Read the Registration Document - Guerbet

Read the Registration Document - Guerbet

Read the Registration Document - Guerbet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

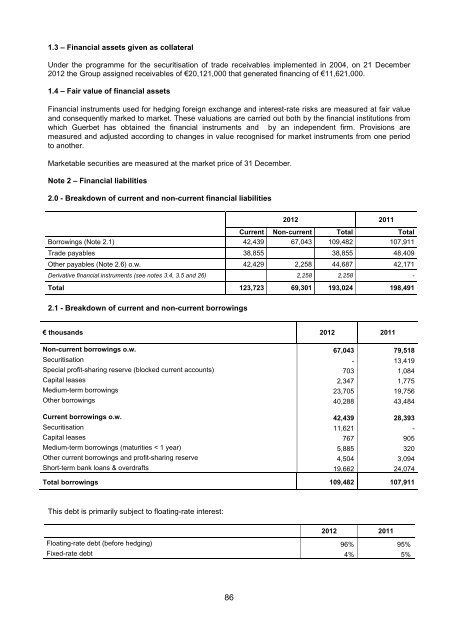

1.3 – Financial assets given as collateralUnder <strong>the</strong> programme for <strong>the</strong> securitisation of trade receivables implemented in 2004, on 21 December2012 <strong>the</strong> Group assigned receivables of €20,121,000 that generated financing of €11,621,000.1.4 – Fair value of financial assetsFinancial instruments used for hedging foreign exchange and interest-rate risks are measured at fair valueand consequently marked to market. These valuations are carried out both by <strong>the</strong> financial institutions fromwhich <strong>Guerbet</strong> has obtained <strong>the</strong> financial instruments and by an independent firm. Provisions aremeasured and adjusted according to changes in value recognised for market instruments from one periodto ano<strong>the</strong>r.Marketable securities are measured at <strong>the</strong> market price of 31 December.Note 2 – Financial liabilities2.0 - Breakdown of current and non-current financial liabilities2012 2011Current Non-current Total TotalBorrowings (Note 2.1) 42,439 67,043 109,482 107,911Trade payables 38,855 38,855 48,409O<strong>the</strong>r payables (Note 2.6) o.w. 42,429 2,258 44,687 42,171Derivative financial instruments (see notes 3.4, 3.5 and 26) 2,258 2,258 -Total 123,723 69,301 193,024 198,4912.1 - Breakdown of current and non-current borrowings€ thousands 2012 2011Non-current borrowings o.w. 67,043 79,518Securitisation - 13,419Special profit-sharing reserve (blocked current accounts) 703 1,084Capital leases 2,347 1,775Medium-term borrowings 23,705 19,756O<strong>the</strong>r borrowings 40,288 43,484Current borrowings o.w. 42,439 28,393Securitisation 11,621 -Capital leases 767 905Medium-term borrowings (maturities < 1 year) 5,885 320O<strong>the</strong>r current borrowings and profit-sharing reserve 4,504 3,094Short-term bank loans & overdrafts 19,662 24,074Total borrowings 109,482 107,911This debt is primarily subject to floating-rate interest:2012 2011Floating-rate debt (before hedging) 96% 95%Fixed-rate debt 4% 5%86