Sustained Innovation and Creativity - Toyota Industries Corporation

Sustained Innovation and Creativity - Toyota Industries Corporation

Sustained Innovation and Creativity - Toyota Industries Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

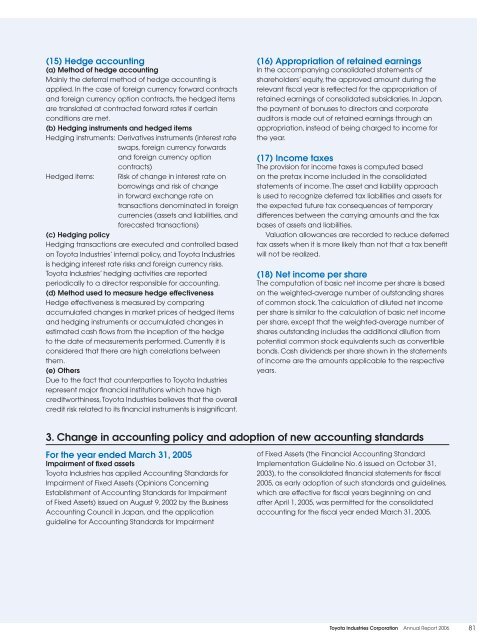

(15) Hedge accounting(a) Method of hedge accountingMainly the deferral method of hedge accounting isapplied. In the case of foreign currency forward contracts<strong>and</strong> foreign currency option contracts, the hedged itemsare translated at contracted forward rates if certainconditions are met.(b) Hedging instruments <strong>and</strong> hedged itemsHedging instruments: Derivatives instruments (interest rateswaps, foreign currency forwards<strong>and</strong> foreign currency optioncontracts)Hedged items: Risk of change in interest rate onborrowings <strong>and</strong> risk of changein forward exchange rate ontransactions denominated in foreigncurrencies (assets <strong>and</strong> liabilities, <strong>and</strong>forecasted transactions)(c) Hedging policyHedging transactions are executed <strong>and</strong> controlled basedon <strong>Toyota</strong> <strong>Industries</strong>’ internal policy, <strong>and</strong> <strong>Toyota</strong> <strong>Industries</strong>is hedging interest rate risks <strong>and</strong> foreign currency risks.<strong>Toyota</strong> <strong>Industries</strong>’ hedging activities are reportedperiodically to a director responsible for accounting.(d) Method used to measure hedge effectivenessHedge effectiveness is measured by comparingaccumulated changes in market prices of hedged items<strong>and</strong> hedging instruments or accumulated changes inestimated cash fl ows from the inception of the hedgeto the date of measurements performed. Currently it isconsidered that there are high correlations betweenthem.(e) OthersDue to the fact that counterparties to <strong>Toyota</strong> <strong>Industries</strong>represent major fi nancial institutions which have highcreditworthiness, <strong>Toyota</strong> <strong>Industries</strong> believes that the overallcredit risk related to its fi nancial instruments is insignifi cant.(16) Appropriation of retained earningsIn the accompanying consolidated statements ofshareholders’ equity, the approved amount during therelevant fi scal year is refl ected for the appropriation ofretained earnings of consolidated subsidiaries. In Japan,the payment of bonuses to directors <strong>and</strong> corporateauditors is made out of retained earnings through anappropriation, instead of being charged to income forthe year.(17) Income taxesThe provision for income taxes is computed basedon the pretax income included in the consolidatedstatements of income. The asset <strong>and</strong> liability approachis used to recognize deferred tax liabilities <strong>and</strong> assets forthe expected future tax consequences of temporarydifferences between the carrying amounts <strong>and</strong> the taxbases of assets <strong>and</strong> liabilities.Valuation allowances are recorded to reduce deferredtax assets when it is more likely than not that a tax benefi twill not be realized.(18) Net income per shareThe computation of basic net income per share is basedon the weighted-average number of outst<strong>and</strong>ing sharesof common stock. The calculation of diluted net incomeper share is similar to the calculation of basic net incomeper share, except that the weighted-average number ofshares outst<strong>and</strong>ing includes the additional dilution frompotential common stock equivalents such as convertiblebonds. Cash dividends per share shown in the statementsof income are the amounts applicable to the respectiveyears.3. Change in accounting policy <strong>and</strong> adoption of new accounting st<strong>and</strong>ardsFor the year ended March 31, 2005Impairment of fi xed assets<strong>Toyota</strong> <strong>Industries</strong> has applied Accounting St<strong>and</strong>ards forImpairment of Fixed Assets (Opinions ConcerningEstablishment of Accounting St<strong>and</strong>ards for Impairmentof Fixed Assets) issued on August 9, 2002 by the BusinessAccounting Council in Japan, <strong>and</strong> the applicationguideline for Accounting St<strong>and</strong>ards for Impairmentof Fixed Assets (the Financial Accounting St<strong>and</strong>ardImplementation Guideline No. 6 issued on October 31,2003), to the consolidated fi nancial statements for fi scal2005, as early adoption of such st<strong>and</strong>ards <strong>and</strong> guidelines,which are effective for fi scal years beginning on <strong>and</strong>after April 1, 2005, was permitted for the consolidatedaccounting for the fi scal year ended March 31, 2005.<strong>Toyota</strong> <strong>Industries</strong> <strong>Corporation</strong> Annual Report 200681

![PDF[476KB/5 pages] - Toyota Industries Corporation](https://img.yumpu.com/50288545/1/190x123/pdf476kb-5-pages-toyota-industries-corporation.jpg?quality=85)

![PDF[622KB/13pages] - Toyota Industries Corporation](https://img.yumpu.com/47399131/1/190x245/pdf622kb-13pages-toyota-industries-corporation.jpg?quality=85)

![PDF[792KB/2Pages] - Toyota Industries Corporation](https://img.yumpu.com/45510108/1/184x260/pdf792kb-2pages-toyota-industries-corporation.jpg?quality=85)

![PDF[126KB/4Pages] - Toyota Industries Corporation](https://img.yumpu.com/41525474/1/184x260/pdf126kb-4pages-toyota-industries-corporation.jpg?quality=85)

![PDF[1229KB/26 pages] - Toyota Industries Corporation](https://img.yumpu.com/40908773/1/190x247/pdf1229kb-26-pages-toyota-industries-corporation.jpg?quality=85)