- Page 1 and 2:

annual report2008

- Page 3 and 4:

Conversion to more energy efficient

- Page 5 and 6:

Configure the air conditioner by se

- Page 7 and 8:

MissionWe are committed to excellen

- Page 10 and 11:

About Us[ Tenaga Nasional Berhad ]

- Page 12 and 13:

Corporate Award Highlights[ Tenaga

- Page 14 and 15:

Corporate Award HighlightsThe Brand

- Page 16 and 17:

Corporate Award Highlights12. Malay

- Page 18 and 19:

Notice Of Annual General Meeting[ T

- Page 20 and 21:

Notice Of Annual General MeetingEXP

- Page 22 and 23:

Key HighlightsUnit Demand Growth +4

- Page 24 and 25:

Corporate Performance ChartsProfit

- Page 26 and 27:

FY2008 Core RevenueFY2008 Total RM2

- Page 28 and 29:

Operational StatisticsSales Of Elec

- Page 30 and 31:

[ Tenaga Nasional Berhad ] [ Annual

- Page 32 and 33:

Chairman’s Letter To Shareholders

- Page 34 and 35:

Chairman’s Letter To Shareholders

- Page 36 and 37:

President /CEO’s Review[ Tenaga N

- Page 38 and 39:

President/CEO’s ReviewRising To T

- Page 40 and 41:

President/CEO’s Review[ Tenaga Na

- Page 42 and 43:

President/CEO’s Review[ Tenaga Na

- Page 44 and 45:

President/CEO’s ReviewOur investm

- Page 46 and 47:

GenerationTransmissionDistributionF

- Page 48 and 49:

GenerationMoving forward, Generatio

- Page 50 and 51:

Operations Review - Generation Divi

- Page 52 and 53:

Operations Review - Generation Divi

- Page 54 and 55:

Operations Review - Generation Divi

- Page 56 and 57:

Operations Review - Generation Divi

- Page 58 and 59:

Ir. Ab’llah bin Haji Mohd SallehV

- Page 60 and 61:

Operations Review - Transmission Di

- Page 63 and 64:

TEWAPERLISKGARBKTRCIMATo SDAOBKHMKh

- Page 65 and 66:

To focus on its core businessactivi

- Page 67 and 68:

D i s t r i b u t i o n D i v i s i

- Page 69 and 70:

Voice Recorder (IVR) and IPTelephon

- Page 71 and 72:

continues to carry out operations a

- Page 73 and 74:

SUMMARY OF OPERATIONSFinancial Perf

- Page 75 and 76:

The Division actively monitored the

- Page 77 and 78:

As always, TNB invites thefinancial

- Page 79 and 80:

Operational Summaryi.Regulatory and

- Page 81 and 82:

Operational SummaryIn order to meet

- Page 83 and 84:

Operational ImprovementsEfficiency

- Page 85 and 86:

Divisional GoalsThe Planning Divisi

- Page 87 and 88:

could pose environmentalissue as a

- Page 89 and 90:

As it moves forward to a newera, MT

- Page 91 and 92:

In preparation for stiffercompetiti

- Page 93 and 94:

Razali bin AwangChief Information O

- Page 95 and 96:

The Division had also contributedit

- Page 97 and 98:

Awards and AccoladesICT Chief Infor

- Page 99 and 100:

Operational Improvements• e-Biddi

- Page 101 and 102:

local products. An awarenessprogram

- Page 103 and 104:

Divisional GoalsFollowing a major r

- Page 105 and 106:

Human ResourceManagementApart from

- Page 107 and 108:

Human Resources DivisionWith a manp

- Page 109 and 110:

• Installation of polymeric132 kV

- Page 111 and 112:

Major Projects DivisionUnder the 9

- Page 113 and 114:

Organisation DevelopmentDivisionPro

- Page 115 and 116:

Vegetation and MaintenanceManagemen

- Page 117 and 118:

Dato’ Fuad bin Jaafar(Independent

- Page 119:

Associate /Investment CompaniesJIMA

- Page 122 and 123:

Calendar Of Corporate EventsNovembe

- Page 124 and 125:

Calendar Of Corporate EventsMay 200

- Page 126 and 127:

Media Highlights[ Tenaga Nasional B

- Page 128 and 129:

Statement Of Corporate GovernanceTo

- Page 130 and 131:

Statement Of Corporate GovernanceRo

- Page 132 and 133:

Statement Of Corporate Governance[

- Page 134 and 135:

Statement Of Corporate Governance(b

- Page 136 and 137:

Statement Of Corporate Governance[

- Page 138 and 139:

Statement Of Corporate Governance(7

- Page 140 and 141:

Enterprise Wide Risk ManagementTNB

- Page 142 and 143:

Enterprise Wide Risk Management3. M

- Page 144 and 145:

