Our endeavour is to enhance Stakeholders' Value - Uflex Ltd.

Our endeavour is to enhance Stakeholders' Value - Uflex Ltd.

Our endeavour is to enhance Stakeholders' Value - Uflex Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

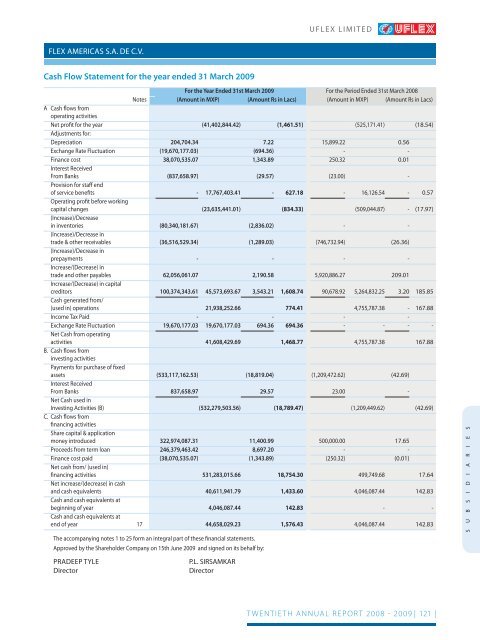

DIRECTOR’S FLEX AMERICAS REPORT S.A. DE C.V.<br />

Cash Flow Statement for the year ended 31 March 2009<br />

UFLEX LIMITED<br />

For the Year Ended 31st March 2009 For the Period Ended 31st March 2008<br />

Notes<br />

(Amount in MXP) (Amount Rs in Lacs) (Amount in MXP) (Amount Rs in Lacs)<br />

A Cash fl ows from<br />

operating activities<br />

Net profi t for the year<br />

Adjustments for:<br />

(41,402,844.42) (1,461.51) (525,171.41) (18.54)<br />

Depreciation 204,704.34 7.22 15,899.22 0.56<br />

Exchange Rate Fluctuation (19,670,177.03) (694.36) -<br />

-<br />

Finance cost<br />

Interest Received<br />

38,070,535.07 1,343.89 250.32 0.01<br />

From Banks<br />

Prov<strong>is</strong>ion for staff end<br />

(837,658.97) (29.57) (23.00) -<br />

of service benefi ts<br />

Operating profi t before working<br />

- 17,767,403.41 - 627.18 - 16,126.54 - 0.57<br />

capital changes<br />

(Increase)/Decrease<br />

(23,635,441.01) (834.33) (509,044.87) - (17.97)<br />

in inven<strong>to</strong>ries<br />

(Increase)/Decrease in<br />

(80,340,181.67) (2,836.02) -<br />

-<br />

trade & other receivables<br />

(Increase)/Decrease in<br />

(36,516,529.34) (1,289.03) (746,732.94) (26.36)<br />

prepayments<br />

Increase/(Decrease) in<br />

-<br />

-<br />

-<br />

-<br />

trade and other payables<br />

Increase/(Decrease) in capital<br />

62,056,061.07 2,190.58 5,920,886.27 209.01<br />

credi<strong>to</strong>rs<br />

Cash generated from/<br />

100,374,343.61 45,573,693.67 3,543.21 1,608.74 90,678.92 5,264,832.25 3.20 185.85<br />

(used in) operations 21,938,252.66 774.41 4,755,787.38 - 167.88<br />

Income Tax Paid -<br />

-<br />

-<br />

-<br />

Exchange Rate Fluctuation<br />

Net Cash from operating<br />

19,670,177.03 19,670,177.03 694.36 694.36 -<br />

- - -<br />

activities<br />

B. Cash fl ows from<br />

investing activities<br />

Payments for purchase of fi xed<br />

41,608,429.69 1,468.77 4,755,787.38 167.88<br />

assets<br />

Interest Received<br />

(533,117,162.53) (18,819.04) (1,209,472.62) (42.69)<br />

From Banks<br />

Net Cash used in<br />

837,658.97 29.57 23.00 -<br />

Investing Activities (B)<br />

C. Cash fl ows from<br />

fi nancing activities<br />

Share capital & application<br />

(532,279,503.56)<br />

(18,789.47) (1,209,449.62) (42.69)<br />

money introduced 322,974,087.31 11,400.99 500,000.00 17.65<br />

Proceeds from term loan 246,379,463.42 8,697.20 -<br />

-<br />

Finance cost paid<br />

Net cash from/ (used in)<br />

(38,070,535.07) (1,343.89) (250.32) (0.01)<br />

fi nancing activities<br />

Net increase/(decrease) in cash<br />

531,283,015.66 18,754.30 499,749.68 17.64<br />

and cash equivalents<br />

Cash and cash equivalents at<br />

40,611,941.79 1,433.60 4,046,087.44 142.83<br />

beginning of year<br />

Cash and cash equivalents at<br />

4,046,087.44 142.83 - -<br />

end of year 17 44,658,029.23 1,576.43 4,046,087.44 142.83<br />

The accompanying notes 1 <strong>to</strong> 25 form an integral part of these fi nancial statements.<br />

Approved by the Shareholder Company on 15th June 2009 and signed on its behalf by:<br />

PRADEEP TYLE P.L. SIRSAMKAR<br />

Direc<strong>to</strong>r Direc<strong>to</strong>r<br />

TWENTIETH ANNUAL REPORT 2008 - 2009 | 121 |<br />

S U B S I D I A R I E S