FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

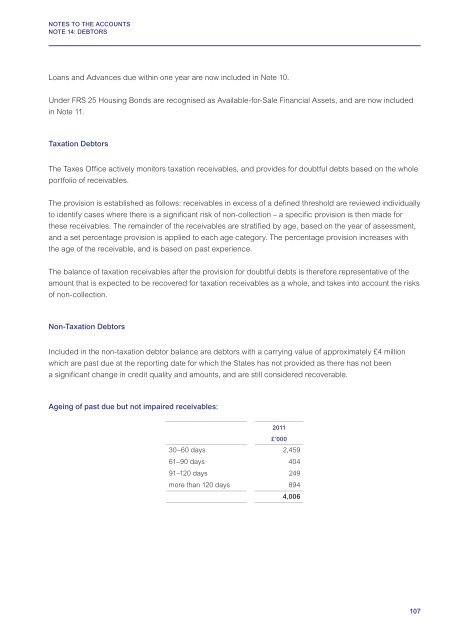

NOTES TO THE <strong>ACCOUNTS</strong>NOTE 14: DEBTORSLoans and Advances due within one year are now included in Note 10.Under FRS 25 Housing Bonds are recognised as Available-for-Sale Financial Assets, and are now includedin Note 11.Taxation DebtorsThe Taxes Office actively monitors taxation receivables, and provides for doubtful debts based on the wholeportfolio of receivables.The provision is established as follows: receivables in excess of a defined threshold are reviewed individuallyto identify cases where there is a significant risk of non-collection – a specific provision is then made forthese receivables. The remainder of the receivables are stratified by age, based on the year of assessment,and a set percentage provision is applied to each age category. The percentage provision increases withthe age of the receivable, and is based on past experience.The balance of taxation receivables after the provision for doubtful debts is therefore representative of theamount that is expected to be recovered for taxation receivables as a whole, and takes into account the risksof non-collection.Non-Taxation DebtorsIncluded in the non-taxation debtor balance are debtors with a carrying value of approximately £4 millionwhich are past due at the reporting date for which the <strong>States</strong> has not provided as there has not beena significant change in credit quality and amounts, and are still considered recoverable.Ageing of past due but not impaired receivables:<strong>2011</strong>£’00030–60 days 2,45961–90 days 40491–120 days 249more than 120 days 8944,006107