Statement Of Internal ControlBoard

- Page 146 and 147: Statement Of Internal Control[ Tena

- Page 148 and 149: Board Audit Committee Report[ Tenag

- Page 150 and 151: Terms Of Reference Of The Board Aud

- Page 152 and 153: Terms Of Reference Of The Board Aud

- Page 154 and 155: Board Of Directorsfrom left to righ

- Page 156 and 157: Profile Of DirectorsTan Sri Leo Mog

- Page 158 and 159: Profile Of DirectorsDato’ Puteh R

- Page 160 and 161: Profile Of DirectorsDato’ Zainal

- Page 162 and 163: Group Executive Council Committee -

- Page 164 and 165: Group Executive Management Committe

- Page 166 and 167: Corporate Social Responsibility[ Te

- Page 168 and 169: Corporate Social Responsibility[ Te

- Page 170 and 171: Corporate Social Responsibility[ Te

- Page 172 and 173: Other Services - Productivity And Q

- Page 174 and 175: Statement Of Environment[ Tenaga Na

- Page 176 and 177: Financial Statements[ Tenaga Nasion

- Page 178 and 179: Directors’ ReportRESERVES AND PRO

- Page 180 and 181: Directors’ ReportDIRECTORS’ BEN

- Page 182 and 183: Income Statementsfor the financial

- Page 184 and 185: Balance Sheetsgroup Companynote 200

- Page 186 and 187: Statement Of Changes In Equitynon-d

- Page 188 and 189: Cash Flow Statementsgroup Company20

- Page 190 and 191: Notes To The Financial Statements2

- Page 192 and 193: Notes To The Financial Statements2

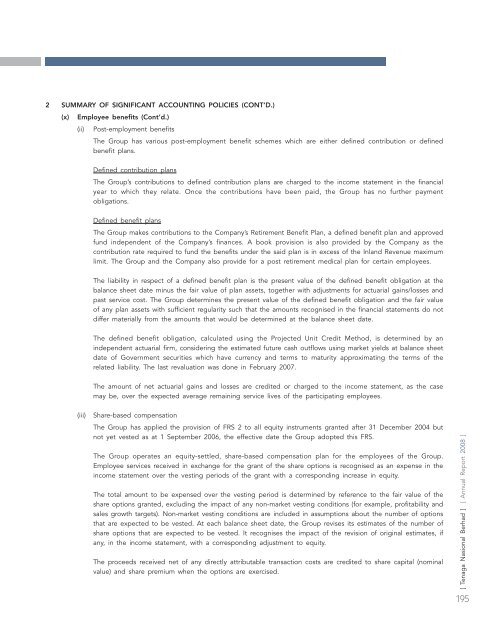

- Page 194 and 195: Notes To The Financial Statements2

- Page 198 and 199: Notes To The Financial Statements2

- Page 200 and 201: Notes To The Financial Statements2

- Page 202 and 203: Notes To The Financial Statements3

- Page 204 and 205: Notes To The Financial Statements6

- Page 206 and 207: Notes To The Financial Statements10

- Page 208 and 209: Notes To The Financial Statements12

- Page 210 and 211: Notes To The Financial Statements13

- Page 212 and 213: Notes To The Financial Statements13

- Page 214 and 215: Notes To The Financial Statements13

- Page 216 and 217: Notes To The Financial Statements13

- Page 218 and 219: Notes To The Financial Statements13

- Page 220 and 221: Notes To The Financial Statements15

- Page 222 and 223: Notes To The Financial Statements15

- Page 224 and 225: Notes To The Financial Statements15

- Page 226 and 227: Notes To The Financial Statements16

- Page 228 and 229: Notes To The Financial Statements18

- Page 230 and 231: Notes To The Financial Statements22

- Page 232 and 233: Notes To The Financial Statements26

- Page 234 and 235: Notes To The Financial Statements28

- Page 236 and 237: Notes To The Financial Statements28

- Page 238 and 239: Notes To The Financial Statements30

- Page 240 and 241: Notes To The Financial Statements30

- Page 242 and 243: Notes To The Financial Statements31

- Page 244 and 245: Notes To The Financial Statements34

- Page 246 and 247:

Notes To The Financial Statements34

- Page 248 and 249:

Notes To The Financial Statements34

- Page 250 and 251:

Notes To The Financial Statements37

- Page 252 and 253:

Notes To The Financial Statements40

- Page 254 and 255:

Notes To The Financial Statements42

- Page 256 and 257:

Notes To The Financial Statements42

- Page 258 and 259:

Notes To The Financial Statements42

- Page 260 and 261:

Notes To The Financial Statements42

- Page 262 and 263:

Notes To The Financial Statements42

- Page 264 and 265:

Notes To The Financial Statements42

- Page 266 and 267:

Notes To The Financial Statements42

- Page 268 and 269:

Notes To The Financial Statements42

- Page 270 and 271:

Notes To The Financial Statements42

- Page 272 and 273:

Statement by Directorspursuant to S

- Page 274 and 275:

Independent Auditors’ Reportto th

- Page 276 and 277:

Analysis Of Shareholdingsas at 9 Oc

- Page 278 and 279:

Analysis Of Shareholdings30 LARGEST

- Page 280 and 281:

Analysis Of Unsecured Convertible R

- Page 282 and 283:

Property List- generation[ Tenaga N

- Page 284 and 285:

Property List- distribution[ Tenaga

- Page 286 and 287:

This page has been intentionally le

- Page 288:

StampSymphony Share Registrars Sdn.