Our endeavour is to enhance Stakeholders' Value - Uflex Ltd.

Our endeavour is to enhance Stakeholders' Value - Uflex Ltd.

Our endeavour is to enhance Stakeholders' Value - Uflex Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DIRECTOR’S UFLEX PACKAGING, REPORT INC.<br />

| 78 |<br />

UFLEX LIMITED<br />

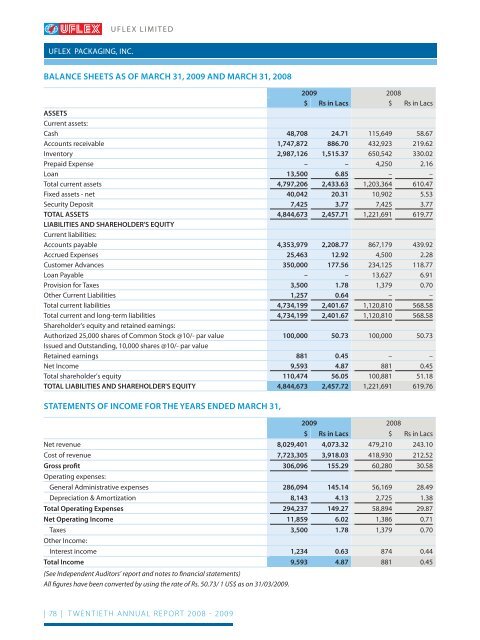

BALANCE SHEETS AS OF MARCH 31, 2009 AND MARCH 31, 2008<br />

2009 2008<br />

$ Rs in Lacs $ Rs in Lacs<br />

ASSETS<br />

Current assets:<br />

Cash 48,708 24.71 115,649 58.67<br />

Accounts receivable 1,747,872 886.70 432,923 219.62<br />

Inven<strong>to</strong>ry 2,987,126 1,515.37 650,542 330.02<br />

Prepaid Expense – – 4,250 2.16<br />

Loan 13,500 6.85 – –<br />

Total current assets 4,797,206 2,433.63 1,203,364 610.47<br />

Fixed assets - net 40,042 20.31 10,902 5.53<br />

Security Deposit 7,425 3.77 7,425 3.77<br />

TOTAL ASSETS<br />

LIABILITIES AND SHAREHOLDER'S EQUITY<br />

Current liabilities:<br />

4,844,673 2,457.71 1,221,691 619.77<br />

Accounts payable 4,353,979 2,208.77 867,179 439.92<br />

Accrued Expenses 25,463 12.92 4,500 2.28<br />

Cus<strong>to</strong>mer Advances 350,000 177.56 234,125 118.77<br />

Loan Payable – – 13,627 6.91<br />

Prov<strong>is</strong>ion for Taxes 3,500 1.78 1,379 0.70<br />

Other Current Liabilities 1,257 0.64 – –<br />

Total current liabilities 4,734,199 2,401.67 1,120,810 568.58<br />

Total current and long-term liabilities<br />

Shareholder's equity and retained earnings:<br />

4,734,199 2,401.67 1,120,810 568.58<br />

Authorized 25,000 shares of Common S<strong>to</strong>ck @10/- par value<br />

Issued and Outstanding, 10,000 shares @10/- par value<br />

100,000 50.73 100,000 50.73<br />

Retained earnings 881 0.45 – –<br />

Net Income 9,593 4.87 881 0.45<br />

Total shareholder's equity 110,474 56.05 100,881 51.18<br />

TOTAL LIABILITIES AND SHAREHOLDER'S EQUITY 4,844,673 2,457.72 1,221,691 619.76<br />

STATEMENTS OF INCOME FOR THE YEARS ENDED MARCH 31,<br />

2009 2008<br />

$ Rs in Lacs $ Rs in Lacs<br />

Net revenue 8,029,401 4,073.32 479,210 243.10<br />

Cost of revenue 7,723,305 3,918.03 418,930 212.52<br />

Gross profi t<br />

Operating expenses:<br />

306,096 155.29 60,280 30.58<br />

General Admin<strong>is</strong>trative expenses 286,094 145.14 56,169 28.49<br />

Depreciation & Amortization 8,143 4.13 2,725 1.38<br />

Total Operating Expenses 294,237 149.27 58,894 29.87<br />

Net Operating Income 11,859 6.02 1,386 0.71<br />

Taxes<br />

Other Income:<br />

3,500 1.78 1,379 0.70<br />

Interest income 1,234 0.63 874 0.44<br />

Total Income<br />

(See Independent Audi<strong>to</strong>rs’ report and notes <strong>to</strong> fi nancial statements)<br />

9,593 4.87 881 0.45<br />

All fi gures have been converted by using the rate of Rs. 50.73/ 1 US$ as on 31/03/2009.<br />

TWENTIETH ANNUAL REPORT 2008 - 2009