Read the Registration Document - Guerbet

Read the Registration Document - Guerbet

Read the Registration Document - Guerbet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

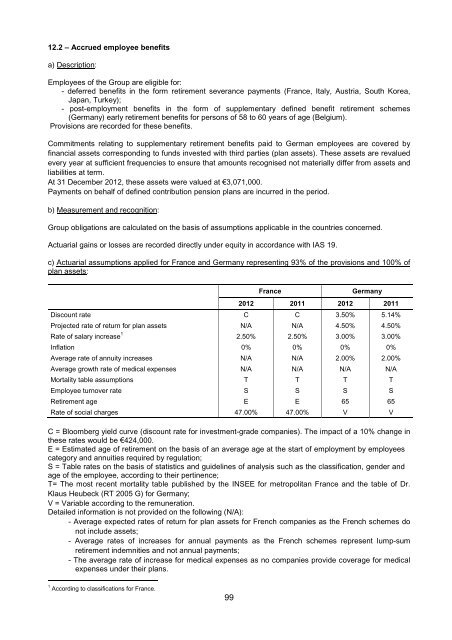

12.2 – Accrued employee benefitsa) Description:Employees of <strong>the</strong> Group are eligible for:- deferred benefits in <strong>the</strong> form retirement severance payments (France, Italy, Austria, South Korea,Japan, Turkey);- post-employment benefits in <strong>the</strong> form of supplementary defined benefit retirement schemes(Germany) early retirement benefits for persons of 58 to 60 years of age (Belgium).Provisions are recorded for <strong>the</strong>se benefits.Commitments relating to supplementary retirement benefits paid to German employees are covered byfinancial assets corresponding to funds invested with third parties (plan assets). These assets are revaluedevery year at sufficient frequencies to ensure that amounts recognised not materially differ from assets andliabilities at term.At 31 December 2012, <strong>the</strong>se assets were valued at €3,071,000.Payments on behalf of defined contribution pension plans are incurred in <strong>the</strong> period.b) Measurement and recognition:Group obligations are calculated on <strong>the</strong> basis of assumptions applicable in <strong>the</strong> countries concerned.Actuarial gains or losses are recorded directly under equity in accordance with IAS 19.c) Actuarial assumptions applied for France and Germany representing 93% of <strong>the</strong> provisions and 100% ofplan assets:FranceGermany2012 2011 2012 2011Discount rate C C 3.50% 5.14%Projected rate of return for plan assets N/A N/A 4.50% 4.50%Rate of salary increase 1 2.50% 2.50% 3.00% 3.00%Inflation 0% 0% 0% 0%Average rate of annuity increases N/A N/A 2.00% 2.00%Average growth rate of medical expenses N/A N/A N/A N/AMortality table assumptions T T T TEmployee turnover rate S S S SRetirement age E E 65 65Rate of social charges 47.00% 47.00% V VC = Bloomberg yield curve (discount rate for investment-grade companies). The impact of a 10% change in<strong>the</strong>se rates would be €424,000.E = Estimated age of retirement on <strong>the</strong> basis of an average age at <strong>the</strong> start of employment by employeescategory and annuities required by regulation;S = Table rates on <strong>the</strong> basis of statistics and guidelines of analysis such as <strong>the</strong> classification, gender andage of <strong>the</strong> employee, according to <strong>the</strong>ir pertinence;T= The most recent mortality table published by <strong>the</strong> INSEE for metropolitan France and <strong>the</strong> table of Dr.Klaus Heubeck (RT 2005 G) for Germany;V = Variable according to <strong>the</strong> remuneration.Detailed information is not provided on <strong>the</strong> following (N/A):- Average expected rates of return for plan assets for French companies as <strong>the</strong> French schemes donot include assets;- Average rates of increases for annual payments as <strong>the</strong> French schemes represent lump-sumretirement indemnities and not annual payments;- The average rate of increase for medical expenses as no companies provide coverage for medicalexpenses under <strong>the</strong>ir plans.1 According to classifications for France.99