Corporate Magazine 2012 - Boehringer Ingelheim

Corporate Magazine 2012 - Boehringer Ingelheim

Corporate Magazine 2012 - Boehringer Ingelheim

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

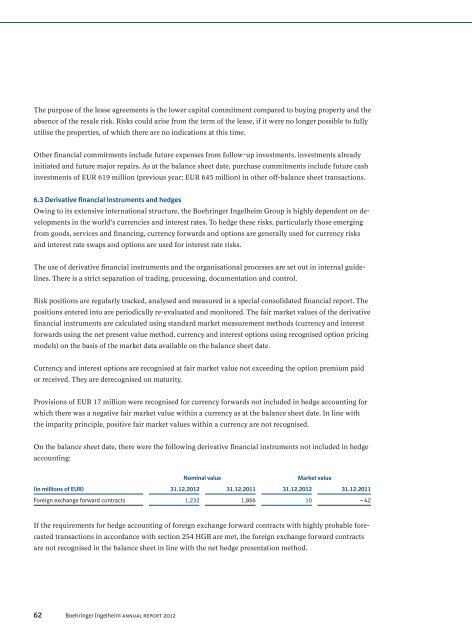

The purpose of the lease agreements is the lower capital commitment compared to buying property and theabsence of the resale risk. Risks could arise from the term of the lease, if it were no longer possible to fullyutilise the properties, of which there are no indications at this time.Other financial commitments include future expenses from follow-up investments, investments alreadyinitiated and future major repairs. As at the balance sheet date, purchase commitments include future cashinvestments of EUR 619 million (previous year: EUR 645 million) in other off-balance sheet transactions.6.3 Derivative financial instruments and hedgesOwing to its extensive international structure, the <strong>Boehringer</strong> <strong>Ingelheim</strong> Group is highly dependent on developmentsin the world’s currencies and interest rates. To hedge these risks, particularly those emergingfrom goods, services and financing, currency forwards and options are generally used for currency risksand interest rate swaps and options are used for interest rate risks.The use of derivative financial instruments and the organisational processes are set out in internal guidelines.There is a strict separation of trading, processing, documentation and control.Risk positions are regularly tracked, analysed and measured in a special consolidated financial report. Thepositions entered into are periodically re-evaluated and monitored. The fair market values of the derivativefinancial instruments are calculated using standard market measurement methods (currency and interestforwards using the net present value method, currency and interest options using recognised option pricingmodels) on the basis of the market data available on the balance sheet date.Currency and interest options are recognised at fair market value not exceeding the option premium paidor received. They are derecognised on maturity.Provisions of EUR 17 million were recognised for currency forwards not included in hedge accounting forwhich there was a negative fair market value within a currency as at the balance sheet date. In line withthe imparity principle, positive fair market values within a currency are not recognised.On the balance sheet date, there were the following derivative financial instruments not included in hedgeaccounting:Nominal valueMarket value(in millions of EUR) 31.12.<strong>2012</strong> 31.12.2011 31.12.<strong>2012</strong> 31.12.2011Foreign exchange forward contracts 1,232 1,866 10 — 42If the requirements for hedge accounting of foreign exchange forward contracts with highly probable forecastedtransactions in accordance with section 254 HGB are met, the foreign exchange forward contractsare not recognised in the balance sheet in line with the net hedge presentation method.62<strong>Boehringer</strong> <strong>Ingelheim</strong> annual report <strong>2012</strong>