FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

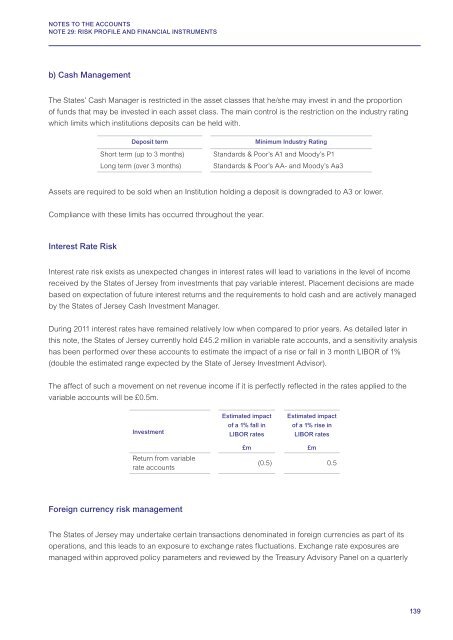

NOTES TO THE <strong>ACCOUNTS</strong>NOTE 29: RISK PROFILE <strong>AND</strong> <strong>FINANCIAL</strong> INSTRUMENTSb) Cash ManagementThe <strong>States</strong>’ Cash Manager is restricted in the asset classes that he/she may invest in and the proportionof funds that may be invested in each asset class. The main control is the restriction on the industry ratingwhich limits which institutions deposits can be held with.Deposit termShort term (up to 3 months)Long term (over 3 months)Minimum Industry RatingStandards & Poor’s A1 and Moody’s P1Standards & Poor’s AA- and Moody’s Aa3Assets are required to be sold when an Institution holding a deposit is downgraded to A3 or lower.Compliance with these limits has occurred throughout the year.Interest Rate RiskInterest rate risk exists as unexpected changes in interest rates will lead to variations in the level of incomereceived by the <strong>States</strong> of Jersey from investments that pay variable interest. Placement decisions are madebased on expectation of future interest returns and the requirements to hold cash and are actively managedby the <strong>States</strong> of Jersey Cash Investment Manager.During <strong>2011</strong> interest rates have remained relatively low when compared to prior years. As detailed later inthis note, the <strong>States</strong> of Jersey currently hold £45.2 million in variable rate accounts, and a sensitivity analysishas been performed over these accounts to estimate the impact of a rise or fall in 3 month LIBOR of 1%(double the estimated range expected by the State of Jersey Investment Advisor).The affect of such a movement on net revenue income if it is perfectly reflected in the rates applied to thevariable accounts will be £0.5m.InvestmentEstimated impactof a 1% fall inLIBOR ratesEstimated impactof a 1% rise inLIBOR ratesReturn from variablerate accounts£m£m(0.5) 0.5Foreign currency risk managementThe <strong>States</strong> of Jersey may undertake certain transactions denominated in foreign currencies as part of itsoperations, and this leads to an exposure to exchange rates fluctuations. Exchange rate exposures aremanaged within approved policy parameters and reviewed by the Treasury Advisory Panel on a quarterly139