25<br />

9 FINANCIAL INSTRUMENTS<br />

(a) Fair value<br />

Fair value <strong>is</strong> the amount for which an asset could be exchanged, or a liability settled, between knowledgeable willing parties<br />

in an arm’s length transaction. The Company’s fi nancial assets and liabilities include investments, cash and cash equivalents,<br />

convertible notes and payables. The carrying amounts of these assets and liabilities approximate their fair values.<br />

(b) Currency profi le<br />

The currency profi le of the Company’s fi nancial assets and liabilities <strong>is</strong> summar<strong>is</strong>ed as follows:<br />

Financial<br />

assets<br />

2009<br />

Financial<br />

liabilities<br />

2009<br />

USD USD<br />

United States dollars 169,722 500<br />

(c) Financial r<strong>is</strong>k<br />

The Company’s activities expose it <strong>to</strong> the various types of r<strong>is</strong>ks which are associated with the fi nancial instruments and market<br />

in which it invests. The following <strong>is</strong> a summary of the main r<strong>is</strong>ks:<br />

(i) Currency r<strong>is</strong>k<br />

The Company invests in s<strong>to</strong>cks denominated in United States dollars (USD). The r<strong>is</strong>k that the exchange rate of the USD<br />

fl uctuates will have no impact as the reported values of the Company’s investments are denominated in USD.<br />

(ii) Credit r<strong>is</strong>k<br />

Credit r<strong>is</strong>k represents the potential loss that the Company would incur if counter parties fail <strong>to</strong> perform pursuant <strong>to</strong><br />

the terms of their obligations <strong>to</strong> the Company. The Company limits its credit r<strong>is</strong>k by carrying out transactions through<br />

companies within the group. At the balance sheet date, there was no signifi cant concentration of credit r<strong>is</strong>k. The maximum<br />

exposure <strong>to</strong> credit r<strong>is</strong>k <strong>is</strong> represented by the carrying amount of each fi nancial asset in the balance sheet<br />

(iii) Interest rate r<strong>is</strong>k<br />

The majority of the Company’s fi nancial assets and liabilities are non-interest bearing and as a result the Company <strong>is</strong> not<br />

subject <strong>to</strong> signifi cant amounts of r<strong>is</strong>k due <strong>to</strong> fl uctuations in the prevailing levels of market interest rates.<br />

TWENTIETH ANNUAL REPORT 2008 - 2009 | 109 |<br />

S U B S I D I A R I E S