FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

FINANCIAL REPORT AND ACCOUNTS 2011 - States Assembly

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

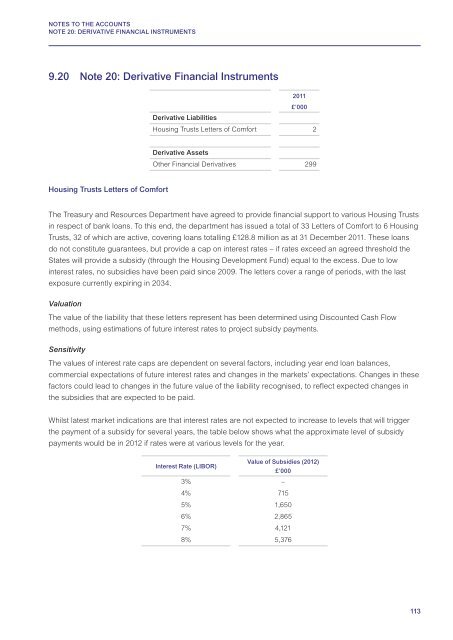

NOTES TO THE <strong>ACCOUNTS</strong>NOTE 20: DERIVATIVE <strong>FINANCIAL</strong> INSTRUMENTS9.20 Note 20: Derivative Financial Instruments<strong>2011</strong>£’000Derivative LiabilitiesHousing Trusts Letters of Comfort 2Derivative AssetsOther Financial Derivatives 299Housing Trusts Letters of ComfortThe Treasury and Resources Department have agreed to provide financial support to various Housing Trustsin respect of bank loans. To this end, the department has issued a total of 33 Letters of Comfort to 6 HousingTrusts, 32 of which are active, covering loans totalling £128.8 million as at 31 December <strong>2011</strong>. These loansdo not constitute guarantees, but provide a cap on interest rates – if rates exceed an agreed threshold the<strong>States</strong> will provide a subsidy (through the Housing Development Fund) equal to the excess. Due to lowinterest rates, no subsidies have been paid since 2009. The letters cover a range of periods, with the lastexposure currently expiring in 2034.ValuationThe value of the liability that these letters represent has been determined using Discounted Cash Flowmethods, using estimations of future interest rates to project subsidy payments.SensitivityThe values of interest rate caps are dependent on several factors, including year end loan balances,commercial expectations of future interest rates and changes in the markets’ expectations. Changes in thesefactors could lead to changes in the future value of the liability recognised, to reflect expected changes inthe subsidies that are expected to be paid.Whilst latest market indications are that interest rates are not expected to increase to levels that will triggerthe payment of a subsidy for several years, the table below shows what the approximate level of subsidypayments would be in 2012 if rates were at various levels for the year.Interest Rate (LIBOR)Value of Subsidies (2012)£’0003% –4% 7155% 1,6506% 2,8657% 4,1218% 5,376113